MARKETSCOPE : Greed Is Good

November, 20 2023Investors are bullish on the outlook, while folks are gloomier than ever on the economy. Last week’s data has almost all been consistent with a narrative of slowing inflation, but also slowing growth.

The opening line of Charles Dickens’s “A Tale of Two Cities” immediately comes to mind:

A confident consensus has taken hold that inflation has topped, and that central banks’ campaign of raising rates is over. Let’s hope that’s right. Now, the crucial question is how much economic damage the victory over inflation will inflict.

CHEERS

Investors brought out their champagne glasses last week to celebrate the latest CPI report, as the rate of inflation fell more than expected in October. Thanksgiving dinner should be a little easier on the wallet this year.

Investors brought out their champagne glasses last week to celebrate the latest CPI report, as the rate of inflation fell more than expected in October. Thanksgiving dinner should be a little easier on the wallet this year.

Stocks soared and Treasury yields tumbled after headline inflation flatlined month-on-month.

This has clearly rekindled traders’ appetite for risk, who are now betting on the end of the monetary tightening cycle and on a first rate cut in the United States at the end of the first quarter of 2024, that has so far excluded the start of a recession.

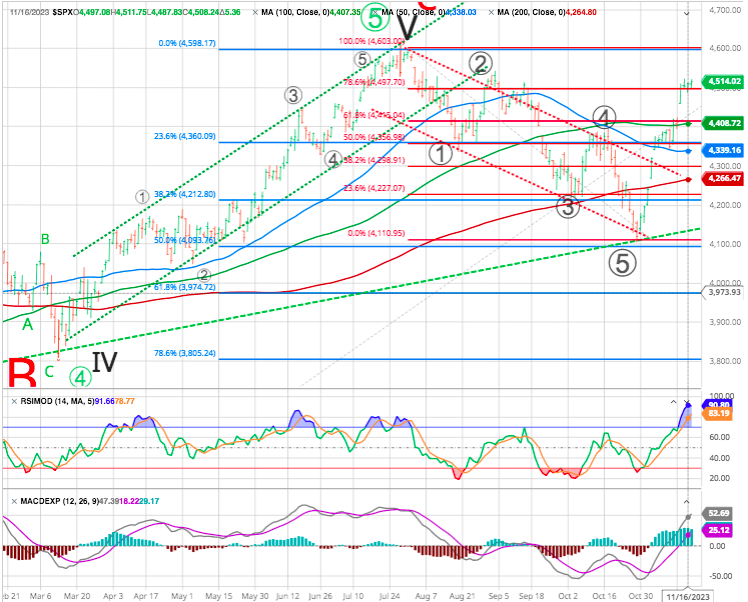

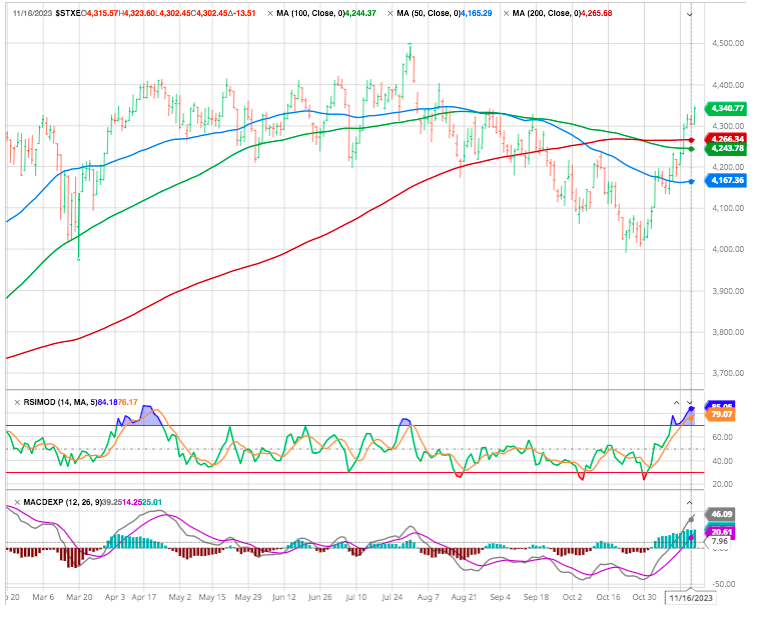

The S&P 500 Index (+2.2%) built on its strong gains over the previous two weeks and moved above the 4,500 barrier for the 1st time since September. The week’s advance was notably broad, with the S&P 500 Index equally-weighted outperforming the S&P 500 by 1%. Value and small-cap indexes also outperformed.

The yield on the benchmark 10-year Treasury note tumbled 19 basis points for the week to 4.44%.

