MARKETSCOPE : SKY HIGH

July, 31 2023

RISK ON

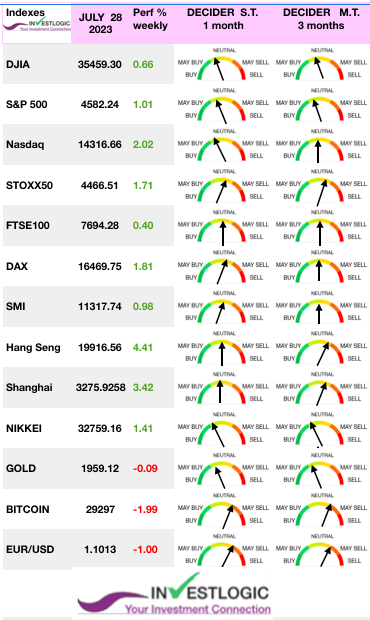

Financial markets had a strong rally last week due to positive corporate results and central bank decisions that were in line with expectations. The U.S. Federal Reserve raised interest rates by a quarter-point, as expected, bringing Fed Funds to the range of 5.25% to 5.50%.

The European Central Bank (ECB) followed suit the next day, increasing rates by 25 basis points for the ninth time since July 2022. Meanwhile, the Bank of Japan (BoJ) maintained its ultra-accommodative policy by keeping rates at the floor. However, the BoJ did raise the ceiling from 0.5% to 1%, signaling its preparation for a future normalization of monetary policy without changing its key rate.

As a result, investors are optimistic about the end of the current monetary tightening cycle. Stocks rose as data showed U.S. consumer sentiment rose and inflation eased, adding to growing optimism that the economy will avoid a recession and encourage the Federal Reserve to end its cycle of interest rate increases.

Main US equities indices ended higher over a week notable for the Dow Jones Industrial Average notching its 13th consecutive daily gain on Wednesday, which marked its longest winning streak since 1987. Of the 11 S&P sectors, nine ended trading in green. Communication Services topped the leaderboard, with the heavyweight sector ending the week with a whopping 6.8% gain.

European markets are catching up With the STOXX 600 ending at 471.63. Chinese equities rallied after Beijing signaled it will provide more stimulus to support the economy.

Looking ahead to the next week, there are several macroeconomic events to keep an eye on. On Monday, China will release its manufacturing and tertiary activity indicators. On Tuesday, Australia will announce its monetary policy decision, and it’s expected to be a 25 basis points rate hike. Similarly, the UK is likely to announce a rate hike on Thursday.

Additionally, investors will see earnings report flood in for a second consecutive week, with almost a third of the S&P 500 companies due to disclose numbers over the next five trading days. Some notable names include Heineken, OnSemiconductor, Toyota Motor, Merck & Co, Pfizer, BP, Uber, Daimler, Costco, Qualcomm, Paypal, Apple, and many others. Investors will be closely observing these reports for insights into company performance and potential market impacts.

MARKETS : Super-Market

The bull market that started in October has surprised many, given the number of traditionally more bearish indicators such as inverted yield curves, leading economic indicators, and rising interest rates. However, as the market has risen, it pressures managers to increase exposure, pushing asset prices higher. For many individuals trading a rising stock market is difficult because of the expectation that the resumption of the “bear market” is inevitable.

As shown below, the S&P 500 is set to close out its fifth straight month of gains. In addition to being up six out of the seven months this year, returns are unusually high, with the S&P advancing 18% year-to-date.

