MARKETSCOPE : Don’t Fight The Tape

October, 16 2023“Sometimes people don’t want to hear the truth because they don’t want their illusions destroyed.” –

Friedrich Nietzsche

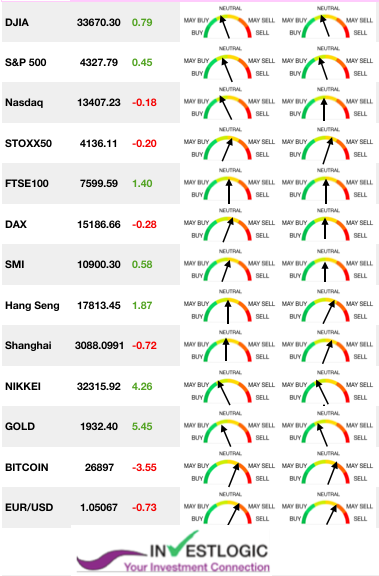

Pretty similar wall street backdrop to the week before !

Last Monday, when the Fed “announced” via several speeches by different officers, the bond market (aka vigilantes) had done the tightening for them and for now, they are done with increasing interest rates further.

The communication exercise from Fed officials to leak to the press that the fall in bonds was the equivalent of a rate hike, leaving little room for doubt as to the Fed’s stance at its next monetary policy meeting, scheduled for early November, led investors to believe that rate hikes were over, paving the way for a rebound in equities after a rather painful August-September session.

Equity markets did what equity markets do in this situation, which is ignore any negative conclusion (e.g. pending recession) from these comments and concentrate on the positive side (e.g. lower rates ahead) only. Wall Street wrapped up a volatile week with a mixed performance from stocks while investors sought safe-haven assets such as U.S. Treasury bonds and gold, as the Israel-Gaza war looked likely to escalate.

Large-cap value stocks outperformed, helped by earnings beats from Citigroup, Wells Fargo, and JPMorgan Chase. The prospect of a widening war in the Middle East boosted energy shares and defense stocks while weighing on airlines and cruise operators.

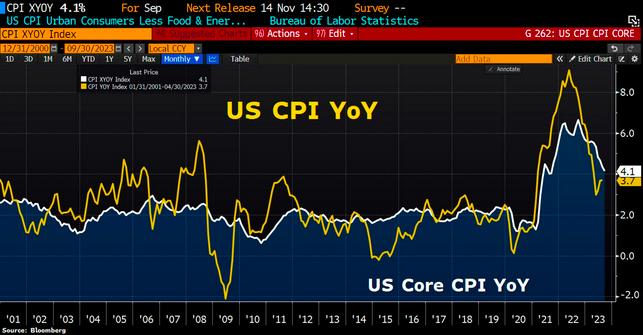

But that was before the publication of the US consumer price index. On a monthly basis, it came in above expectations at +0.4%, or +3.7% on an annual basis.

As a result, bond yields rose, as did the dollar, while the stock markets suffered. The “higher for longer” scenario is back with a vengeance, while doubts remain over a possible new (final?) rate hike in December.

Treasury yields were lower on Friday after their big jump in the previous session. The 30-year Treasury yield ended the week at 4.787%, while the 10-year yield closed at 4.62%.

The onslaught of corporate earnings releases expected from this Monday onwards should take some of the focus off monetary policy. Investors will aim to look through the fog of war headlines next week to recalibrate as economic and earnings releases pour in.

Earnings season is picking up pace, with some 50 companies in the “$50 billion-plus capitalization club”. These include Rio Tinto, Johnson & Johnson, Bank of America, Lockheed Martin and Tesla in the US, and Rio Tinto, ASML, Nestlé, L’Oréal and Roche in Europe.

There will also be plenty of macro-economic data from the USA and China, as well as the much-anticipated Fed Chairman’s speech on October 19 -BTW the anniversary date of October 19, 1987 Crash- , see BONUS –

In the midst of the recent cacophony, Jerome Powell’s words will probably carry even more weight than usual.

