Market Wrap as of April 7: Central Banks Bet

April, 08 2014 Mario Draghi highlighted that “the Governing Council is unanimous in its commitment to using also unconventional instruments within its mandate in order to cope effectively with risks of a too prolonged period of low inflation.”

Mario Draghi highlighted that “the Governing Council is unanimous in its commitment to using also unconventional instruments within its mandate in order to cope effectively with risks of a too prolonged period of low inflation.”

Unconventional policy levers arguably include a negative deposit rate (although we continue to believe this is not the best option). But they also include balance sheet measures such as ending the sterilization of the ECB’s previous Securities Market Program bond purchases, launching another phase of Long Term Refinancing Operations, a targeted credit support program, and even a quantitative easing bond purchase program.

However, Draghi provided no sense of how close the ECB is to actually easing further, let alone doing something unconventional, even though unemployment is proving quite sticky at a disturbingly high level and inflation is continuing to trend lower towards the deflation zone.

The statement (the punch line) included the phrase “within its mandate.” The ECB’s mandate effectively precludes it from engaging in Japanese- or US-style QE: monetizing government debt/deficits is prohibited. The Bundesbank and German Constitutional Court represent strong institutional barriers against “pushing the envelope” in this direction. Instead, don’t be surprised to see the ECB move to a zero or even negative interest rate target to push the FX value of the Euro down.

In the US, Fed Chair Yellen sounded very dovish in Monday’s speech, emphasizing that markets should expect extraordinary policy accommodation for some time, given the slack in the labor market. She broke with precedent by citing anecdotes (this from a person who has perhaps overused the words “data dependent”). She did not repeat the “six-month” guesstimate of how soon after QE ended Fed funds would start rising, but she didn’t “walk it back” either, or give any guidance suggesting anything more dovish than the Fed statement.

She demonstrated empathy without making any promises or commitments. She is a very good politician.

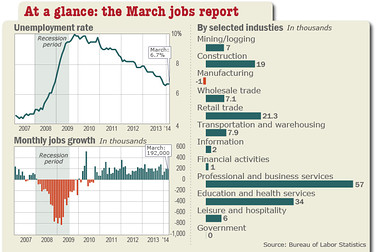

Friday’s “establishment survey” jobs report showed employment rising by 192k in March. That might have been a bit below expectations, but revisions to January and February added another 37,000 . . . for a total effective gain of 229,000. Perhaps most importantly, the length of the average workweek rebounded to 34.5 hours, signaling that the sharp drop (to 34.2) we saw in the past few months was mostly, if not entirely, a weather effect.

Equities: Equities have begun the second quarter with a bit more verve than they did the first as investors are now perhaps more focused on the global improvement base case than the risks. EM equities have also participated in the solid start to Q2. The US lagged global markets as the MSCI indices for Europe, Japan, and Emerging Markets were all up 1-2% last week.

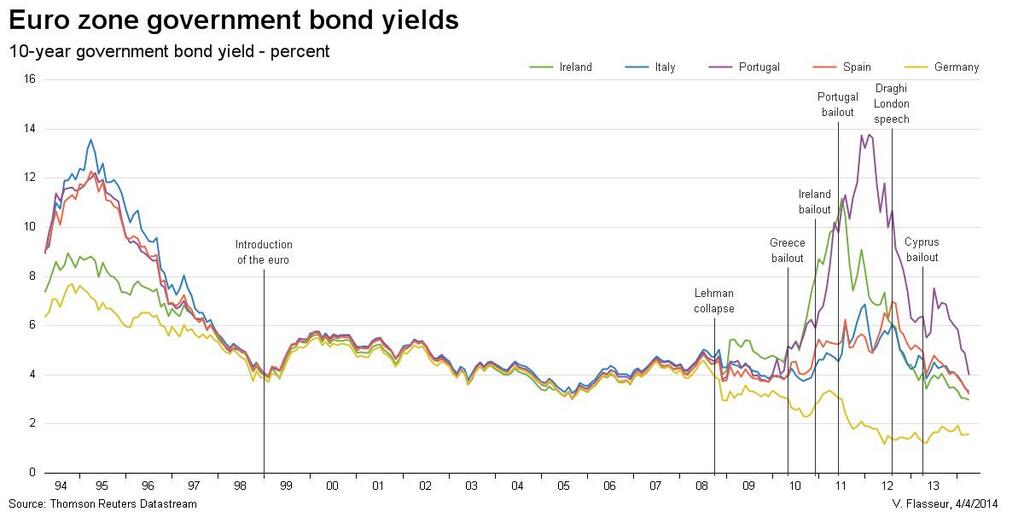

Bonds: With the focus on risk themes ebbing for now, the demand for G7 government bonds initially eroded, although it improved after the US jobs report in spite of its upbeat tone. Perhaps bond investors focused on the still substantial slack. Eurozone bond markets were well-behaved as well: peripheral spreads narrowed further on Draghi/ECB statements.

Currencies: Currencies flashed mixed signals. The dollar gained about 0.5% against the Yen and against the Euro. RMB appears to have stabilized following its marked weakening during Q1.

Commodities: Oil (Brent) briefly dipped below $104 for the first time since November on reports Libyan supply was poised for improvement.

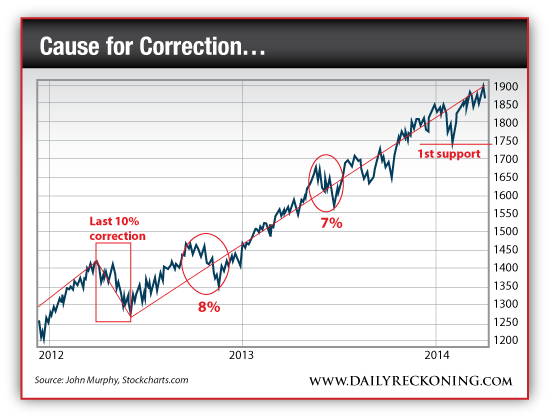

For the past few months, trading has been easy. You buy the dip. You find the strongest names and ride them to new highs. You book gains. Lather, rinse, repeat. But when it comes to the markets, easy trading doesn’t last forever. After the dismal market action we witnessed toward the end of last week, it’s becoming apparent that the market isn’t going to play nice anymore.

Predicting the specific timing and extent of a stock market crash is always difficult, and the immense complexity of today’s economic situation makes such a prediction even more challenging. With that being said, our analyses indicate that the danger inherent in the financial system has surpassed the level at which a near-term outsized stock market crash – that would also involve (as seen in 2008) various other markets as well – is of tremendous concern.

The key ingredients for a correction are starting to appear. Investors are rotating into safer sectors like utility stocks. It’s time for you to get defensive… Keep in mind, we’ve done nearly two years without a correction of at least 10% in the S&P 500. Take a look:

Market cycles are lining up in support of a correction, too. Stocks are historically weak during a midterm election year (check). And spring is usually the season they begin to falter (double check).