We have repeatedly acknowledged the many bearish and recessionary signals. While those signals continue to suggest a recessionary economic outcome, which should lead to lower stock prices by its very nature, there is an undeniable momentum in the markets. As such, we have to trade the market we have while remaining on alert for risks as they develop. – see second part below –

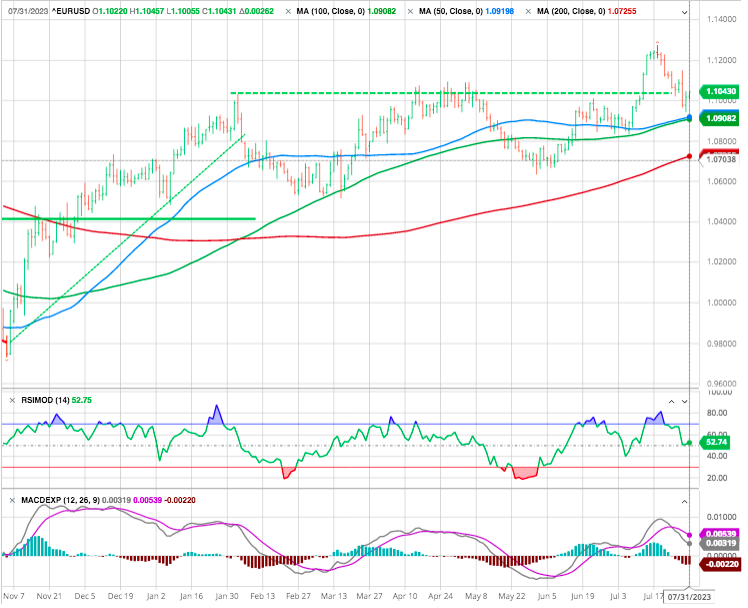

USD

The European PMI indices disappointed, causing the EUR/USD to decline to 1.1036 USD for 1 EUR. Despite this temporary weakness, the consensus view is that the EUR/USD will continue its upward trend seen in recent months.

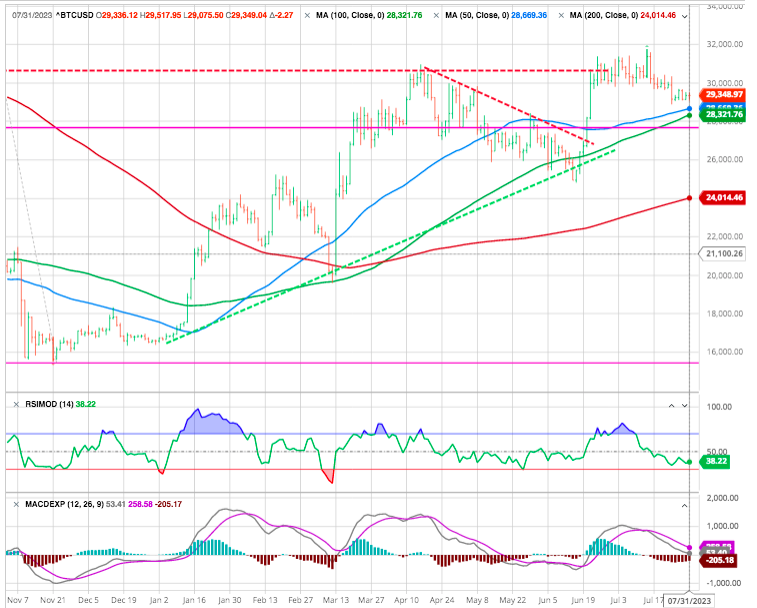

CRYPTOS

Last week, the price of bitcoin has dropped by over 3% and is currently hovering around $29,000. On the other hand, ether has experienced a milder decline, falling just over 1% to the $1850 level. The crypto-asset industry has been facing challenges in recent weeks due to lawsuits from the US Securities and Exchange Commission (SEC) against crypto companies within its jurisdiction and the lack of regulatory clarity, which is impacting the industry’s participants. Without significant catalysts specific to the cryptocurrency market, it’s likely that digital currencies will face difficulties in gaining momentum again during the summer period.