MARKETS : All quiet on the positioning front

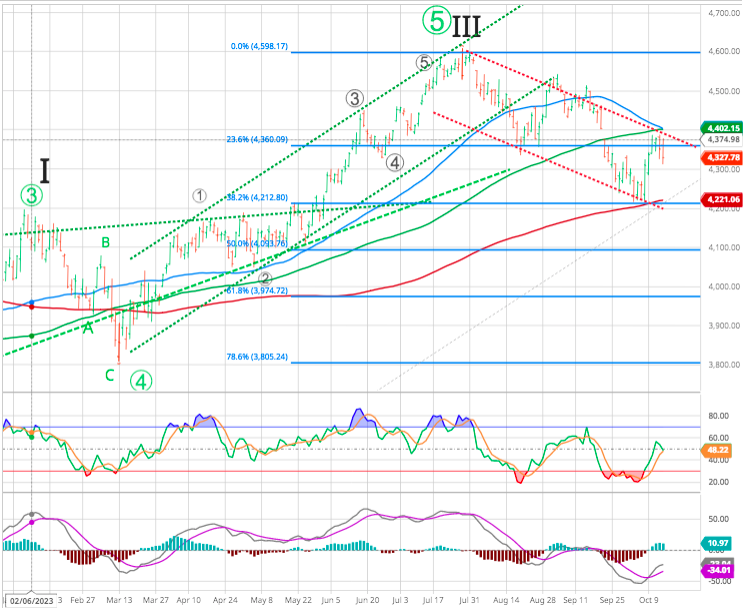

With the markets deeply oversold from the summer sell-off, The market rallied from the deeply oversold condition despite the news of the conflict in Israel. While the initial reaction was a flow of capital in defense and energy stocks, as well as bonds, the market returned its focus to the start of the upcoming earnings season.

We could see some consolidation at these levels into next week before another attempt at resistance level.

It’s still premature to dismiss the view that the market remains in a bear market rally. Despite the 14.0% year-to-date gain through Oct. 11, the S&P has yet to fully recover from its steep loss in 2022.

It will mostly depend on earnings reports as they get underway in earnest next week. The key, however, will be forward guidance that leads to concerns about a slower economy next year.

The question is whether earnings season will provide the support needed to overcome the fear of “conflict” in the short term. We will be watching those reports closely. -See below-

Moreover, conflicts are often a negative for financial markets immediately, but not over the longer term.

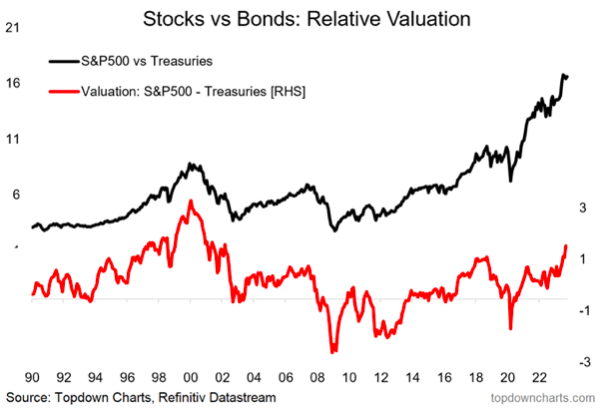

Stocks vs Bonds — Relative Value:

Not just price, value is also looking stretched. Stocks are the most expensive vs bonds since the dot com bubble. You would need a repeat of dot-com for stocks to get more expensive vs bonds from here.

But not only are stocks (S&P500 — larger caps, and especially tech) expensive vs bonds, they’re also expensive vs history, and meanwhile bonds are outright cheap.

