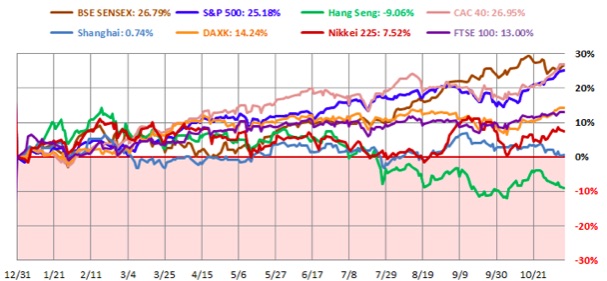

MARKETSCOPE as of November 8,2021

November, 10 2021

All three major market indexes closed at new all-time highs, even after a late drop in tech stocks weighed on the final Nasdaq number. Pfizer said interim data showed its COVID-19 pill reduced the risk of hospitalization or death by 89%, which boosted classic reopening plays such as airlines and cruise ships. And positive momentum carried over from the Fed’s signal this week that inflation is “transitory” and likely would not require a fast rise in interest rates. The House of Representatives also managed to pass the bipartisan infrastructure bill (around $1bn), and Biden vowed Friday that the $1.75tn social infrastructure package would be passed in the coming weeks.For the week, the S&P 500 gained 2%, pushing its year-to-date gains to 25%, the Dow added 1.4%, and the Nasdaq rallied 3.1% for its best weekly showing since April.

Where are the opportunities?

Of the sectors that have led the rebound since mid-October and are on the verge of forming a new 52-week high, the US Consumer Discretionary and Technology sectors and the European Consumer Staples and Consumer Discretionary sectors show the greatest divergence between the level of the sector index and the internal dynamics of its members.

These indices have benefited from the positive momentum of their leaders, the stocks with the most weight in the indices. To the extent that we expect the risk-on environment to prevail into the end of the year, we think investors will continue to look for higher potential opportunities in similar sectors – benefitting other members of these sectors accordingly.

The notoriously scary month of October is now well over . Well, we are confident that the month of October 2021 should attenuate the poor market-reputation of this month – the stock market reached record levels on Friday as strong earnings from major companies bolstered investor confidence. The S&P 500 added 0.19% to close at a record high of 4,605.38, and the tech-heavy Nasdaq Composite jumped 0.33% to close at its own record of 15,498.39. The Nasdaq also notched an intraday record high of 15,504.12. The Dow Jones Industrial Average rose 89.08 points, or 0.25%, to finish at 35,819.56, just under its all-time high reached last week. Nearly half of the S&P 500 has now reported third-quarter earnings, with a large majority delivering better-than-expected results.

“Earnings have helped and a reminder that US reporting so far has been better than the long-term average in terms of beats,” Jim Reid, head of thematic research at Deutsche Bank. “It has still been healthier relative to some of the stagflationary gloom stories seen through September and early October which has perhaps helped the relief rally.”

The move for stocks came despite a disappointing economic report on Thursday. GDP growth for the third quarter came in at 2.0%, below the 2.8% expected. The reading marks a slowdown from 6.7% growth in the second quarter. However, the third quarter report captured much of the delta wave of Covid-19 that rolled through the U.S. but has since receded, leading some to believe it was a short-term slowdown.

The October ISM non-manufacturing gauge beat estimates, hitting a series record in October as it soared to 66.7, up from 61.9 (est.62) – a level not seen since 1997. -Check our ABS Matrix -.

Oil is continuing its rise. Light Sweet Crude rose some 10% for October, trading around $82/Bbl. Big ol’ oil stocks such as Exxon [XOM] and Chevron [CVX] reported record earnings. As oil rises, traditional producers gain in value and at the same time, their competition, i.e., alternative energies rise as well! The hydrogen sub-sector of alternative green energies has been grabbing headlines all year, although we are still grappling with the real-life issues of how to actually store and transport it.

ECB President Christine Lagarde on Thursday tried to play down the chances of a rate hike for 2022, hinting that market players might be getting ahead of themselves with their predictions. The Eurozone’s central bank decided to keep interest rates and its monetary policy stance unchanged despite ongoing inflationary pressures. Some market participants believe the ECB is underestimating current inflationary pressures and will therefore likely have to announce a rate hike before the start of 2023. Indeed, money markets have priced in the probability of a 20-basis point hike for December 2022.

The ECB foresees inflation at 2.2% in 2021, 1.7% in 2022 and 1.5% in 2023 — thus below its 2% target. The bank will be updating those forecasts in early December. Euro zone inflation hit a new 13-year high in October, as the currency bloc battles surging energy costs. Headline inflation on Friday came in at 4.1% for this month, according to preliminary data from Europe’s statistics office Eurostat.

We would argue that whilst it is likely that general price levels may well rise because of energy price increases and significant disruptions in supply routes for just about everything, we doubt that raising interest rates could be effective in generating supply and employment of truck drivers. We trust that Christine knows this better than we do. Euro rates are likely to remain put. The USD/Euro trading supports this view, as the Euro has softened a little since the ECB meet. Strangely, the Euro at $1.15940 is within a gnat’s whisker from its initial level in January 1999 at $1.17! Everything moves but nothing changes…

Well, as FX trades in pairs, the Eurozone inflation must be viewed with USA inflation lenses – the headline inflation came in at 4.4% and 3.6% for the core ex food and energy. Quite similar… US benchmark 10-year treasury yield fell back to 1.57%. This inflation must be transitory…

The Federal Open Market Committee released their November policy statement followed by the regular press conference from Fed Chair Jerome Powell. Chair Powell was as dovish as possible while still announcing a plan to reduce the pace of monthly QE.

The Federal Reserve outlined a plan to reduce the pace of monthly asset purchases, a widely expected move. While a tapering plan was outlined, Chair Powell also firmly pushed back on the idea of rate hikes in the first half of 2022.

In a coming paper that will follow, we’ll review the actual policy changes, the initial market reaction, and the medium-term economic implications.

We are glad we have chosen to stay invested in equities and we maintain our outlook favouring equity exposure for the remaining two months of 2021. We also remain vested in an overweight energy position, a mix of old oil and new alternatives. Bitcoin is trading around $63’000, close to its all-time highs. We remain agnostic here, believing that Crypto gets its value due to a limited supply of nothing.

HAPPY TRADES