MARKETSCOPE : HAWKISH PAUSE

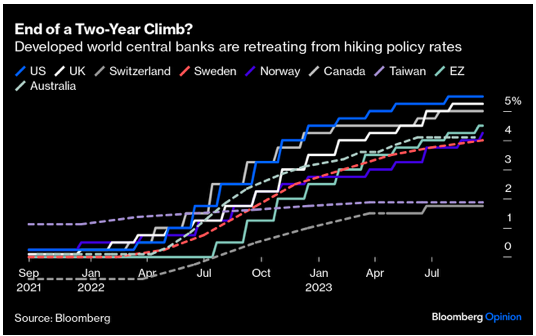

September, 25 2023Central banks look a bit lost, and so do investors in the current economic climate. There are those who don’t do anything but threaten to (Fed, BoE), those who should have done something but didn’t (The Swiss National Bank), those who did something but promised not to (ECB)- Only Swede’s Riskbank hiked to 4% Thursday, but sent strong signals that it was done. And the one that never does anything (BoJ).

As a mountainer we liked the excellent John Authers’ article (as usual) in Bloomberg Opinion :Rates are like mountains.

All of which has led to a resurgence in volatility, as the financial markets have not taken kindly to the Fed’s talk of further tightening between now and the end of the year, and the prospect of high interest rates for longer than expected in the USA and Europe.

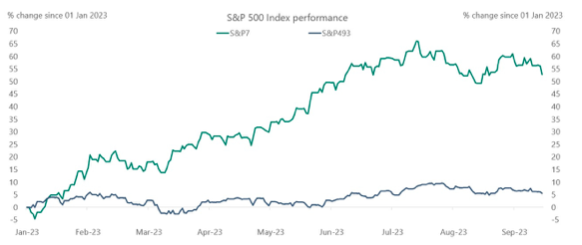

US markets S&P 500 and Nasdaq post worst weekly performance since March for each. That marked the third straight negative week. Heat map for the week with the big swingers (aka The Magnificent Seven) notably weaker:

In relation to the above, we mentioned on several occasions about the Magnificent Seven (MSFT, TSLA, NVDA, GOOGL, AMZN, META, AAPL). The following chart shows that eliminating those seven stocks out of the S&P 500, the S&P 493 would basically be flat year-to-date

The bottom line is of course that if you buy the S&P 500 you buy a bunch of expensive stocks making up over 30% of the index and carrying an average P/E of 50.

A Vanda Research notes that inflows into the artificial intelligence (AI) sector continue to decline. The VIX jumped back above 17 on the week. Bond yields surged after the central bank forecasted one more rate hike for 2023.

The yield on the 10-year Treasury note climbed 12 basis points on the week to 4.44%, slipping a bit on Friday after surging Thursday to its highest level since October 2007, as the Fed projected interest rates would remain higher for longer.

As noted by the excellent Albert Edwards, SG strategist :

The US 10y broke new ground for this cycle at 4.43%, a level not seen since October 2007… just before everything fell apart. Meanwhile, investors are marvelling at the equity market’s resilience in the face of rising bond yields. Funny, it was just the same back in October 2007 as the S&P hit a record high… just before everything fell apart. And to cap it all, the oil price in October 2007 was, like now, surging above $90/b (on its way to $150). Three months later, after everything had indeed fallen apart, the US was in recession, bond yields and equity prices were collapsing, and the Global Financial Crisis was upon us. That can’t happen again, surely?

TREASURY YIELDS ARE HEADED EVEN HIGHER- STOCKS WON’T LIKE IT -See below discussion on Landing-

If all yields rise, the stock market’s earnings yield also needs to increase. This means that stocks should fall at the end of the day.

MARKETS : If It Squawks Like a Hawk…, Sounds like a Hawk and Looks Like a Hawk…Chances Are, it’s Probably a Hawk.

TREASURY YIELDS ARE HEADED EVEN HIGHER- STOCKS WON’T LIKE IT -See below discussion on Landing-

If all yields rise, the stock market’s earnings yield also needs to increase. This means that stocks should fall because, at the end of the day.

Markets took a hit this week as the Fed projections of “higher for longer” killed the “rate cut hopes.”

