MARKETSCOPE : Stay Calm and Carry On !

January, 24 2022

“Be fearful when others are greedy, and greedy when others are fearful!” – Warren Buffet.

In the wake of the fall in US technology stocks and fears of a forthcoming Fed tightening, financial markets have been in a bad way again this week, leading to sell-offs in most sectors. Only the luxury goods sector has regained some color, while banking stocks, which had largely benefited from expectations of a rate hike, are once again suffering from profit taking. Volatility has resurfaced, especially since the first US corporate results have generally disappointed investors.

This sell-off was in line with an overall sell-off in technology (growth) stocks at the end of the year

At the end of the week the US markets closed sharply lower DowJones -4.6 %, S+P500 -4.5 %, NASDAQ -6.2%, DAX -4.1%, SPI -4.2%, FTSE100 -2.6% STOXX50 -3.8%, H-K +1.10%.

This past week, retail investors began to panic sell as “meme” stocks fell apart. Previous favorites became an anathema from AMC to Gamestop to Pelton and Netflix. The selling pressure took the S&P 500 below its trendline support.

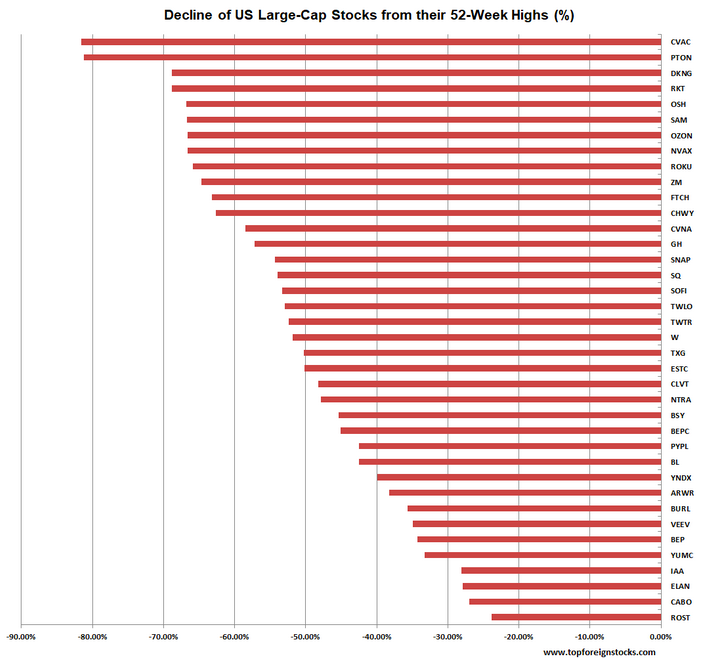

Freshly minted publicly traded companies have been taken to the woodshed in the last month. According to the Wall Street Journal, two-thirds of the companies that made their public debut in 2021 are trading below their IPO price.

As noted the market breadth is not good for NASDAQ. For example, last Friday (16) 690 stocks reached their 52-week lows compared to 84 for 52-week highs on the NASDAQ according to WSJ market data.

Many large-cap stocks trading on the exchange have declined 20% or more from their 52-week highs. A recent journal article noted that as of Jan 7, 36% of stocks in the NASDAQ Composite were down 50% or more from their recent 52-week highs.

By the way, JEREMY GRANTHAM who has been bearish for months did not hesitate to announce couple of days ago that the SUPERBUBBLE had just exploded… And that the loss of capital that will follow could reach 35’000 billions – We don’t even know what that means. He thinks that the irrational behavior of many investors will lead to a total collapse in all asset classes… the possibility of a 40-50% contraction to revert the massive extension from the long-term growth trend is highly probable CASH is KING!!!

SELL THE DIPS BUY THE RIPS (sell on rally)

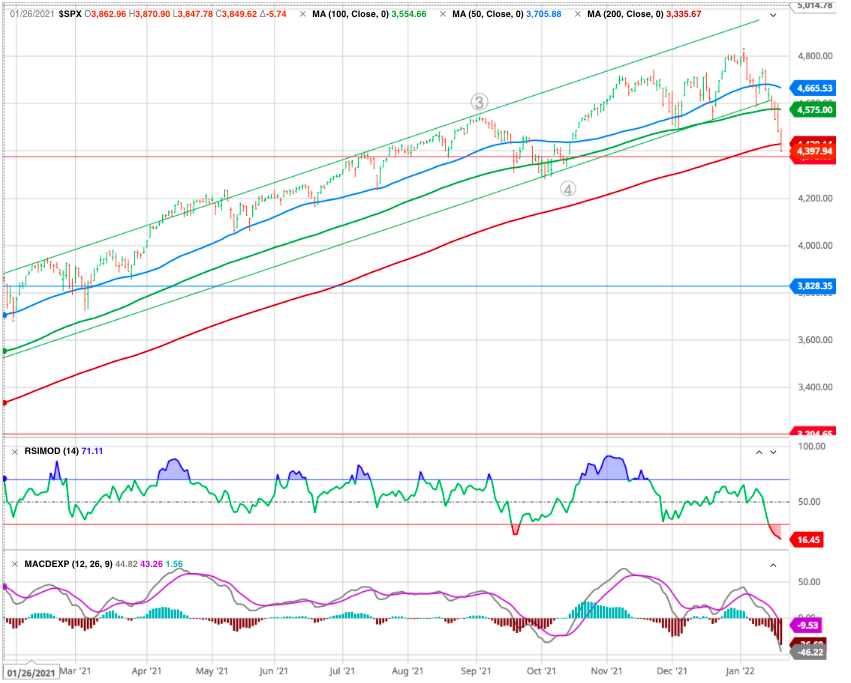

The current correction has already wipe out the rally following the October correction. We identify first Fibo support (purple) at 4375 (correction or 1.8% of the main wave from April 2020). The next Main support would be 3828 at 50% (blue).