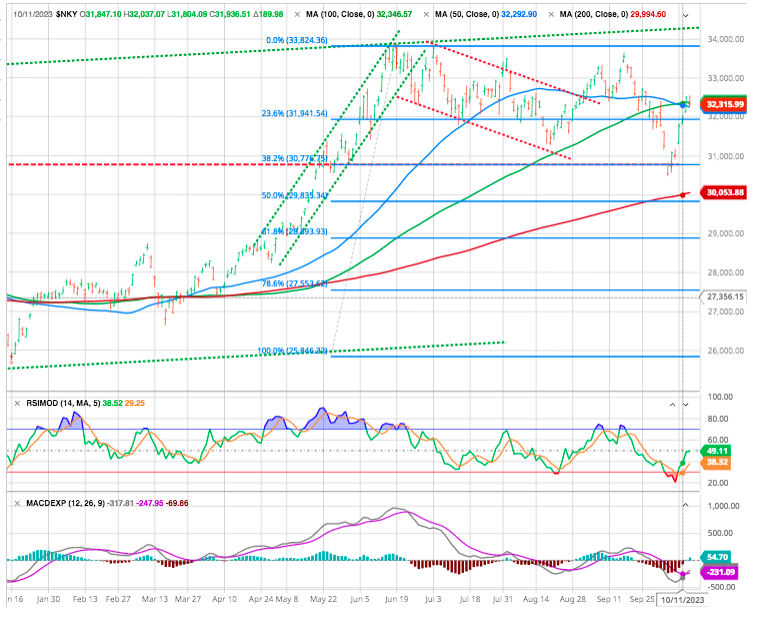

Japan : the relief rally has reached an intermediary resistance

After a decline below to the 38.2% Fibonacci retracement of the rally initiated in January. Since then, a rebound is underway and has pushed the index towards an intermediary resistance given by the 50-day DMA. Then the market could test the 33’850 high.

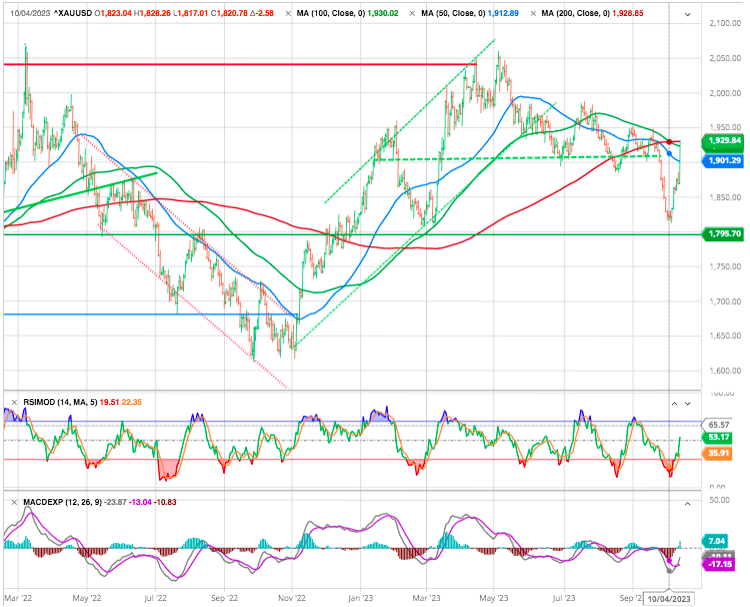

GOLD : WHAT IS NEXT FOR GOLD?

What is bad for the world is good for gold.

Several commodity prices, including oil and gold, have increased over the past week. For gold, it’s been an up-and-down year. In April, gold surged above $2,000—the first time the precious metal closed above $2,000 since soaring to an all-time high of $2,089 in August 2020.

Since that recent high this past spring, gold has fallen nearly 9%, facing headwinds this year such as receding fears of a US slowdown, surging bond yields, and better performing equities.

The threat of the conflict escalating along with macroeconomic factors could be the catalyst for the next sustained upturn in the gold price. From a charting perspective, $2,000 appears to be a key resistance level.

EARNINGS SEASON : Begins with big tech not banks !

