MARKETSCOPE : Bullmania

November, 06 2023The Bulls Strike Back !

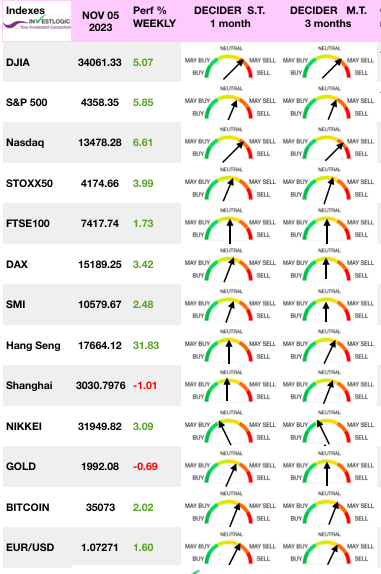

Financial markets rebounded last week due to positive corporate results and a significant drop in bond yields.

Stocks closed sharply higher to extend a monster rally that saw the big three indexes sweep to their biggest weekly gains of the year. The rally has been broad-based, but the best-performing stocks have been the names that did the worst in the 10 days prior and led by the small-cap Russell 2000 Index, which scored its best weekly gain since October 2022. (see Markets).

In Europe, the STOXX Europe 600 Index rebounded from the previous week’s loss and ended 3.41% higher. In Asia, the BoJ remained committed to its ultra-loose monetary policy stance at its October meeting, leaving its short-term lending rate unchanged at -0.1%. However, the central bank now allows yields to rise more freely—it will now regard its 1.0% ceiling for 10-year Japanese government bond yields as a reference, rather than strictly capping interest rates at that upper bound.

Investors grew more hopeful on macroeconomic announcements and that that the Federal Reserve’s interest rate hikes might have ended. The essential points to emerge from it are as follows:

- The US Treasury cut back slightly on the amount of long-term bonds it’s planning to auction, compared to prior plans;

- The Bank of Japan allowed 10-year yields to rise, but didn’t release control completely, as some thought possible;

- The Federal Reserve offered guidance taken as a strong hint that it didn’t plan any more rate hikes;

- US unemployment data were both weaker than for the month before, and weaker than expected.

The October jobs report Friday came in weaker than expected, showing the Fed’s campaign to cool the economy and stifle inflation could be working. The unemployment rate rose to 3.9%. That’s its highest since January of last year. But in historic terms, it’s not very high at all and there could be much further to go.

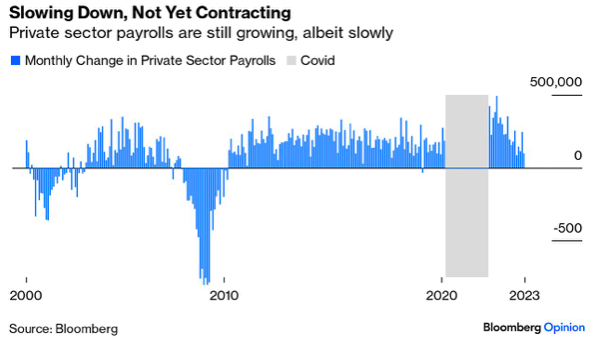

Private sector payrolls are still growing at a normal rate. The rate of change matters, and it shows deceleration, but companies are still expanding their workforce:

excluded the months when the unemployment rate was most distorted by the pandemic-gray area-, for legibility:

Source Bloomberg opinion

Meanwhile, the single most important aspect of labor growth as it affects inflation, wage growth, came in slightly above expectation

Investors head into the new week with stocks making a recovery push and Treasury yields falling back. The economic calendar is light. Federal Reserve Chairman Jerome Powell will speak at a panel at the IMF’s annual research conference. European Central Bank President Christine Lagarde, Bank of Japan Governor Kazuo Ueda and Bank of England Governor Andrew Bailey will also speak. The turn in the bond market will be a major point of discussion.

MARKETS : “Santa May Be Early This Year”