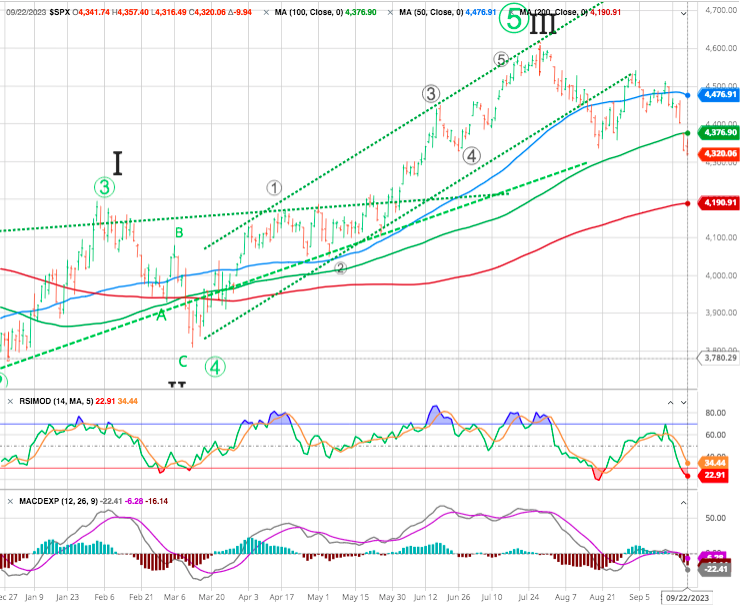

Now, the S&P 500 is sitting on a critical level of technical support at 4,320, which is essential not only from a short-term standpoint but also from a long-term one because that 4,320 is also the August 2022 high. A break below that price would leave many investors wondering if the entire “bull market” run was a trap on a failed break-out attempt. A breakdown from here probably sets up a retest of the 200-day moving average of around 4,190.

We can see that the market has already edged down through the key short-term support at 4350 — but more importantly, financial conditions have been tightened.

It took a bit longer than expected for the correction to begin, but in late July, the market peaked and has continued to correct through September. The entire summer rally was bizarre from the start, happening at the same time that rates started to rip higher. Which, of course, unwound a relationship between real yields and the stock market that had been in place for years.

Since then, rate cut expectations were pushed out by a year and corporate bankruptcies hit their highest levels since the pandemic.

The S&P 500 is now down 340 points, or 7.5%, since the Fed removed a recession from their forecast.On July 26th, the Fed raised rates and said they were not longer expecting a recession. The Fed marked the EXACT high in the S&P 500 which just hit its lowest levels since June.

Again, it looks evident at this point: the entire rally was driven by a short-volatility trade that is unwinding and likely still has more to unwind because being short-volatility in an environment where rates are rising, credit spreads are widening, and the dollar is strengthening is not the place one wants to be.

With the market still in a broader uptrend, the bullish backdrop remains, but there is a risk of a decline to 4200.

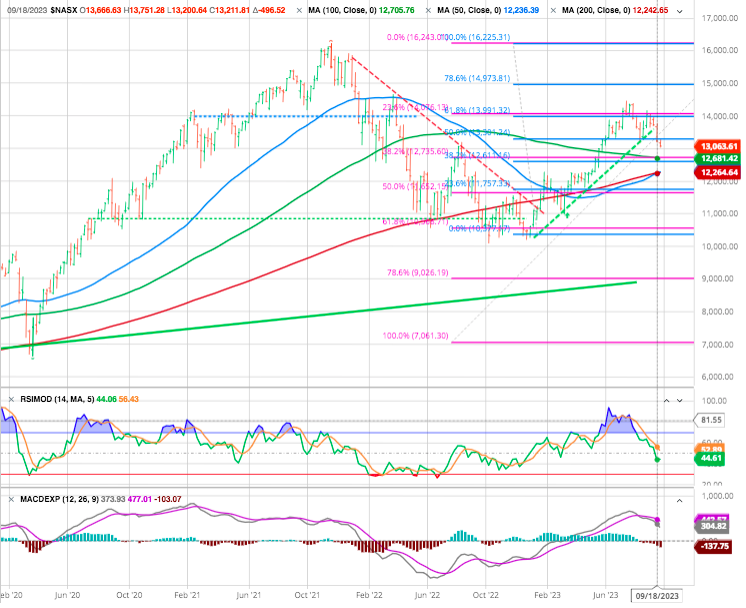

Considering the heavy tech NASDAQ, we look at one of our favorite weekly charts :

We can note that after recouping 61.8% (Blue Fibo) of the bear wave and challenging the previous low, we are now correcting with the first support at the 200 SMA (12300).

It would seem that on the surface, at least, everything that led to the rally starting in mid-May is now unwinding, reflected in the technical patterns. As noted once, this could turn out to be one of the biggest bull traps in 20 years, and it sure seems like that is precisely what is happening now.

