INVESTMENT STRATEGY & ASSET ALLOCATION

January, 27 2023

- Do not hold your breath for a durable recovery in U.S. equities in the year 2023. Instead, let the market pay you to wait for better opportunities farther down the road but patient investors can find potential income and returns looking abroad in other markets.

- We remain defensively positioned in equity and bond investments in the markets of the industrialised nations. In the short term, we consider the potential for price gains to be limited. On the other hand, we are more positive about equities and bonds from emerging markets and Asia. These could continue to benefit from the weakening US dollar.

- We are taking initial profits on commodities, but still consider these investments more interesting than equities. We keep an allocation into Gold (and precious metals) as it should offer an hedge in economically difficult times.

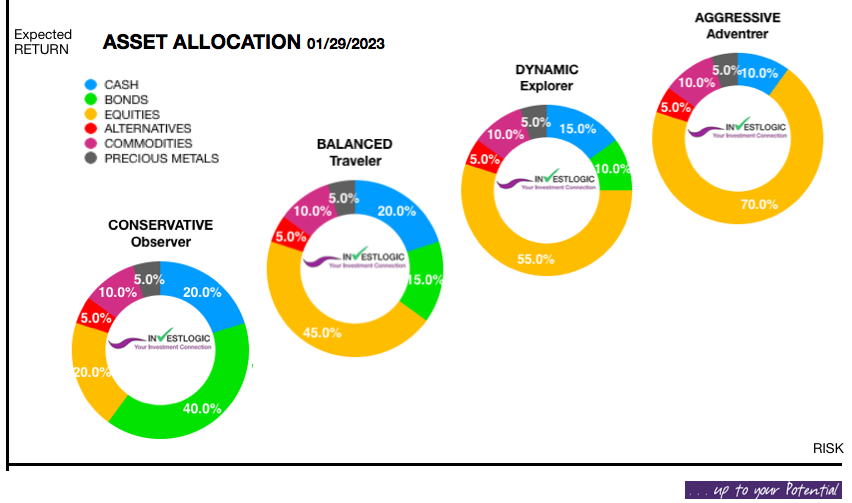

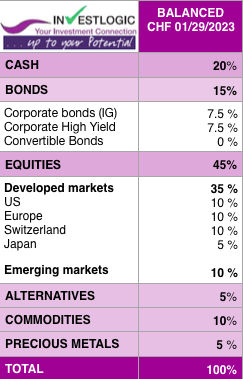

Your investment type >>Click “Find your Risk Profile” here

Globally we keep a strong cash position in order to increase our security exposures as opportunities will develop. We still favor the defensive sectors in developed countries as the risks of recession in these regions are increasing. On the other hand, we support a higher exposure to emerging markets.

The economy continues to falter

In the USA, business sentiment is increasingly deteriorating. US inflation fell again in December. This is partly explained by lower oil prices, but also by the fact that the economy now actually appears to be slowing down. With the labour market still in good shape and continued strong excess consumer demand for goods, we expect the US Federal Reserve to make further interest rate hikes.

There’s a sense of relief in Europe that the worst scenarios in relation to gas and electricity shortages have so far been avoided. Inflation seems to have peaked but remains the major issue in Europe. The European Central Bank is likely to make further significant interest rate hikes. Just as a reminder, the level of business and consumer confidence still points to negative growth in future.

In Switzerland the economy continues to perform well by international standards, but a considerable slowdown in growth is expected here, too. Consumer confidence remains at an historic low, and household spending fell in real terms in December. However, there’s a risk of low inflation leading to a much stronger Swiss franc over the medium term.

China missed its own growth targets for 2022 by some margin, achieving growth of 2.9 percent by the end of the fourth quarter. The cause of this poor performance has a lot to do with political choices and its regulatory crackdowns on its global technology franchises, restrictions on debt restructuring among homebuilders and zero-COVID policy, which has produced rolling lockdowns and interrupted economic momentum.

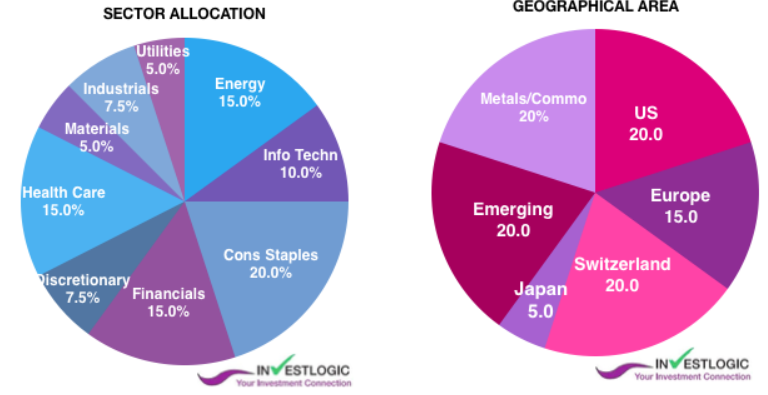

SECTORS : Stay Defensive

Turning to the market’s 11 individual sectors, our oscillator tool also confirm some notable developments. See the green vs red area.

