MARKETSCOPE : Sell High, Buy Low !

January, 17 2024Guzzling Jets and Gallons of Dom Perignon

The world’s five richest men have more than doubled their fortunes from $405 billion to $869 billion since 2020 —at a rate of $14 million per hour— while nearly five billion people have been made poorer. If current trends continue, the world will have its first trillionaire within a decade but poverty won’t be eradicated for another 229 years. – OXFAM

Last week stocks edged higher for the week, as traders examined the first batch of fourth-quarter earnings and a pair of closely-watched inflation reports.

Slightly higher-than-expected US inflation did not alter expectations of a first reduction in the cost of borrowing in March. A slowdown in inflation is one of the pillars of the current narrative, which should enable the Fed to lower its key rates, ideally as early as next March.

After an initial negative reaction, stock market indices managed to recover, particularly during the US session. Several tech giants recorded solid gains. Energy stocks underperformed as oil prices pulled back early in the week. US our largest banks—JPMorgan Chase, Citigroup, Bank of America, and Wells Fargo—reported fourth-quarter results on Friday. Data releases on the week’s light economic calendar came in roughly in line with expectations.

After an initial negative reaction, stock market indices managed to recover, particularly during the US session. Several tech giants recorded solid gains. Energy stocks underperformed as oil prices pulled back early in the week. US our largest banks—JPMorgan Chase, Citigroup, Bank of America, and Wells Fargo—reported fourth-quarter results on Friday. Data releases on the week’s light economic calendar came in roughly in line with expectations.

The yield on the benchmark 10-year U.S. Treasury note falling back below 4% over the week.Two-year Treasury yields tumbled to their lowest levels since May, dropping 24 basis points for the week.

STOXX Europe 600 Index ended the week little changed while ECB’s Lagarde says the worst of the inflation fight is likely over.

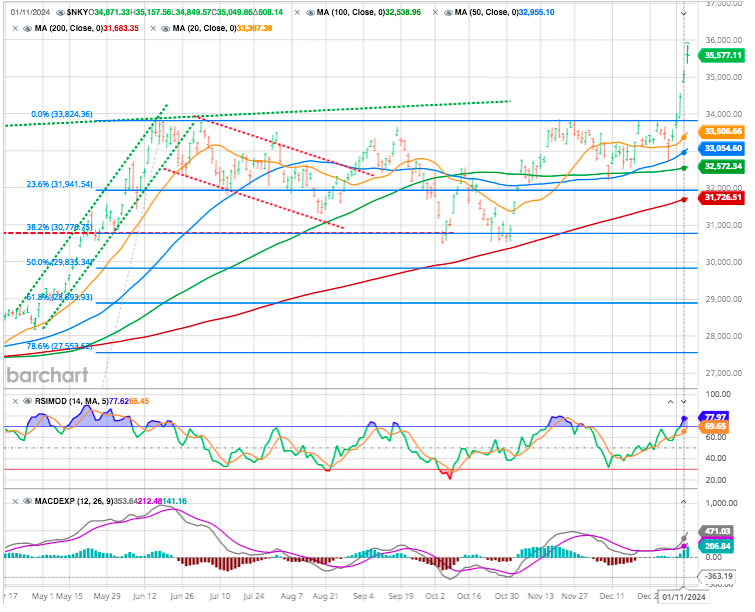

In Asia, Japan’s Nikkei 225 Index rose 6.6%, the highest level in almost 34 years. Chinese equities retreated as data showed that China’s deflationary cycle persisted into December, raising expectations of increased government support in 2024.

The main statistics expected in this week are consumer health in the US, December retail sales (Wednesday) and the University of Michigan’s confidence index for January (Friday). Corporate results will come in bigger numbers next week: after a new series of US banks (Morgan Stanley, Goldman Sachs…), the first non-financials, such as Rio Tinto, Repsol and Compagnie Financière Richemont, will follow.

Heading into the Q4 earnings season, consensus EPS estimates have been cut by 6% since September vs. a typical 4% reduction in estimates. However, earnings breadth, which is the total number of companies with positive EPS growth, is expected to improve for the third straight quarter.

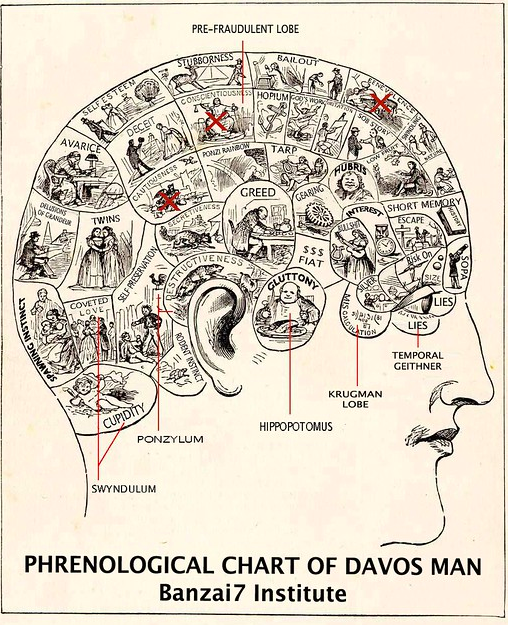

Davos Reunion

MARKETS : Outrageous !