Stocks celebrated the positive surprise on inflation this week but the festivities may be a bit premature as “Powell has to keep the hawkish bent for fear that what is happening today continues… a melt up in stocks and collapse in market rates – that can be inflationary.” noted Investing Group Leader Lawrence Fuller.

In Europe, the STOXX Europe 600 Index ended the week 2.8% higher as investors increased bets on central banks cutting interest rates soon as the final inflation reading for October was in line with the preliminary figure, declining, while the same trend was confirmed in the UK.

In Asia, the Nikkei 225 Index rose by 3.1% while in China, data remained mixed, with consumer spending showing signs of recovery, but the property market still in a state of depression. In Europe.

In this shortened week due to Thanksgiving, investors eyes will be on the Federal Reserve’s release of minutes from the FOMC meeting .

MARKETS : Boom And Bust, Baby !

“Be fearful when others are greedy and be greedy only when others are fearful.” – Warren Buffett-

The overall trend suggests the bull market will continue with a broadening rally, positive seasonality, and historical analogs highlighting a prospective path (much?) higher, tough the recent market uptrend may need to be digested with a pullback.

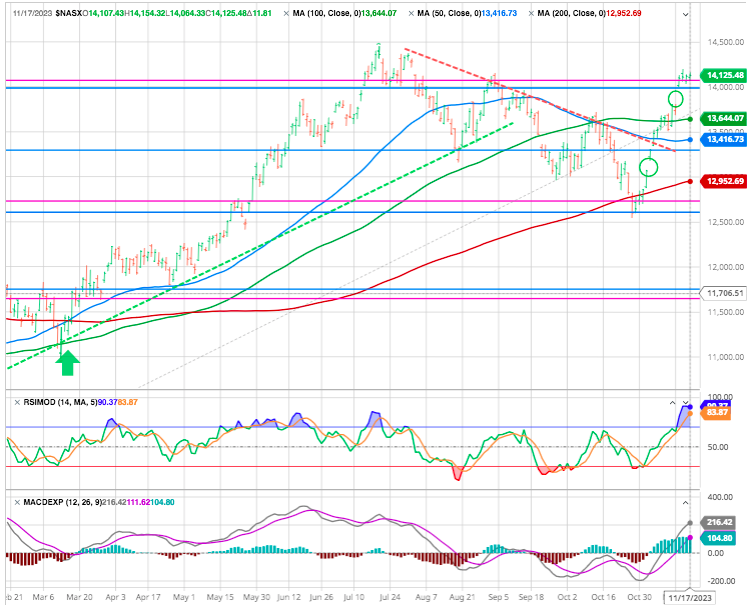

The market’s celebration saw the Nasdaq exit correction territory on Tuesday, with the “Magnificent Seven” adding more than $200B to their market caps. It took only 11 sessions (approximately two weeks) to :

- Recover back above the broken key support line (12’950 )

- Regain the 200-day moving average (continues red line)

- Break above key resistance (13’500)

- Create two runaway gaps (circled), the latest should be closed !

- Produced a nearly 10% rally from bottom to top.

As for the S&P 500, as of today’s close, the S&P move in just the first half of the month already ranks as the 6th most significant November monthly move in over seventy years.

We are currently wrestling with the 78.6% last wave down Fibo retracement level (red), which is also resistance from the September highs. Given the more overbought conditions, it is not surprising the market has had trouble advancing over the last several days.

Given we are entering a holiday-shortened week, trading volume will be light, and volatility will likely pick up. If the market does correct soon, supports will be the previous 61.8% and 50% retracement levels, respectively.

The NDX now vs 1999 analogy updated. Not likely, but just imagine the pain should this scenario play out.

Small-caps, which have lagged their large-cap peers in 2023, also played some major catch-up over the session, with the Russell 2000 (IWM) closing up 5.4% and lifting the index into positive territory for the year, though only the 27th most significant one-day move since 2000, and look at that multi-year underperformance.

We do suspect that small caps might well lead when the market begins its next holiday leg up. If not, we will take it as a signal a recession looms.

Who said this business was easy?