First, the two healthiest sectors of late – Energy (XLE) and Consumer Staples (XLP) – continue to show underlying strength. Stocks in these two sectors remain the best bets for conservative investors looking to establish new positions today.

However, Industrials (XLI), Financials (XLF), and Health Care (XLV) sectors also have each a notable positive trend.

Finally, it’s also worth noting that some sectors still aren’t showing any signs of improvement such as Communications Services (XLC), Information Technology (XLK), and Real Estate (XLRE).

EMERGING MARKETS’ EMERGENCE

For investors, the steep drop in equity markets overall in 2022 may raise the question of where to find value and long-term opportunity. We believe that emerging markets may be one of the most mispriced asset classes, with attractive valuations compared with historical levels.

Over the past 20 years, emerging markets equities have evolved, serving as a source of ever-changing investment opportunities. Liquidity has deepened, and investor interest has increased. Demographic trends and urbanization are supportive long-term tailwinds that can accelerate growth for the asset class; with a growing middle class comes a consumer that is younger, increasingly more educated, and a faster adopter of new technology, with constant changes in consumption patterns and preferences.

Much capital has left emerging markets in recent years, and many parts of the asset class are under-owned and attractively valued as a result. Overall, emerging markets equities are among these particularly attractively valued assets with high financial productivity (or return on equity, free cash flow yield, and dividend yield).

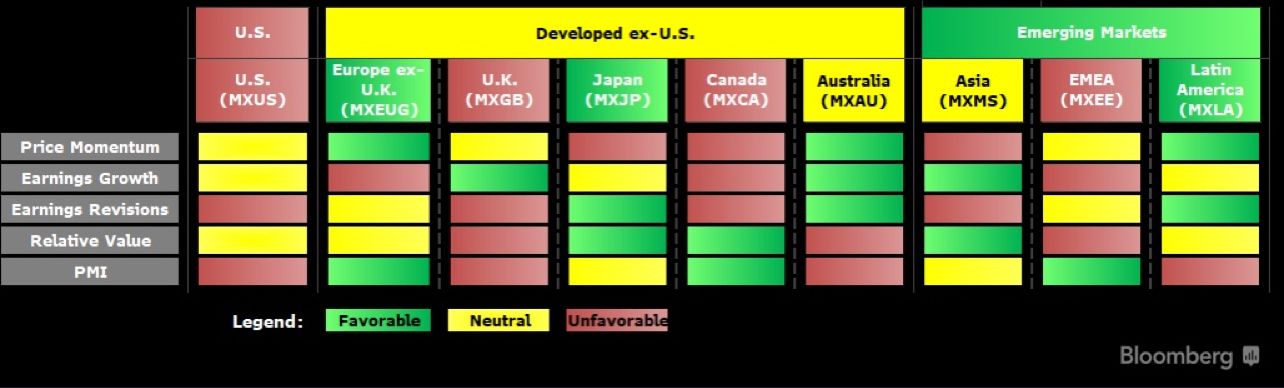

Bloomberg Intelligence global allocation model favors EM over developed markets with US lagging the rest to start 2023. Within developed markets, the euro zone and Japan look best positioned. EMEA has fallen to the bottom of EM rankings in favor of Latin America, which has exhibited the best price momentum and seen more earnings estimates revised upward.

There is simply no denying that secondary markets in Europe, Asia, and elsewhere are dramatically outperforming those in the U.S. for the first time in years. Only time will tell if this is a temporary phenomenon or the start of a long-term trend.

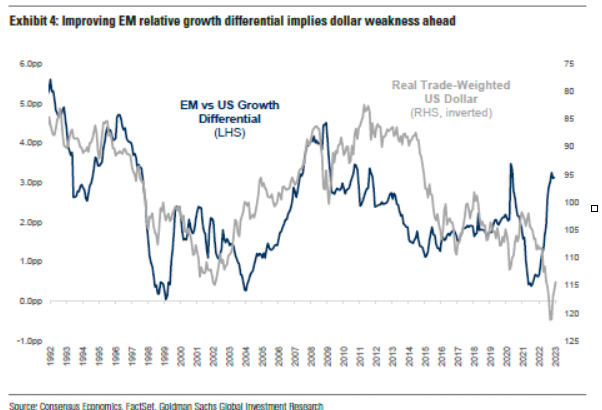

There are many reasons for the emerging markets’ resurgence, led by the weakening dollar and the reopening of China.

MSCI Emerging Market Index (USD)

source : FT

The dollar has depreciated 7% since its high in October, pushing EM assets higher. Historically, the two have had an inverse relationship.