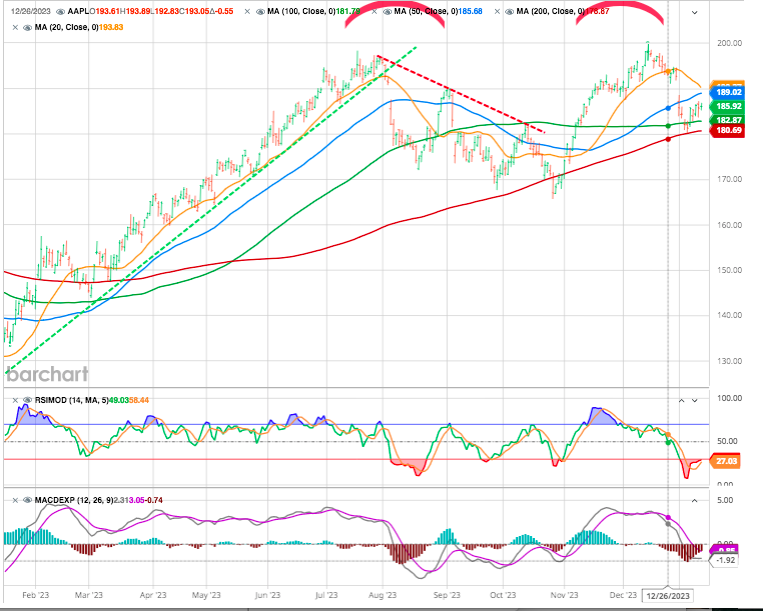

As Apple Goes So Goes the Market

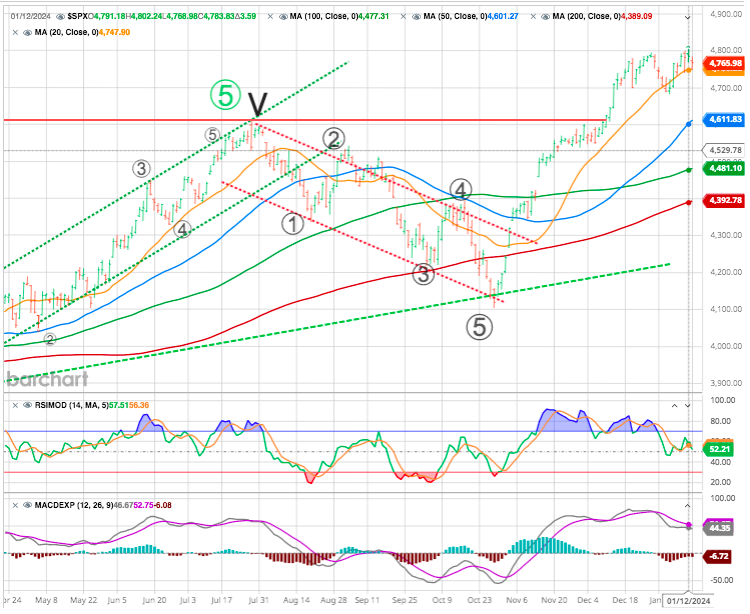

On a technical basis, the market remains on a sell-signal while the overbought conditions, as the RSI shows, are slowly being reduced. Notably, the S&P 500 index has held support at the 20-DMA, which keeps the bullish trend intact.

Technical indicators are urging caution as they see potential for a bull trap developing in the US stock market indices. When the market does not provide any reasonable pullback after a 700-point rally, it really is the most prudent manner in which to approach the market.

The market has been consolidating since December. As we noted previously, the more egregious overbought condition of the market would limit upside gains. Such has indeed been the case. However, the good news is that the market consolidation allows the moving averages to catch up, thereby reducing the deviation in early December. While more work is needed, further consolidation can be accomplished over the next few weeks.

The market remains overbought on many levels. While such does NOT mean the market can not experience a short-term rally, it suggests that gains may be somewhat limited until those excesses are reversed.

