MARKETSCOPE : Ready… Set…

February, 06 2023False Start

And we know the end …..

Last week, investors showed that they don’t blindly follow central banks anymore. Despite a small 25 basis point increase in Fed rates and an announcement that it might continue to raise rates in the future, investors did not care, as this was already widely anticipated.

The interpretation is that the market is free to do what it wants, and if it wants to fight the Fed, good luck. The chairman’s message on Wednesday appeared confused and his calls for caution were a flop, although no different from what it had been for months, and it seems he’s more than happy to let the market determine its own fate. We shall discuss it below.

The bulls rejoiced. The Fed had finally “pivoted dovish” … or so it goes.

The market is therefore putting aside the speeches of central bankers as well as fears about inflation, the two drivers of the past year.

The market is therefore putting aside the speeches of central bankers as well as fears about inflation, the two drivers of the past year.

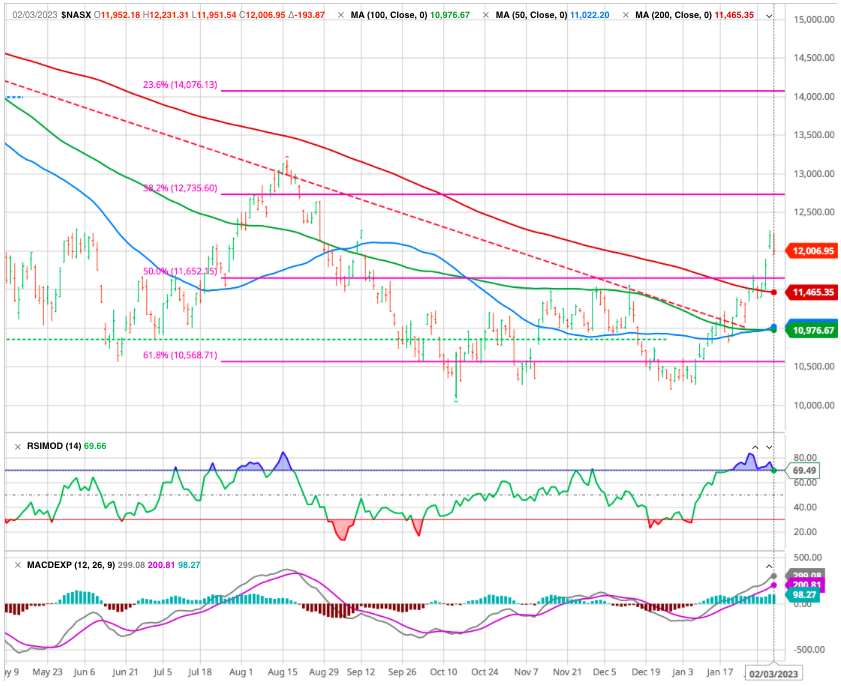

Tech stocks led the charge higher with the Nasdaq Composite Index (IXIC) trading at the highest levels since the second week of September. The index, which ended the last week 3.3% higher, was up about 20% at one point last week, relative to its late-December low. The Dow Jones Industrial Average (DJI) index closed 0.15% in the red last week.

On Friday, a monster jobs report on Friday dealt another blow to bulls, further accelerating a late-week selloff. The US nonfarm jobs in January came out at 517k, roughly triple consensus estimates and the biggest gain in six months. The unemployment rate slipped to 3.4%, its lowest level since 1969.

U.S. Treasurys sold off on the blowout report, with the two-year yield soaring 21 basis points to 4.29% and the benchmark 10-year note rising 14 basis points to 3.53%.

Most of the US equity indexes extended their winning streaks into February, helped by some upside surprises in economic data and Q4 earnings reports, as well as some dovish signals from the Fed. The S&P 500 reached an intraday high of 4,195 on Thursday, its best level since late August and booked its fourth weekly gain in five weeks, up 1.6%, as investors bet inflation is headed lower.

Shares in Europe rose while the ECB and BoE hiked by 50 basis points.

It’s time for a reality check.

MARKETS :

“When the facts change, I change my mind. What do you do sir?”