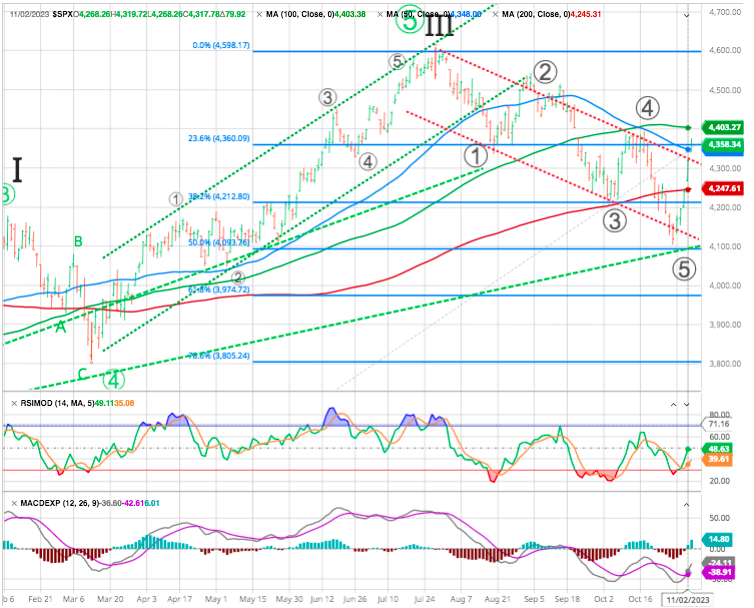

Risk assets and bonds surged as buyers jumped in to buy the recent dip. The break of the 200-DMA was reversed on Thursday, and the 50-DMA was breached on Friday.

It also worth to note that the uptrend line from March 2020 (dotted green) has been tested and hold !

However, technically, the S&P500 needs to break the key resistance levels, first the 50dma, and more importantly the 100dma, which would be the “higher-high” and open up the possibility for the S&P500 to reach the year-high point at 4600.

Given that the Fed did little to talk up the projections of further rate hikes, the market took this as meaning the Fed is likely done hiking rates. Of course, that means, from the market’s perspective, the subsequent actions will be “rate cuts.” Those actions set the market up for a possible rally into year-end.

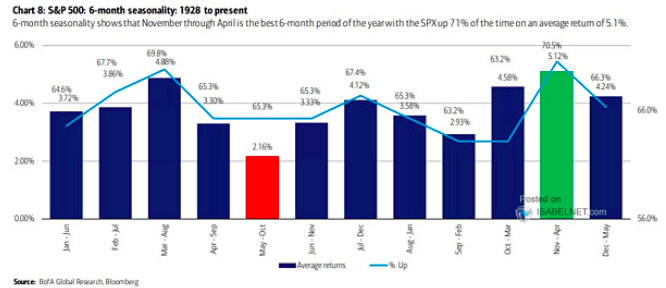

As Ed Yardeni pointed to this chart ” the stock market may have just bottomed”. The seasonal effect might also play a positive factor :

With a rather brutal October behind us, the seasonal statistics of November and December provide a more optimistic outlook for a rally. From a historical perspective, November through April is the best 6-month period of the year, with the S&P 500 index rallying 71% of the time with a 5.1% average annual return.

Watch Out a Boomerang Effect

From an Elliott Wave perspective, the market is completing a A-B-C correction wave impulse from the October lows. After topping in wave C at 4600, the SPX began an new downtrend in 5 waves. Last week, we broke below the 200-day MA, but found support at the 50 % retracement at 4100. As mentioned last week

it is reasonable to expect a 2nd wave counter-trend rally back to fibo 61.8 % of the latest downtrend wave,the 4375-4475 range, before wave 3 and 5 begins to take us down in earnest into 2024.

Then, we could head as low as 3900, to test the next fibo level at 61.8 %. It’s important to note that the 4100-3900 area has had the most trades in the SPX over the last two years.

Short Covering

Another explanation to this strong up rally is short covering

Within stocks, Bloomberg’s Factors To Watch service reveals that there was a surge out of defensive “quality” stocks with well-defended balance sheets and earnings, which are viewed as conservative investments in difficult times, while there was a big rebound in the stocks that had been most heavily sold short, meaning that investors were betting against them. Anyone who had been assuming imminent disaster decided they needed to rethink swiftly.

Traditionally defensive, low-beta sectors utilities and consumer staples are among the groups leading the downdraft in the S&P 500, and suggesting that in periods where rising bond yields dominate equity-market psychology, a new defensive strategy is necessary.

Consumer staples have sold off 10.5% over the past three months, and utilities have tumbled 16%, doubling the overall market decline. Utilities’ relative price drops in tandem with S&P 500 decreases are relatively rare historically, as utilities tend to reliably outperform the S&P 500 when the index is weak.

In contrast, energy and communications stocks have posted gains of 5.4% and 6% respectively, suggesting that in an environment where rates are dominating the equity landscape, the definition of equity-market defense changes materially.