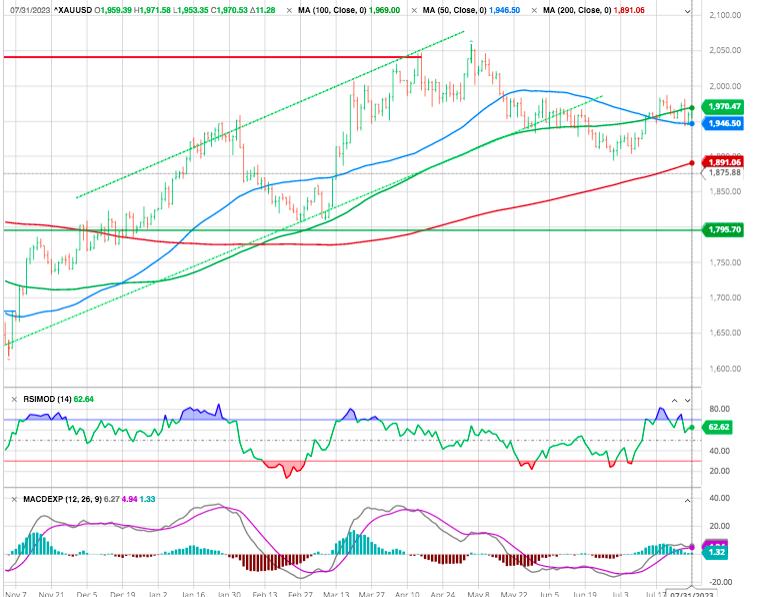

GOLD

Gold has historically been a safe haven during periods of geopolitical tensions, economic crises or global market instability. We reamain positive on Gold with a strong support around 1920.

Soft Landing Optimism Is Everywhere. That’s Happened Before.

People are often sure that the economy is going to settle down gently right before it plunges into recession, a reason for caution and humility.

Talk of a soft landing has increased as inflation moderates and unemployment remains historically low. But such predictions have proved wrong in the past.

In late 1989, an economic commentary newsletter from the Federal Reserve Bank of Cleveland asked the question that was on everyone’s mind after a series of Federal Reserve rate increases: “How Soft a Landing?” Analysts were pretty sure growth was going to cool gently and without a painful downturn — the question was how gently.

In late 2000, a column in The New York Times was titled “Making a Soft Landing Even Softer.” And in late 2007, forecasters at the Federal Reserve Bank of Dallas concluded that the United States should manage to make it through the subprime mortgage crisis without a downturn.

Within weeks or months of all three declaration, the economy had plunged into receesion. Unemployment shot up, businesses closed, growth contracted.

It is a point of historical caution that Is relevant today, when soft landing optimism is again surging.

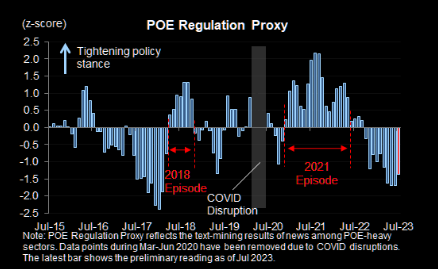

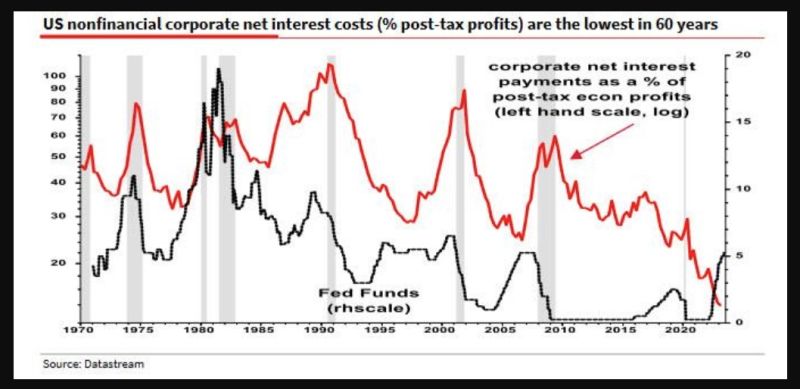

Albert Edwards the SocGen strategist explains in one chart why this time is different and how the rise interest rates hasn’t triggered a recession yet.