John Maynard Keynes

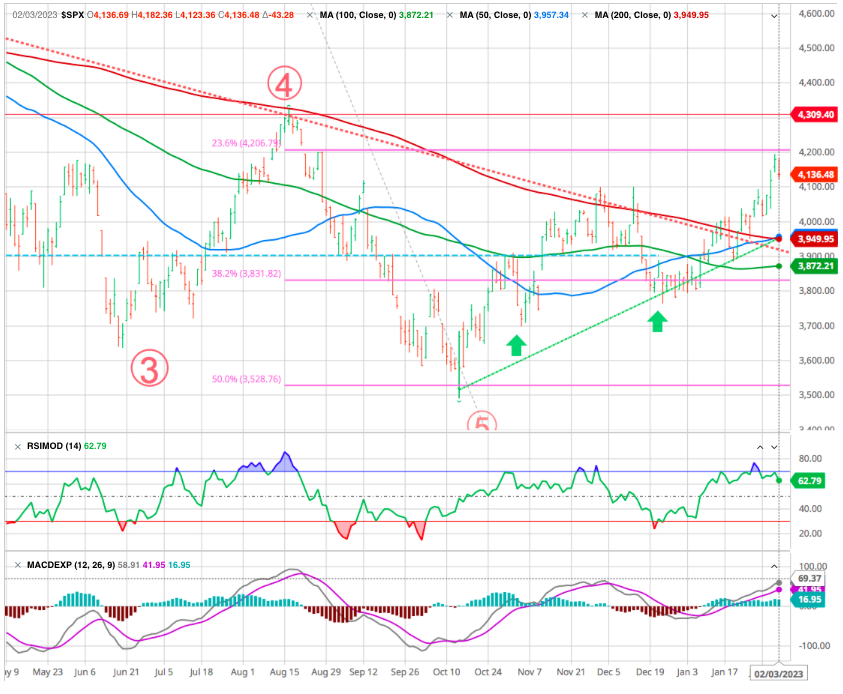

The market surge continued last week but ran into resistance on Friday as markets are pushing well above the 50-DMA. The S&P 500 blasted higher through its 200-day moving average over the past few days (chart). The four previous attempts to break out of this average failed. This one should succeed. The S&P 500’s 50-day moving average has just risen slightly above its 200-day moving average, which may be bottoming now.

However, while the weakness on Friday was not unexpected, it is also necessary to determine whether the current breakout is legitimate.

To confirm whether the breakout is sustainable, thereby ending the bear market, a pullback to the previous downtrend line that holds is crucial. Such a pullback would accomplish several things, from working off the overbought conditions, turning previous resistance into support, and reloading market shorts to support a move higher.

The final piece of the puzzle, if the pullback to support holds, will be a break above the highs of this past week, confirming the next leg higher. Such would put 4300-4400 as a target in place.

A break BELOW the downtrend line, and the current intersection of the 50- and 200-DMA, will suggest the breakout was indeed a “fasle start” Such will confirm the bear market remains, and a retest of last year’s lows is likely.

Certainly the biggest lesson from last weeks the strong rally in the beaten tech stocks. Especially the Meta’s rally triggered by cost cutting, Zuckerberg has learned a few lessons from the recent experience: if you want investors on your side, nothing works better than chopping costs.

The Metaverse cost $4.3BN during the quarter reducing Meta’s operating earnings by 40%. It Meta stopped spending on the metaverse the company could be dramatically more profitable while freeing billions to buyback stock.

If you really want to pile into the rally in speculative assets, you could, but it might be better to acknowledge that your opinions are prone to be changed by emerging facts. Meanwhile, Friday’s action in the Nasdaq-100 index, and in the ARK Innovation ETF, which manager Cathie Wood modestly describes as “the new Nasdaq,” was interesting.

source : John Authers Bloomberg

The two are moving absolutely in line — even though ARK in theory should be more volatile. And despite the ostensible fact that higher rates should do particular damage to the case for speculative tech stocks, neither was particularly dented by the employment news. That’s a reason for concern.

Reasons for the Bulls

U.S. stock bulls are taking heart from a range of market signals pointing to an upbeat year for Wall Street. The break out in the transportation industry group paves the way for further industrial sector strength. The semiconductor group is showing exceptional strength which in itself tends to be a leading indicator for the NASDAQ, also called the new transport.

- Equities’ positive January performance :

- A widely followed market theory, popularized by the Stock Trader’s Almanac, claims that as January goes, so goes the full year. After 2022 saw US stocks have their fourth worst year since 1945, the momentum appears to have shifted thus far this year, with the S&P 500 gaining 5% in January 2023.

- When the S&P 500 has advanced in January, the market has gone on to rise in the subsequent February-December period 83% of the time, with an average 11-month gain of over 11%, according to an analysis of data going back to World War II by CFRA Research.