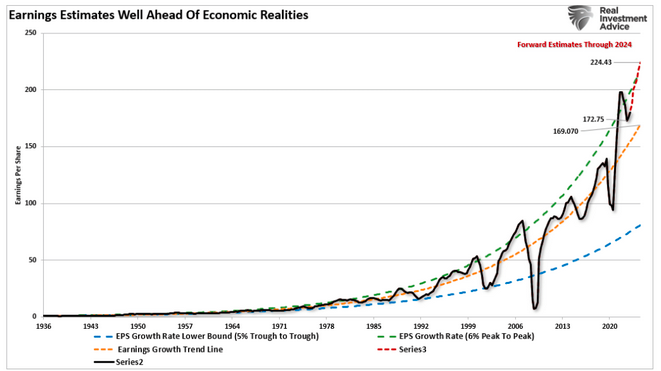

As earnings season gets underway, we will want to pay attention to clues as to the impact of inflation, conflicts, slowing spending, or weaker economic outlooks on future revenue growth and profitability. Such is particularly important given that forward estimates remain well above long-term growth trends and economic realities.

While global equities have been focused on moves in interest rates over the last month, earnings estimates have been moving higher. forecasts for profit margins: nearly 3/4 of companies in the S&P500 have seen increases in forward earnings estimates during the past 3 months.The earnings recession may have ended in 2Q. Earnings revision momentum is gaining in most global markets with high energy-sector weights.

Source Gina Martins Bloomberg Intelligence

However, Société Générale’s Albert Edwards, long a bear argues that large US companies are playing the yield curve borrowing long term and then earning 5% or more on their cash, adding as a result 5% to profits: « greedflation » has boosted margins and delayed the recession. Stay tuned!

Forget banks, 3Q earnings does not start until this Wednesday when Netflix and Tesla report. Alphabet, MSFT, AMZN and META all report the week after and Apple reports on Nov 2nd

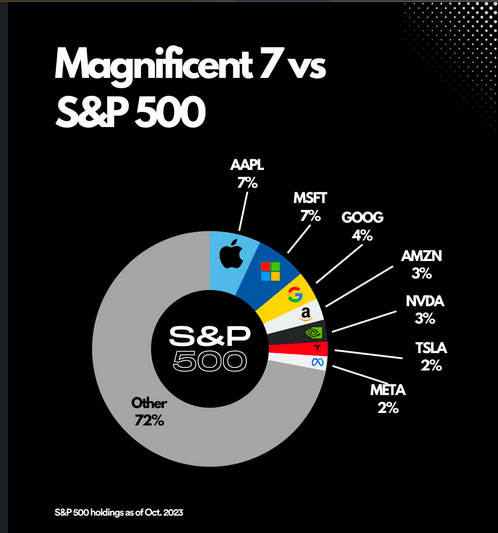

The market will focus to the start of the upcoming earnings season and began chasing the “Mega-7” capitalization companies. Those magnificent punch way above heir weight thanks to premium valuation multiples.

The group makes roughly 30% of the S&P500 market capitalization but only 10% of its sales and about 16% of its earnings.

The 7 biggest constituents by market cap have returned 92% on average this year:

1) Alphabet Inc. +53%

2) Microsoft +34%

3) NVIDIA +206%

4) Amazon +50%

5) Meta +153%

6) Apple +35%

7) Tesla +111%

So hits and misses from their results will prompt outsize moves in the index.

Thank the FED : the stock market just ended its loosing streak !

The FED may be pivoting- it is not elegant, graceful and refined BUT the FED officials have gone out of their way to talk down the likelihood for another hike. Fed speakers have acknowledged that the surge in bond yields has resulted in tighter financial conditions.

The market too is coming around: fed futures pricing implies a one in three chances of another rate hike this year down from roughly 50/50 odds a few weeks ago ago.

On the flip side higher fo longer is now the message. This is just as well as falling rates in 2024 would mean a worse economic outcome. A FED conscious of the bond market’s tightening effect is better that one that is not !