Actually, as shown on the chart below, Corporate NET interest payments as a % of post-tax economic profits (red line) has been going DOWN despite Fed Funds (black line) going UP!

As Albert Edwards says: “We can see clearly from the Fed’s Z1 (table L103) that the US corporate sector is a massive net borrower. Normally when interest rates rise, so too do net debt payments, squeezing profit margins and slowing the economy. BUT NOT THIS TIME. Corporate net interest payments have instead collapsed, something very strange has happened, and it helps explain the recession’s tardy.”

As Edwards concludes, a sizeable proportion of the “huge, fixed rate borrowings during 2020/21 still survives on company balance sheets in variable rate deposits” meaning that corporations continue to benefit from locking in the ultra low rates of 2020 and 2021 even as their cash interest income are soaring.

Companies have effectively played the yield curve in reverse and become net beneficiaries of higher rates, adding 5% to profits over the last year instead of deducting 10%+ from profits as usual.

Putting it all together, Edwards says that “it’s not just ‘Greedflation’ that has boosted US profit margins and delayed the recession (…) Interest rates simply aren’t working as they once did. It is indeed a mad, mad world”

STRATEGY UPDATE

We maintain that this market action is largely a result of mechanical re-risking, due to the decline in volatility and emergence of the AI-themed megacap rally.

We remain of the view that the delayed impact of the global interest rate shock (real estate, consumer credit, quantitative tightening and liquidity, etc.), steady erosion of consumer savings and post COVID pent up demand, and deeply troubling global geopolitical context will result in market declines and re-emergence of market volatility. We acknowledge that we cannot time this inflection near term, but there are no data points that would prompt us to change our methodology or conclusions.

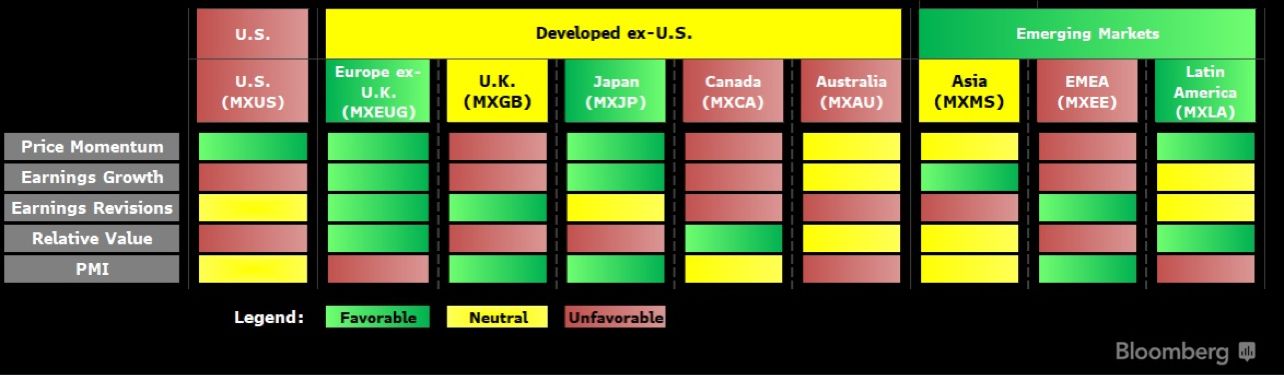

Slowing growth and disinflation create space for EM central banks to deliver rate cuts in 2H23, keeping us over exposed EM .

Regional Evaluation (Source Bloomberg intelligence)

China has plagued EM equities this year, but our scorecard still supports the outlook for EM stocks. Latin America may be particularly well positioned – as central bank policies appear set to ease in the region, valuations are well below pre pandemic norms. On forward P/E, Brazilian equities trade 3.7 standard deviations below 2014-2019 average, while Mexican equities are 2.1 standard deviations below.

Happy trades