- An up January after a down year, however, was followed by a gain of 23.1% from February to December with a 92% success rate.

- “Golden cross” chart pattern on the S&P 500

- Every chart watcher noted that the S&P 500’s 50-day moving average rose SLIGHTLY above its 200-day moving average on Thursday, a pattern known as a golden cross.

- Since 1950, the S&P 500 has produced an average 12-month return of 10.5% after a golden cross formed, while the overall average annual return since 1950 is 9.1%. However, when a golden cross has appeared as the 200-day moving average is declining – as it is now – the average 12-month return for the S&P 500 jumps to 16.8%.

- If it holds, further raises the probabilities of the bear market low being set in October.

- More stocks making new highs rather than new lows.

- Such a figure tends to confirm that the rally is being led by a broad range of stocks, rather than a cluster of heavyweights. That happened as many times in January as it did during all of 2022.

Why are many still bearish?

However, some investors believe stocks may have gotten ahead of themselves

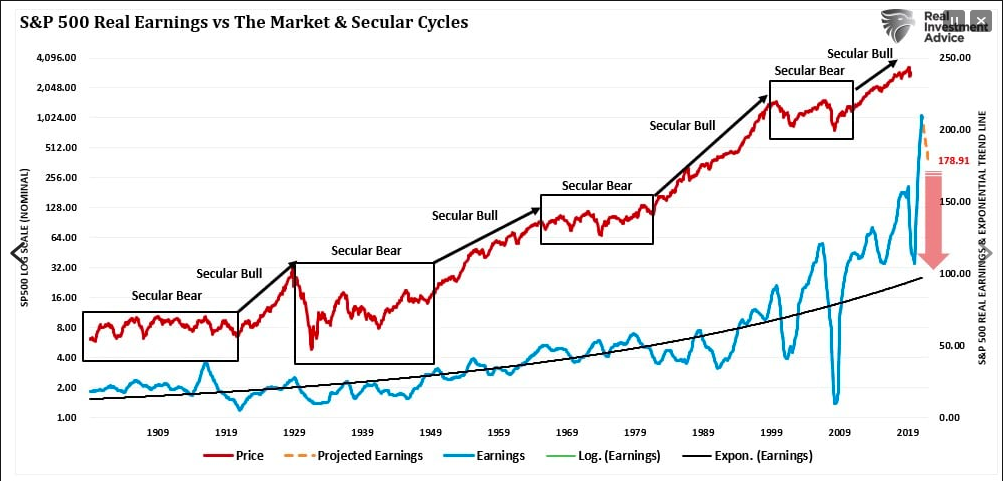

For one thing, earnings, which continue to exhibit weakness.

S&P 500 Q4 GAAP earnings were down 20% year-over-year, the 3rd consecutive quarter of negative YoY growth and the largest decline since Q2 2020 (note: combination of actual/estimates with 37% of companies reported thus far).

Second, the Fear & Greed Index has continued to move higher and briefly closed in “Extreme Greed” territory on Tuesday. Now, this isn’t necessarily a bearish omen. It’s not unusual for sentiment to become extreme at the start of a significant rally. However, it does suggest stocks are likely to take at least a “breather” in the near term.