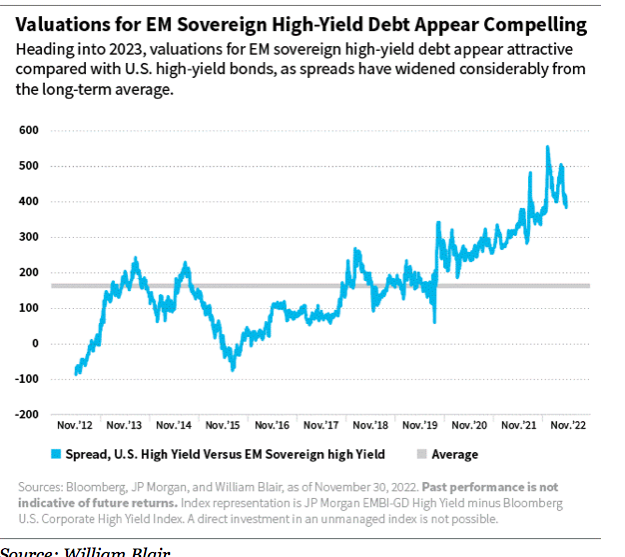

EM debt is now attractively valued on both an absolute and relative basis. EM sovereign high-yield spreads appear particularly compelling to him, especially in relation to US high-yield levels.

Source: William Blair

The fact that many emerging central banks were obliged to start hiking in 2021, long before the Federal Reserve and the European Central Bank, has left many emerging-market sovereigns offering attractive yields.

For longer-term investors, buying or overweighting EM now looks a good idea. For shorter-term investors, the chances are that they will be tested by volatility along the way.

Buy China?

If there’s one almost universally popular call for 2023, it’s “buy China” — not just its bonds, but even its beleaguered stocks. On any simple what-goes-down-must-come-up model, this makes ample sense. China’s stock market endured almost a perfect storm in 2022.

Chinese equity valuations are at reasonable levels and the conditions should be in place for an earnings recovery. China is plainly a more interesting investment opportunity than it was 12 months ago. But, just as always with China dynamic, the case might not be quite as clear as it seems.

Chinese equity valuations look reasonable and corporate earnings could be set to rebound, but the most important factors are that progress is already being made in the two areas that caused the biggest problems last year – Covid and the property market. And looking further ahead, several secular themes may make China a compelling long-term investment case.

Markets rallied sharply on the news of COVID policy change and anticipation of economic reopening. Consumers were initially cautious, staying at home rather than visiting shopping malls and restaurants, but the relaxation of restrictions could start to unleash three years’ worth of pent-up consumer demand as people saved money during lockdowns.

China’s GDP could grow by 5% this year far outpacing Europe and the US. Better yet, China’s stocks are cheap at 12X PE making it one of the cheapest in the world with earnings expecting to grow 14% this year.

Hang Seng Index

Technically we observe that the HSI is getting closer to a major resistance at 50% Fibo retracement and a long term resistance around 22’900.

Signs are that the Lunar New Year Holiday sparked a boom in travel bookings, pointing to a revival in consumer spending. As a result, travel, retail and leisure-related stocks have been leading the stock market in recent weeks.

As well as selected consumer stocks, internet giants getting a regulatory reprieve and companies aligned with Beijing’s long term policies

- YUM CHINA HOLDINGS and JD.COM are two interesting ways to play the Chinese consumer post pandemic recovery

- LVMH and PUMA are two ways to play China’s re-opening without going to China

- To play the travel recovery: InterContinental Group with its holiday Inn chain throughout China, Japan’s Central Japan Railway as well as Korea’s cosmetics and household goods company LG H&H would all benefit

A more stable property sector could be another catalyst for a rebound in confidence and consumption in 2023. Encouragingly, the government has begun to provide more direct support to property developers to help ensure pre-sold homes are completed.

There is huge scope for innovation and growth within China’s healthcare sector, which has been thrust into the spotlight by Covid. China’s spending on healthcare still lags that in the EU, Japan and the US as a percentage of GDP. Greater investment must be a priority because the pressure on the healthcare system will only increase as 398 million people – nearly 30% of China’s population – will be aged 65 or over by 2060.

Meanwhile, reforms in the financial markets, including the ongoing liberalisation of capital markets and improvements to market infrastructure, could benefit some financial services companies and may also prove supportive of the wider economic outlook.

China’s drive for self-sufficiency may benefit areas including software, healthcare, semiconductors and electric vehicles.

Interestingly Albert Edwards from SG flagged up a fascinating paper just published by the US Federal Reserve entitled “What Happens in China Does Not Stay in China”.

The authors point out that each of China’s last three stimulus episodes accounted for around 1.5% of global GDP, stimulating aggregate risk appetite, an expansion in global asset prices and global credit, a narrowing of corporate bond spreads and a rise in gross capital flows. China matters.

Invest wisely and live richly !

Until next time