As for the critical 10-year Treasury yield, it had looked as though the bond selloff was overdone. Last week’s surge back into bonds has left the 10-year yield challenging the short-term support of its 50-day moving average, but did not break the upward trend line. The 10-year U.S. Treasury yield tumbled from 4.88% to an intraday low on Friday of around 4.48%, its lowest level since late September. A few more days of traffic in the same direction are needed before we can clearly say that the upward trend is over:

Soft Landing does not mean No-Recession

The appearance of soft landing is likely to support the stock market over the near term. However, the soft landing does not mean NO Recession, it is likely only a transition to the hard landing in 2024.

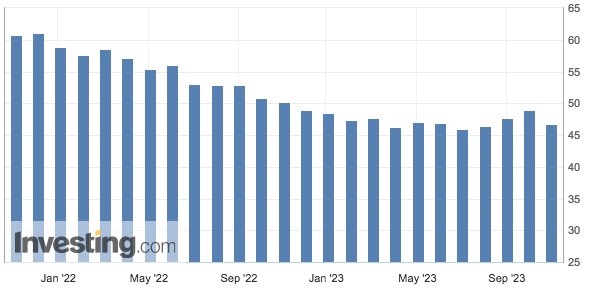

Economic activity in the manufacturing sector contracted in October for the 12th consecutive month following a 28-month period of growth,

The Manufacturing PMI registered 46.7 percent in October, 2.3 percentage points lower than the 49 percent recorded in September. The overall economy dropped back into contraction after one month of weak expansion preceded by nine months of contraction and a 30-month period of expansion before that.

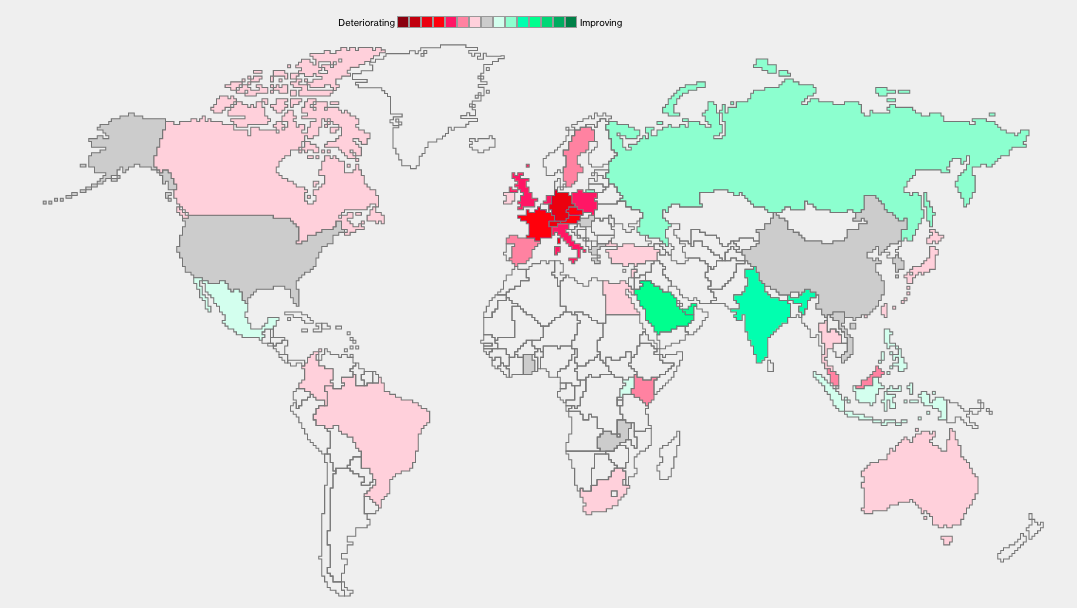

World’s Purchasing Managers

Source Bloombergas of 11/05/23

The signs of a slowdown that became apparent in late October will just be the beginning.

The current macro environment is starting to resemble the soft-landing scenario, from the post-pandemic inflationary period and the booming economy due to reopening.

The question is whether the soft-landing phase is only the transition to the hard landing phase. In other words, will the slowdown eventually transition into a recession? How long until the payroll report starts showing job losses?

But most importantly, the effect of the inverted yield curve has not been fully reflected yet. The yield curve has been inverted since October 2022 – for 12 months now, and historically the recession usually follows within 12 months of the initial inversion.

The inverted yield curve results in lower credit supply to the businesses, which eventually produces job losses and induces the credit event in the weaker indebted firms. This has always produced a recession based on historical evidence.

Thus, it is likely that the current soft-landing phase is just a transition to a recession.

In addition, there are very real risks in the market that could derail the rally. First, there is an active geopolitical situation that could cause a spike in oil prices and change the inflationary picture. Second, the bond market is still facing the issue of the high-supply meeting the low demand, and the US government could still shutdown on November 17.

Happy trades