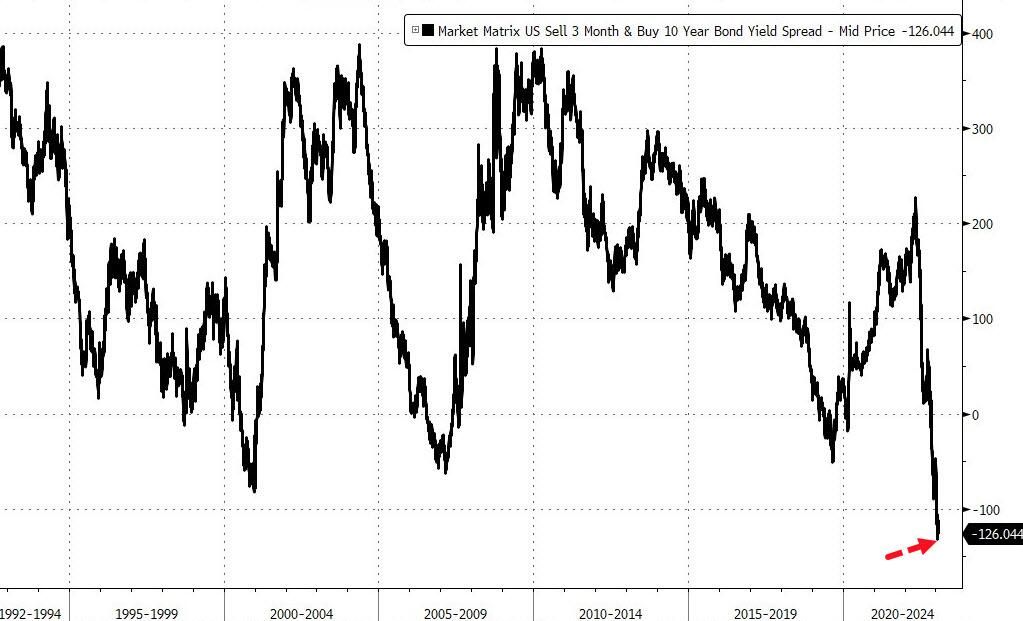

The third concern has to do with the U.S. Treasury yield curve. Based on past inversions, the U.S. economy could potentially be in recession by the end of this year.

The US yield curve is the most inverted ever..

We believe the U.S. economy remains in the midst of a “rolling recession,” with consumer goods and housing/housing segments related in recession, but stronger services spending serving as a positive offset for now.

STRATEGY : Don’t Fight the FED

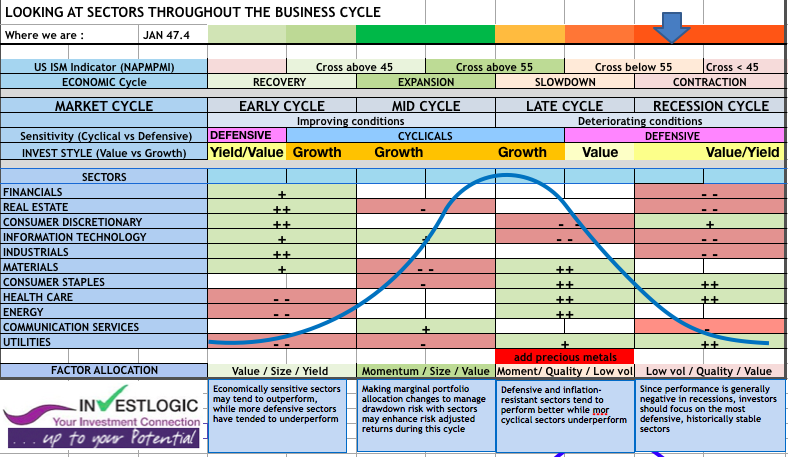

Given that stocks have enjoyed various rebounds over the past year, mostly driven by hopes that the Federal Reserve will pivot to a more dovish stance. But none of these rallies have lasted. We do expect an inflection point in 2023, as central banks end tightening and the growth outlook improves. At present, we favor a defensive tilt to protect against near-term risks, along with select cyclicals to prepare for a sustained turn in market sentiment.

We are remaining underweight equities at the moment and increased cash levels a bit last week due to the overbought conditions of the market. If the market confirms the “stop” of the bear cycle, we will aggressively add risk for the next leg higher.

Beyond that, whether Keynes said it or not, we should accept that a lot of the facts are surprising, and we might have to change our opinions. Which means that taking an aggressive position in anything is a bad idea.

We strongly suggest you balance this understanding of market structure with where we’re currently at in the U.S. economic cycle (CHECK our ABS proprietary Matrix).

The ISM supply managers’ survey of manufacturing, which has proved to be a great leading indicator for the economy over the years. This implies an imminent hard landing and a pressing need for the Fed to pivot, and pivot soon.

OIL

It’s party time for risky assets, well not for all of them since oil is losing ground this week for the second week in a row. The sharp increase in weekly inventories in the United States has clearly weighed on oil prices, thus taking a backseat to OPEC’s instructions to its members, which still advocates caution and lower production due to continuing uncertainties around global demand for crude. US WTI prices is losing ground at USD 76 per barrel.

GOLD

The ounce of gold peaked at USD 1956, but is still poised to end the week down nearly 1%. The World Gold Council said that demand for gold is at an all-time high in 2022, thanks in large part to central banks’ appetite. Central banks have accumulated more than 1,100 tons of gold, double the level in 2021.