Well, as we made a high around 4790 during this past week, we outlined that the stronger support for the SPX is at 4610, with a upper support to 4690. And, as long as the market holds that support on all pullbacks, then it leaves the door open to head to the 5000+ level,

Of course, should the market break support it opens the door to a more appropriate type of pullback that we normally see in these types of structures, which should point us down to the 4450 area before the market embarks on its upward path,

With a number of divergences in our indicator work, toppish trend momentum (mature trend), our sentiment frame in outright contrarian territory, the too low volatility, and taking into account extreme oversold yields, we still think that the current breakouts is the setup for a classic bull trap instead of believing in the start of a larger breakout campaign.

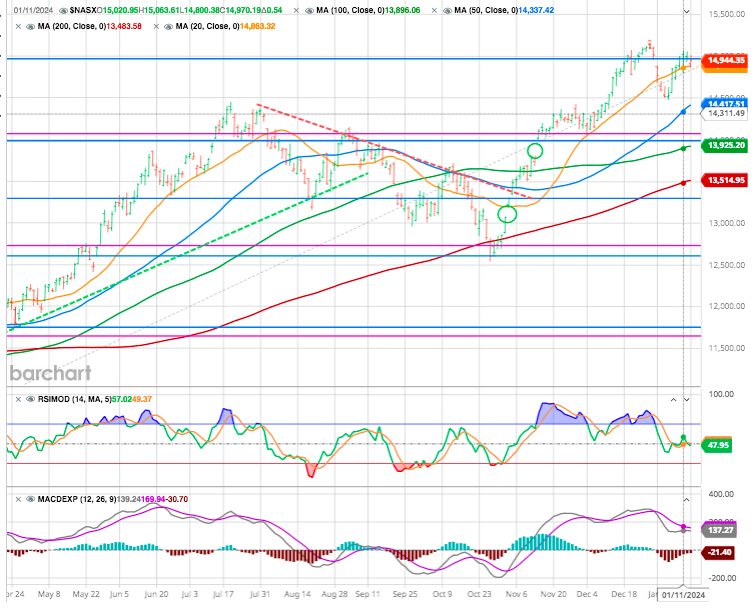

NASDAQ

Over the next few weeks, we are looking for what sectors or markets will begin to define themselves as the leaders for this year. Furthermore, as noted previously, earnings season could catalyze investors to step back into the markets for now.

Will it be the “Magnificent 7” again, or will last year’s laggards, like Healthcare, take center stage?

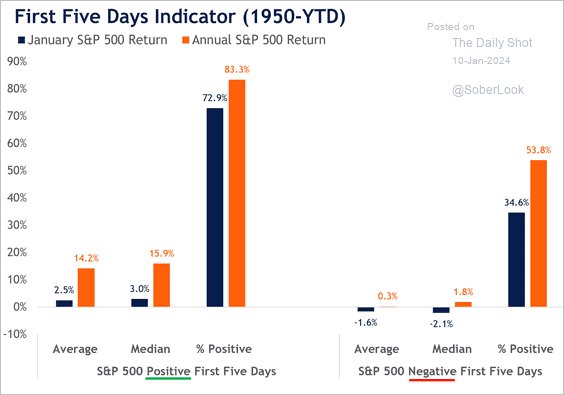

January First Five Days Indicator

The S&P 500 Index failed that initial test of the New Year by providing a negative return over those first five trading days. As shown in the chart below, the implications of the failure are potentially lower returns for the entire year.

Source RIA

When the S&P 500 index is negative during the first 5 days of the year, it substantially lowers the odds of the year being favorable. Not only do the odds of a positive year decrease, but also the average annual rates of return. However, while the start of the year has been challenging, we still have a long way to go this year, and many possible outcomes still lie ahead. As such, the markets will focus on the return for January, which, historically, can save the dismal start to the New Year.

NIKKEI

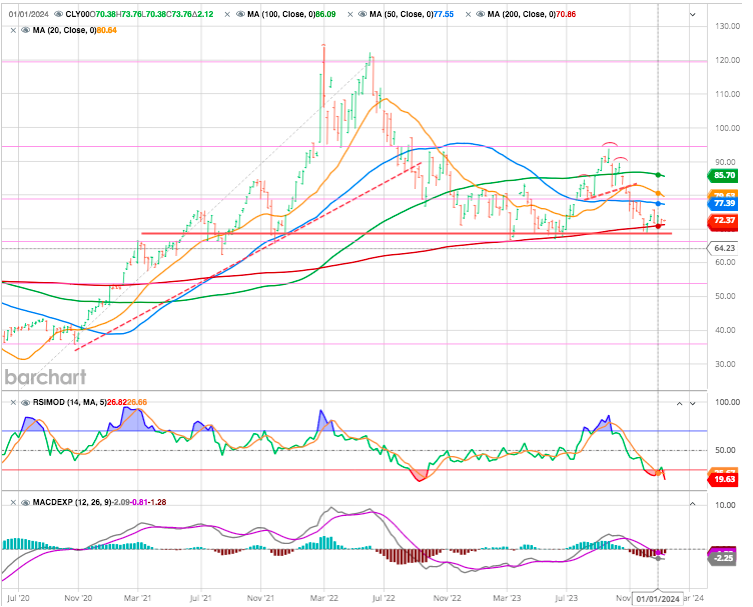

Energy

Oil prices continue to be buffeted between tensions in the Red Sea and pessimistic data on the global supply/demand balance, with Saudi Arabia in particular shaking up the market at the start of the week by lowering its selling price to Asia.

