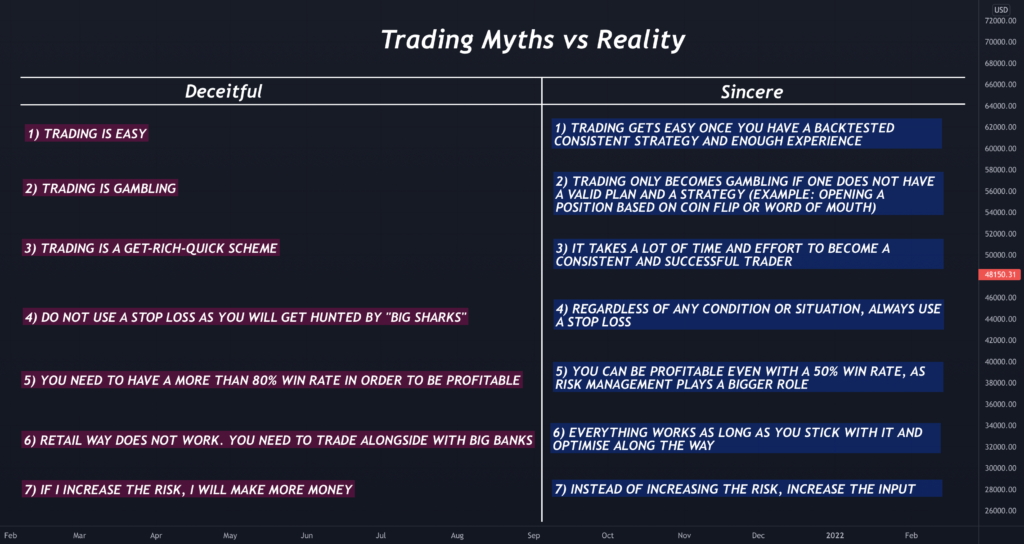

Investlogic’s Tips : Myths and Reality of Trading

January, 05 2022

1) Most people think that trading is easy and they can quit their job or whatever they do and start making a living off trading straight away. In fact, in order to be profitable, consistent, and be a full-time trader in general, he or she MUST have a backtested strategy and be experienced enough in this sector. Remember that it takes a while to be successful, but it is fully worth it!

2) “Trading is like a casino”- we hear this one quite often. Only two types of people use this expression a lot: those who have never been able to become successful in this industry, and those that have no plan or idea about what they are doing. One should never open a positions based on a coin flip or what others are saying. Ideas and analyses of other can be used as a confluence and inspiration for a trader to open a positions on a specific security.

3) Whether it is trading or any other industry, one can never be rich over the course of a night. It takes 10-14 for someone to become a licensed surgeon, at least 6 years to become a professional lawyer. What makes you think that you will become a professional trader in just a few weeks or months?

4) No matter what the situation is, always use a Stop Loss to avoid deep losses. Whether liquidity hunt exists or it does not, it is always important to stay safe and sound.

5) Risk management is always more important than the win rate. Imagine having a 1:3 Risk-to-Reward ratio on your next 10 trades and the win rate is only 50%. That means you will win 5 and you lose 5. Now, let’s say that we decide to risk 1% of our total capital per trade. If we do quick maths, we will see that with only 50% win rate and 1:3 RR, we will result in making a juicy 10% return from the total of our next 10 trades. Of course, this is not always the case, as there are some factors that should be considered, such as spreads, fees, pip value etc. However, this is a perfect example to help you get the overall idea.

6) There is a big number of traders who do not like the “Retail Way” and would rather trade the “Smart Money” concept, which is apparently the closest thing that we have to the Institutional Trading. The bottom line is this: choose a strategy that suits you the best, and go with it while optimizing along the way. Changing strategies every week/month will not make one consistent. It is crucial that you stick with one trading plan and be loyal to it.

7) Many beginning traders tend to increase their risk in attempts to make more profits. This approach is so risky and totally wrong. If one is willing to make more money trading, it is important that he or she increases the input, and not the risk.

Until next time