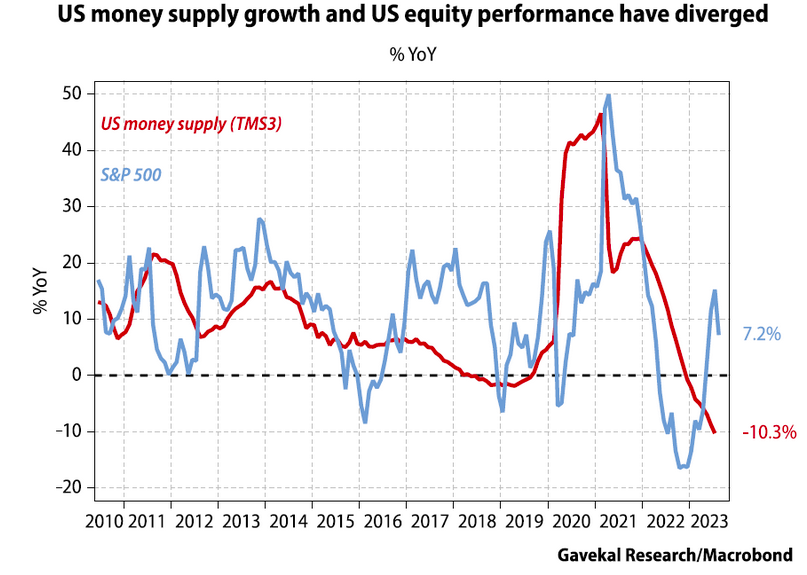

And we tell you shrinking money supply is usually not good for equity valuations :

So what to watch for in terms of any buying opportunity would be a peak in yields, a peak in the US dollar, and a peak in energy prices… in the meantime, the momentum is still higher on all 3 counts, which is a real and material tightening already delivered by markets !

As a Bloomberg intelligence survey shows US large cap equity sector scorecard is leaning back into energy for the first time in a year. Communications still leading the charge – in the top third of ranks for the 4th straight quarter. Defensive sectors still bringing up the rear.

GOLD

STRATEGY

“Tactics without strategy is the noise before defeat.” — Sun Tzu

Investors holding for the long-term should continue to prepare for the market adjusting to the Fed’s restrictive policy. Consider parking some of the capital gains into money market funds. Start a position in energy stocks at lower prices. And be wary of high-flying technology stocks and IPOs.

We had opportunities to de-risk proactively with the market at higher levels. If the market moves decisively below near-term support, we should take profits in riskier and more volatile positions.

Increasing dry powder is an excellent idea in times of uncertainty. Due to the Fed’s heavy-handed approach, we face increasing economic uncertainty, inflation, and monetary policy uncertainty.

Investing is a marathon – Not a sprint. Therefore, despite the near-term uncertainty, volatility, discomfort, annoyance, and anything else we may feel, it’s crucial to maintain a long-term perspective.

Although I have nothing against trading, we are not day trader or a swing trader.We keep a long-term (2-5 year) investment horizon. Therefore, we look for the highest quality companies in the most promising sectors likely to outperform over the long term. We encourage everyone to keep a long-term outlook and avoid falling into the trap of thinking that investing is a short-term game.

FED : Caveat Emptor- Its Buyer’s beware

An aggressive do-nothing by the FOMC. This fine committee of select members of Federal Reserve Banks around the US did not hike key interest rates but rather signaled via the

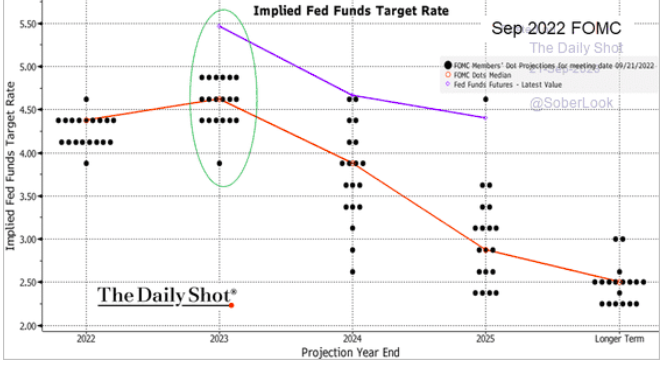

An aggressive do-nothing by the FOMC. This fine committee of select members of Federal Reserve Banks around the US did not hike key interest rates but rather signaled via the dart board dot plot, that one more hike can be expected for 2023. Powell noted during his press conference.

“In terms of inflation, you are seeing – the last three readings are very good readings. It’s only three readings. You know, we were well aware that we needed to see more than three readings. The only concern – and it just means this. If the economy comes in stronger than expected, that just means we’ll have to do more in terms of monetary policy to get back to 2%, because we will get back to 2%.”

In any case, they expect to keep rates higher for longer through 2024 than they anticipated earlier this year. Such quelled hopes of a return to monetary accommodations anytime soon and shifted the expectations for cuts forward.

The Federal Reserve will continue reducing its holdings of Treasury securities, agency debt, and agency mortgage-backed securities, which will have a negative impact on stock markets. Elevated interest rates will pressure dividend-income investors.