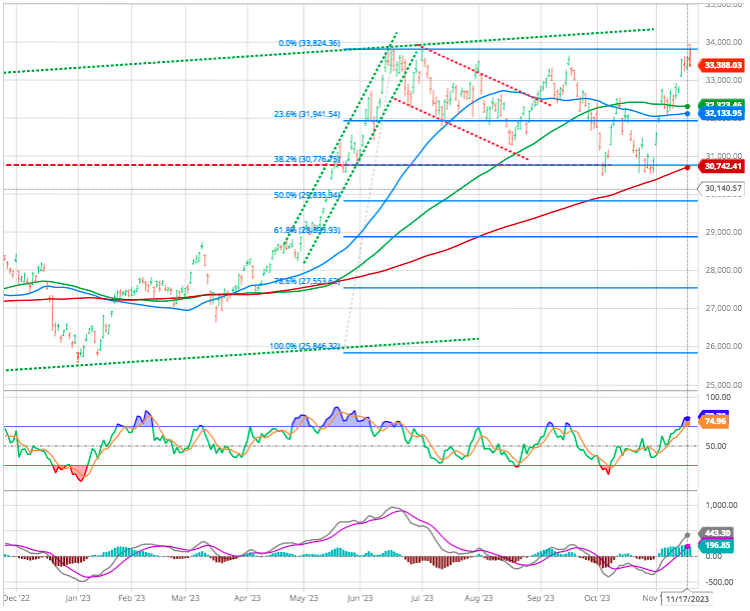

The STOXX 50 is up close to 8% from the October bottom and less than four percent away from reaching a new recovery high, but the best news is that the index has now closed for two days above the 200-day moving average:

And for the Japanese Nikkei we are less than one percent away from a recovery high and only 15% from a new-all time high:

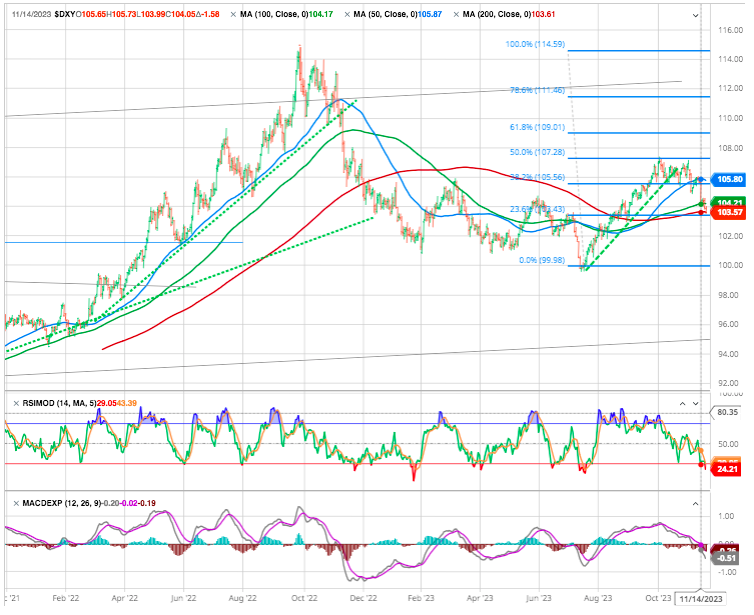

In this environment the USD might be a determinant. The USD index is now on its support at 103.5, the next is at 101.5

“Prepare for stocks to plunge by a third and a recession to strike imminently !”

That is the warning by legendary market forecaster Gary Shilling.

He suggests the S&P 500, which hit a record high of nearly 4,800 points in January last year, could nosedive to about 2,900 points, its lowest level since May 2020. The benchmark stock index fell by 18%, including dividends, last year but has rallied 17% this year. He expects stocks to fall because the US economy was faltering.

“We probably do have a recession coming shortly if we’re not already in it,” Shilling said.

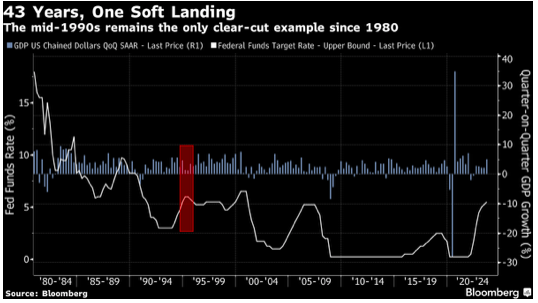

As hard landing always start as a soft landing we would be tempted to follow that feeling. Further, according to Bloomberg report here, soft landings are rare. There’s only been one since the Fed under Paul Volcker tamed inflation in the early 1980s. That happened in the much more peaceful and growth-friendly environment of 1995:

Past experience does mean that we should tend to regard a hard landing as the default most likely outcome. Absent other evidence, when the Fed hikes this much, we should expect one.

STRATEGY

Fears of a downturn in economic conditions have little sway on the large-cap sector scorecard, from Bloomberg Intel, which embraces a recovery in the S&P 500 for a fifth straight quarter. Signals of emerging leadership in higher-risk, early-cycle sectors first surfaced a year ago, and a clear preference remains for cyclicals. Communications, technology, energy and — finally — financials are now on top, as defensives still trail.

While the threat of global recession looms, earnings expectations needs to be adjusted before the market can sustainably embark on an upward trend again.

Until that happens, there’s a significant risk of downturn. That in turn implies caution about the rally in stock markets. Our strategy remains longer term slightly underweight equity allocation, not least because much higher interest rates give investors an alternative to equities again in the form of bonds and money market funds.

Happy trades

BONUS