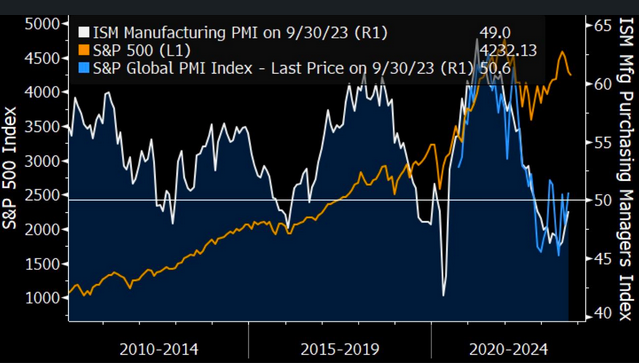

One of the more reliable indicators for stocks appears to be confirming a slowly improving outlook. PMI peaks occurred before stock-market highs the past decade, and accurately indicated the 2022 market meltdown. PMI troughs have been less consistent leading indicators for stocks but preceded or coincided with lows in 2009 and 2016.

Maybe a soft lending is possible after all.

See INVERTED YIELD CURVE : A RECESSION WARNING ?

Happy trades

BONUS

Investment Risk in 2023

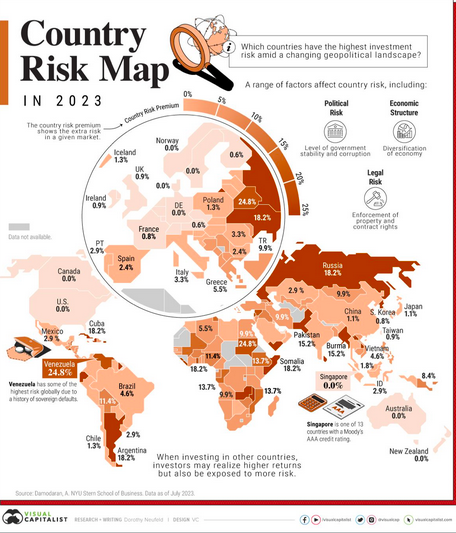

What is the risk of investing in another country?

Given the rapid growth of emerging economies, and the opportunities this may present to investors, it raises the question: does investment exposure abroad come with risk, and how can that risk be analyzed?

To help answer this question, this graphic shows country risk around the world, based on analysis from Aswath Damodaran at New York University’s Stern School of Business.

Five countries share the highest risk: Belarus, Lebanon, Venezuela, Sudan, and Syria. In Belarus, Russian military forces continue to operate. Venezuela has faced hyperinflation and endemic corruption for many years.

On the other hand, 13 countries had the lowest risk, including several European nations, #Singapore, and NewZealand. This is due to factors such as their AAA-rated government bonds, low corruption, and strong property right protections.

What Does This Mean for Investors?

The growth of emerging economies presents opportunities for investors, shaped by demographic influences, rising GDP, and technological advancements seen globally.

Adding to this, diversification across sectors, assets, and geographies may stand to benefit investors more generally.

With this in mind, investments in other countries are exposed to country risks that go beyond, but ultimately influence the long-term performance of stocks, bonds, and other financial assets. Considering these factors, the reward of investing in international companies may come with #macroeconomic and country-specific risks.

OCTOBER CRASH 36 years later a new crash ? *

In a few days (19 October), it will be 36 years since the 1987 financial crash, when the S&P500 plunged -20.5% in a single day (Black Monday), a decline unmatched for the US stockmarket, even in 1929.

Aside from the starkness of the crash, we should remember that it occurred amid an equity bear market (-34% between August and December 1987). The main factor of the equity bear market in 1987 was a powerful bond market correction (10-year T-Note +325bp between January and the peak in October).

We are currently in the midst of a very powerful bond market correction in nominal terms (+420bp since the low points of summer 2020, +320bp since the beginning of 2022), but even more so in real terms (+350bp over two years), significantly more than in 1987.

There are also three differences with 1987, making the current situation worse.

First, in 1987, interest rates rose in a period of economic growth, whereas we are currently in a slowdown.

Second, the yield shock of 1987 was not obviously excessive in view of nominal GDP growth, while interest rates and nominal GDP growth are now diverging which will at some stage raise the issue of debt sustainability.

And finally, absolute equity market valuations are relatively low compared to today. Also, the yield gap with real long-term interest rates appears a little worse.

* Source : Jean-Pierre Petit, LCV Research (Les Cahiers Verts de l’Économie).