USD

The euro regained ground this week against the major currencies, due to the position of the European Central Bank. The institution raised rates by a quarter point, as expected, keeping a firm speech, where the Fed and the Bank of England seemed more measured. The British pound, on the other hand, lost ground as the BoE governor suggested that much of the work has been done in the current monetary tightening cycle. Elsewhere, the yen advanced against the U.S. dollar to JPY 129.60 per USD.

Cryptocurrencies

Bitcoin remains at equilibrium around $23,000 this week, after recording its best January since 2013. A performance that can be explained by a clear revival of investor appetite for risky assets in the beginning of 2023. If the macroeconomic environment continues to brighten and U.S. monetary policy softens in the coming months, the conditions will be right for the cryptocurrency market to continue its ascent. But it is still far too early to draw any certainty on this subject.

Does the FED Throw In the Towel ?

Investors feared that Jerome Powell would chastise them for their excessive optimism. Nothing of the sort happened. The central banker appeared confused and his calls for caution were a flop. His posture even reinforced the bulls’ favorite scenario of the moment: the Fed is very close to its rate peak and the economy will hold up until it is time to resume a downward cycle.

As expected, the Federal Reserve hiked its policy rate by 25 basis points to 4.50%-4.75% on Wednesday, slowing the rapid tightening campaign that had dented stocks and other assets in 2022. “We’ve [now] raised rates four and a half percentage points, and we’re talking about a couple of more rate hikes to get to that level we think is appropriately restrictive,” Fed Chair Jay Powell declared. While the central bank reiterated that it would be data-dependent, investors are already seeing the light at the end of the tunnel.

Let’s have FED text explanation

The declaration noted that FED expects “ongoing increases” in the FFR will be needed, as it has since it started raising rates last year. And it reaffirmed its view that it will likely need to keep rates at “restrictive” levels (i.e., higher) “for some time” even after it stops hiking.

However, the Fed statement also included two notable changes from its last announcement on Dec. 14.

First, the Fed changed its assessment of inflation, as highlighted below.

Dec. 14:

Recent indicators point to modest growth in spending and production. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures.

Feb. 1:

Recent indicators point to modest growth in spending and production. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation has eased somewhat but remains elevated.

In short, most measures of consumer price inflation have been moving lower since last summer. But this is the first time the Fed has officially acknowledged this trend.

The Fed also made a small but significant change in how it will assess the need for additional rate hikes going forward.

Dec. 14:

In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.

Feb. 1:

In determining the extent of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.

In other words, it appears the Fed is no longer asking, “How fast do we need to raise interest rates?” Instead, it is now asking, “How much higher do we need to raise interest rates?”

During his post-meeting press conference, chairman Jerome Powell further emphasized these ideas.

While he noted that inflation remains above the Fed’s long-term target, he also acknowledged that the Fed’s tightening is beginning to weigh on the real economy and that inflation has fallen significantly.

“Consumer spending appears to be expanding at a subdued pace, in part reflecting tighter financial conditions over the past year. Activity in the housing sector continues to weaken, largely reflecting higher mortgage rates. Higher interest rates and slower output growth also appear to be weighing on business fixed investment.”..

Powell also emphasized that the Fed is now focused on how much further it needs to tighten, even using the same phrasing as the official statement above:

“Shifting to a slower pace will better allow the committee to assess the economy’s progress toward our goals, as we determine the extent of future increases that will be required to attain a sufficiently restrictive stance.”

Together these changes suggest the Fed could potentially halt further rate hikes as early as its meeting next month. And indeed, futures markets are now pricing in just one more rate hike in March, followed by potential rate cuts beginning as soon as the second half of this year.

The market’s reaction to the Fed’s “dovish” shift suggests that the recent rally could continue, especially if net liquidity conditions remain positive over the next several months. Actually financial conditions are now easier than last September when Powell “unleashed hell” at the Jackson Hole summit.

As mentioned last week, net liquidity could become significantly tighter again in the second half of the year even if the Fed does stop raising rates. Only a complete reversal of its quantitative tightening (QT) program – which the Fed currently has no plans to do – would likely prevent this.

That means liquidity could begin “drying up” around the same time a recession begins weighing on earnings. And this combination would create massive headwinds for stocks.

Therefore we should focus primarily on the healthiest low- and medium-risk stocks in the healthiest sectors and markets, avoiding unhealthy, high-risk, and speculative investments, and continuing to hold some extra cash.

We do think conservative investors would be wise not to get too aggressive with new investments in the meantime.

Happy trades