The Fed kept interest rates the same due to the lag in monetary policy’s effects on the economy and uncertainty about the impact of tighter credit conditions.

The median projection for the federal funds rate at the end of the year was 5.6%, implying one more hike – the same seen in the June projection. Policymakers also increased their forecasts for the fed funds rate at the end of 2024 to 5.1%, compared with the previous 4.6%, while the median projection for the end of 2025 rose to 3.9% from 3.4%.

This push forward of rates is based on the idea that the economy remains strong, creating a resurgence of inflation later this year.

So far the Fed has seemed to add enough pressure on financial conditions with less fallout for growth and employment compared to previous U.S. inflation battles. That has led the market to price in an economic “soft landing,” which has helped prop up stocks for much of the year, contrary to many of the initial forecasts on Wall Street.

It seems Powell has really convinced investors that heis not sure why the economy is still so strong. They find that all too believable. And that in turn convinces them that only something bad (a big dip in the economic data or a financial accident) will prompt him to cut rates any time soon.

The key question is whether that can keep on going. Have the 525 basis points in interest rate hikes delivered since March 2022 already filtered through the economy? Will things hold up if those levels are held through 2024? What about other curveballs like higher energy costs, student loan repayments, damaging labor strikes or a government shutdown?

Wishful Soft Landing

Consumer spending should continue slowing, and the labor market could turn south. Inflation is also relatively high, well above the Fed’s 2% target rate. The soft landing scenario is in danger, and the market’s taper tantrum could worsen.

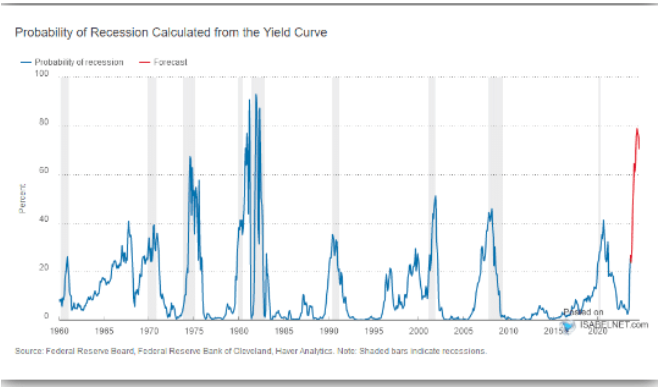

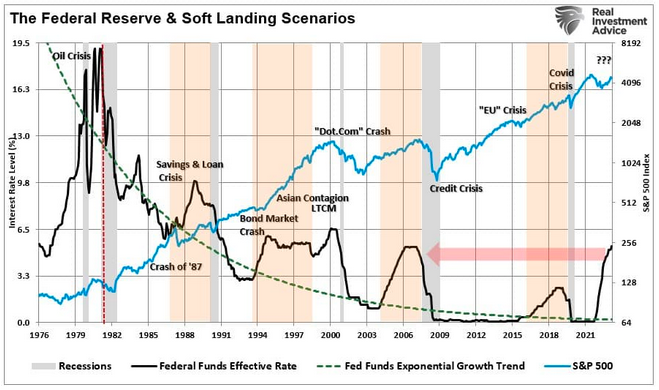

Based solely on the inverted yield curve alone, the probability of a recession is at one of the highest levels since the 1980s.

As Lance Robert noted, the Fed projections NEVER include the risk of a recession, and today, like then, it believed it could navigate a soft landing in the economy. They were wrong on multiple counts. There are ZERO times in history when the Fed was hiking rates that outcomes were not bad to awful. After rates peaked and yield curves UN-inverted, recessions, bear markets, and crisis events occurred.

The Fed will likely be surprised again in the next few months as the lagging economic data they focus on gets revised sharply lower.

So far, the markets have continued to place “hope” on the extremely elusive “soft landing” scenario. However, there are many risks to that view, as noted. As the WSJ said:

“Similarly, this summer’s combination of easing inflation and a cooling labor market has fueled optimism among economists and Federal Reserve officials that this elusive goal might be in reach. But soft landings are rare for a reason: They are tricky to pull off.“

The reason is that many factors have yet to reveal themselves.

- The Fed’s aggressive rate hiking campaign has a “lag effect” that will impact the economy in 2024.

- The restart of the student loan payments will extract spending from the economy.

- A potential Government shutdown could clip growth heading into the end of the year.

- The autoworkers strike could have an impact on growth.

- Higher interest rates weigh on consumption, which is nearly 70% of the economic equation.

Furthermore, from a purely contrarian point of view, the experts no longer consider a “recession” a risk.

Happy trades

BONUS