In the grand scheme of things, a 7% decline isn’t all that concerning. It doesn’t even qualify as an official market “correction” (a drop of 10% or more from a peak).

However, it is the biggest pullback we’ve seen since the market fell nearly 9% ahead of the 2020 U.S. presidential election. And, more importantly, some of the most popular and widely owned areas of the market have performed far worse than the S&P 500 would suggest.

For example, the Nasdaq 100 Index (NDX) — which has a greater concentration in high-growth technology stocks — has fallen more than 11%.

The small-cap Russell 2000 Index has lost more than 17% to date.

Bing Bong! Nasdaq breadth on the other hand is in free-fall as the previously popular hot growth/tech stocks correct from frothy levels. Such is the worst start for the Nasdaq since 2008 and is at support from October lows.

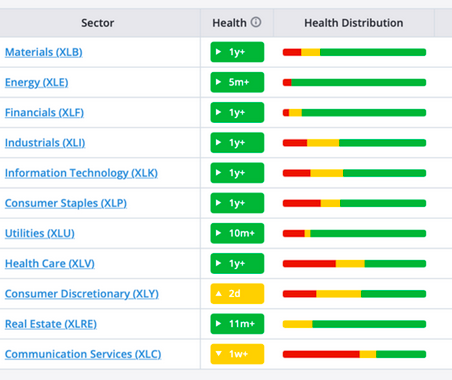

S&P Sectors tool is sending a similar message about the individual sectors here in the U.S.

This marks the first time we’ve seen fewer than 10 of the 11 sectors trading in the Green Zone since last March.

Now, these changes could be the first indications that a more significant correction is beginning, so we’ll certainly be keeping a close eye on them

Again, most sectors and most of the stocks within them remain healthy. Just one of the Yellow Zone sectors — Communication Services — is at serious risk of falling into the Red Zone today.

In other words, despite the intense selling in some areas, we think this is just a normal bull market correction so far. They’re not detecting any of the usual signals that precede a crash or severe bear market.

With earnings season kicking into gear this week, it would not be surprising for the market to hold first support, given that earnings should be reasonably robust. In addition, given we are looking at earnings for the 4th quarter of 2021, where there was still substantial liquidity in the system and the Fed was still highly accommodative. However, as we get into the later quarters of 2022, the support for earnings will fade considerably.

Tech giants Microsoft (NASDAQ:MSFT), Apple (NASDAQ:AAPL) and Tesla (NASDAQ:TSLA) are due to report with investors looking to earnings results for reassurance after last week’s selloff, but market volatility looks set to continue for now.

Conclusion : Welcome back to reality

When the “bull is running,” we believe we are more intelligent than we are. As a result, we take on substantially more risk than we realize as we continue to chase market returns allowing “greed” to displace logic. Like gambling, success breeds overconfidence as the rising tide disguises our investment mistakes.

The current market selloff, and rotation to value, may undoubtedly be essential clues. With market valuations elevated, leverage high, and economic growth and profit margins set to weaken, investors should be paying close attention. Stock picking will be more important this year ! and fundamentals will have to be examined more that the previous year!

Risk is still prevalent. With sell-signals still intact, and the market not back to short-term oversold levels, there is still downside pressure on stocks.

Cryptos

The cryptocurrency market continues to sink, moving further away from its historical highs every day. At this rate we will soon have halved the record of $3 trillion in total market capitalization reached only 2 months earlier. At the time of writing, the market weighs “only” 1800 billion. A bitcoin down almost -10% over a week, which has the effect of sowing (even more) fear among crypto-investors.

Few days ago 21 JAN bitcoin broke support area 41000-39600 and fall for 22% in last few days.

We think BTC will be back to test support area as resistance because if you see a history you will that price always tested this area twice.

So in our opinion at first we will fall to support zone 30-29k.

Will the FED be your Friend ?

A key part of the correction has basically been a combination of surging inflation (and inflation expectations), along with the market waking up to the Fed policy pivot: “don’t fight the Fed” means go with the flow when the Fed is easing vs tightening, and they have resolutely shifted into a tightening bias this year.

It’s set to be a major week for markets, between the Federal Reserve meeting and an avalanche of big-name earnings. Fed Chair Jerome Powell is expected to signal that the central bank is on course to deliver its first rate hike since 2018 in March, in a bid to tackle soaring inflation. Some folk have (wrongly, as a guess) been floating the idea of a 50bp hike… something that seems unlikely given how risk-averse the Fed has been this cycle). Given a lot of this correction has to do with repricing risks, we could easily see a relief rally post-Fed although we could state that The Federal Reserve Doesn’t Care About the Stock Market. SEE OUR BLOG

Fed’s most considerable risk remains the “stability” of the financial markets. While the Fed is concerned about “inflation” and its impact on the economy, financial instability is a greater risk. Just as in 2008, a cratering financial market undermines economic growth and exacerbates the risk of a financial crisis from a highly leveraged economy.

We suspect the Fed will ultimately opt for financial stability. However, the Fed has a long history of making the wrong choice first before coming to the rescue.

Happy trades