Financial Advisors Need Relationship Alpha

March, 25 2014 As wise and well equipped as any of us all are, we cannot predict the future with any degree of certainty. The legendary money manager, Peter Lynch, once said something to the effect that investing allows us to build a bridge of well-thought out and time-tested assumptions, but we always need to take a ‘leap of faith’ between what is known and what will actually come to be.

As wise and well equipped as any of us all are, we cannot predict the future with any degree of certainty. The legendary money manager, Peter Lynch, once said something to the effect that investing allows us to build a bridge of well-thought out and time-tested assumptions, but we always need to take a ‘leap of faith’ between what is known and what will actually come to be.

Prior to the end of 2013, the trade-off for a high ‘sleep at night’ factor was lower return expectations. Now, in hindsight, these well-rested clients are experiencing, as the kids today say —FOMO — “fear of missing out!”

I share this preamble because this is where uncertainty creates opportunity. Thoughtful advisors can bring a great deal of comfort and guidance to their clients as long as they are willing to take a deliberate approach to both educating and managing expectations. Difficult and confusing times only highlight the need for good advice the value that a trusted advisor can offer. This is when “Relationship Alpha” becomes most apparent in the attribution report between a client and advisor. During these times, conducting a careful review of client investment objectives, risk tolerance, time horizon and life goals (retirement, educational funding, etc.) becomes critical.

Revisit, Revise and Re-educate

How do sophisticated advisors construct portfolios? Typically, they use some form of asset allocation process to determine the most suitable portfolio for their clients’ particular goals. Some focus on traditional investments; others split traditional asset classes into sub-asset classes; still others add alternative investments. Regardless of the mix, these processes share a common objective—to obtain the highest return for a given level of expected risk. Index funds are often employed in allocations, but probably more often an advisor selects actively managed investments in an attempt to enhance performance, thereby validating the advisor’s fees.

Outperforming the broad market has historically been very difficult, both in absolute terms and in tax- and risk-adjusted frameworks. Where adding value is the goal, advisors may be better served by changing their performance benchmark from the market’s return to the returns that investors might achieve on their own, without professional guidance. A financial advisor has a greater probability of adding value, or alpha, through relationship-oriented services, such as providing cogent wealth management and financial planning strategies, discipline, and guidance, rather than by trying to outperform the market.

At the start of a new relationship these conversations are typically engaging and enthusiastic, but rarely are they revisited with any vigor down the road. Now is the time to tell the client: “Given the market turmoil and the passage of time, let’s engage in these conversations as if we’re renewing our vows and recommitting to one another on your financial journey!” Pose a hypothetical question: “If your accounts were entirely in cash, rather than invested as they are today, what approach would you choose to take now?” Prudent advisors will be prepared, of course, to provide an answer to the same question. This dialogue will help validate the current collective approach, or generate productive questions about its current state. From here, advisors can re-educate clients about the disciplines of investing, the need for proper asset allocation and portfolio construction and the rationale behind chosen asset exposures and exclusions.

I started this piece with a time-tested idiom, and I will end it with one. They say, “The strongest steel comes from that which endures the strongest fires.” Relationship Alpha really comes to the fore during times of complexity and confusion. The strength of a client relationship grows only with dedicated interaction and the reapplication of the vigor and passion that helped the journey begin. Clients engage financial advisors for their thoughts, their judgment, their wisdom and their direction. Now is not the time to be shy or muted in bringing these forward. Always, but especially now, is a good time to show you care.

Our Goal

Our goal is to serve as a lifelong, indispensable advisor to you and your family by offering impartial advice aimed at making you financially successful. We combine the personal service of a small, boutique firm with the technological capabilities of a large company. We maintain long-term relationships with specialists in law, tax and insurance to ensure that we can offer you the very best advice in each discipline.

We make specific investment recommendations based on your individual needs, circumstances and goals, not based upon the commissions that a particular financial product might pay.

Advisor’s Alpha

Historically, many investment advisors have sought to add value through the two active portions of return—market- timing and security selection—despite the mounting data suggesting that these efforts will help neither their clients nor themselves in the long run. Over longer time horizons, active management often fails to outperform market benchmarks.

In the past, the passive portion of investment performance—the beta return—was viewed by many as leading only to “average” returns and requiring no investment skill. Today, ironically, the capturing of beta has become a cornerstone for leading financial advisors, who routinely incorporate index funds or exchange-traded funds (ETFs) into their recommend- ed portfolios. This transition has been facilitated by at least two factors. First, the “democratization of indexing” via ETFs brought a plethora of index- oriented investment opportunities to anyone with a brokerage account. Second, a move toward fee- based, holistic investment guidance took hold among many advisors. In our view, it is these disciplined advisors who are best positioned to add value to their client relationships.