In terms of prices, Brent is still trading below the USD 80 mark, at precisely USD 78, while WTI is trading at around USD 72.50 close to our previously identified target/support of 68USD

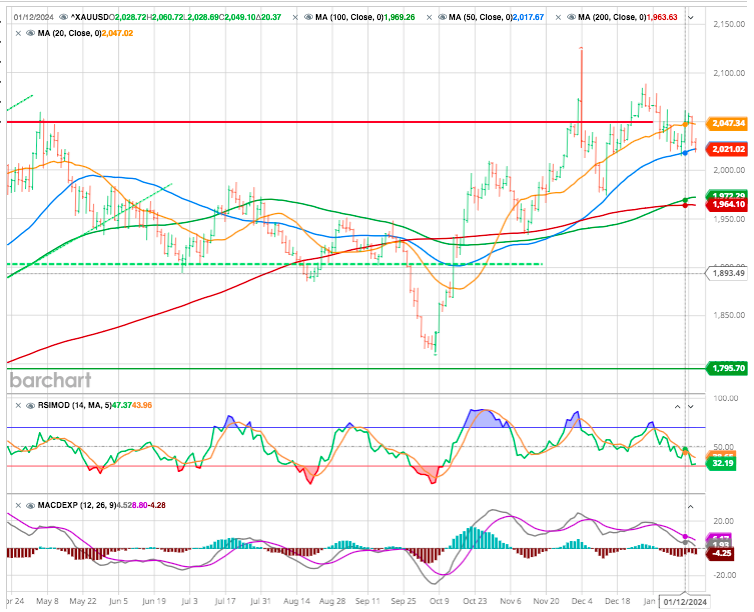

Metals

Copper

Often considered as the barometer of the global economy Dr Copper is trading around USD 8300. It emains under pressure on the London Metal Exchange, weighed down by uncertainties over the economic outlook following the World Bank’s warning that global growth is set to stall in 2024 at 2.4%, compared with 2.6% last year.

Gold is also losing ground, albeit modestly, with the precious metal trading at around USD 2030.

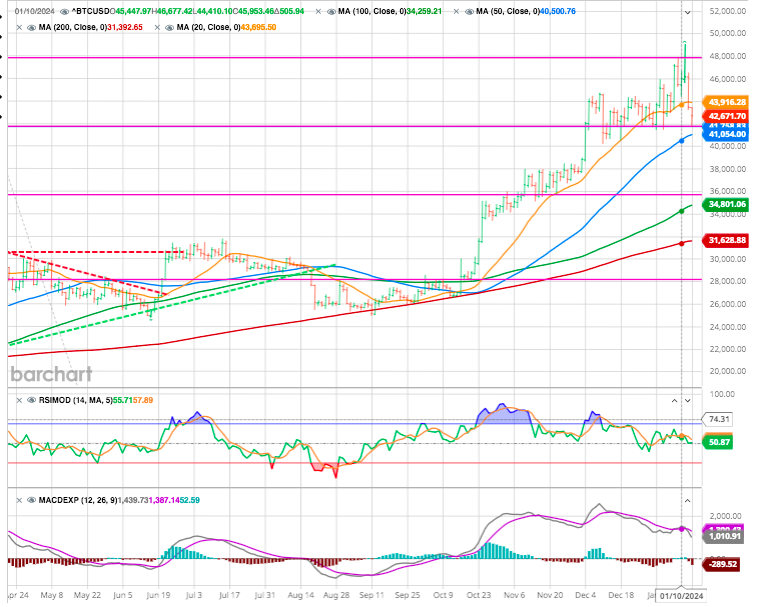

Cryptos

The news that has been stirring the cryptosphere past week is, of course, the decision by the SEC, the US financial markets regulator, to approve Bitcoin Spot ETFs, i.e. the marketing of exchange-traded funds backed directly by Bitcoin. Bitcoin surged on the news but then retreated.

After years of refusal, and at the request of several asset management companies, including behemoths BlackRock, Invesco and Fidelity, the regulator finally gave the go-ahead for the launch of 11 products.

This “institutionalization” of Bitcoin trading opens the door to widespread popular investment in the crypto-king.

Happy trades

Bonus :