Over the last years, compensation in the investment industry has shifted markedly from commission-based, transaction-oriented sales toward fee-based asset management.

The benefits of this shift for clients and advisors alike suggest that the trend is likely to continue. From the client’s perspective, asset-based fees largely remove concern about potential conflicts of interest in the advisor’s recommendations, and in some cases they obligate the advisor to act as a fiduciary. From the advisor’s perspective, asset- based compensation can promote stronger client relationships and more reliable income streams. The advisor can spend more time with clients, knowing that compensation does not depend on whether or not a transaction occurs.

This transition, however, has not been devoid of obstacles.

For some clients, paying fees regardless of whether transactions occur may seem like “money for nothing.” This is viewing the advisor’s value proposition through only one portion of the cost- benefit lens. The benefit and wisdom of not allowing near-term market actions to result in the abandon- ment of a well-thought-out investment strategy can be underappreciated in the moment.

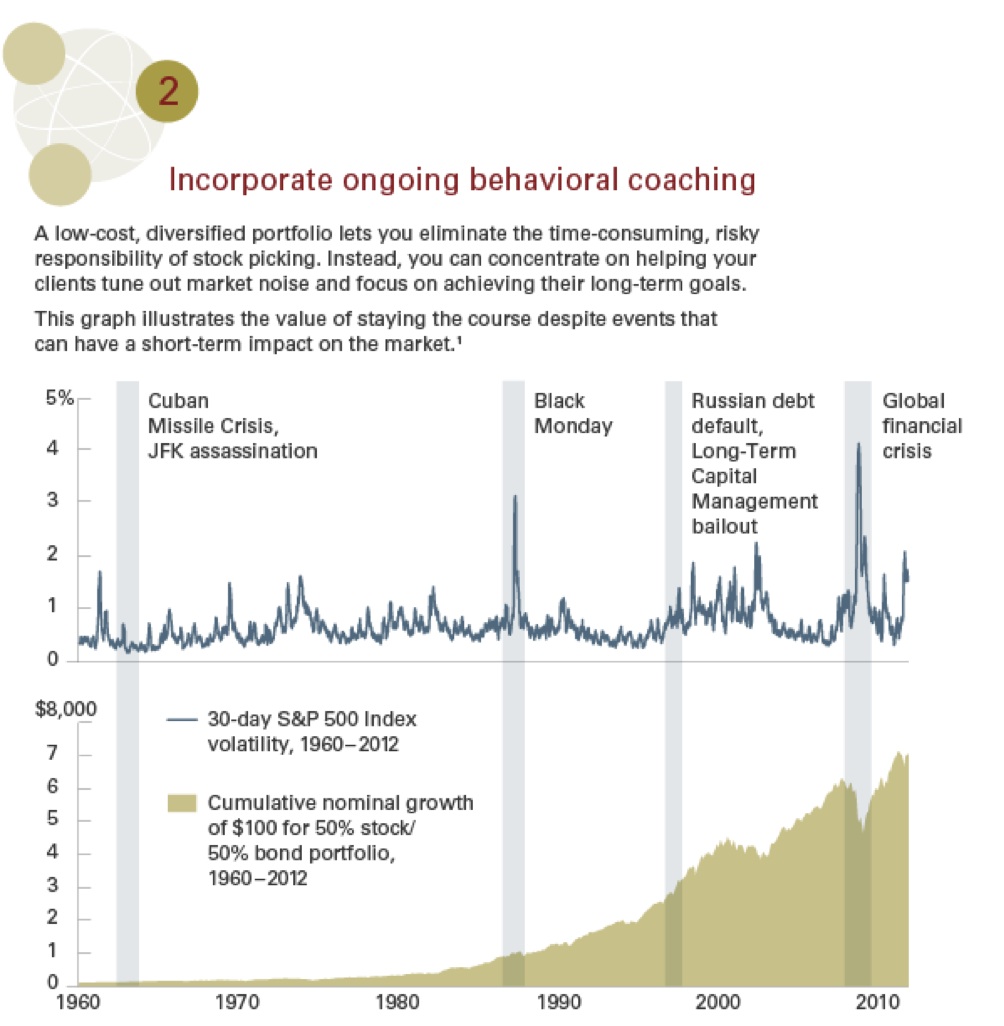

Rather than investment capabilities, the advisor’s alpha model relies on the experience and stewardship that the advisor can provide in the relationship. Left alone, investors often make choices that impair their returns and jeopardize their ability to fund their long-term objectives. Many are influenced by capital market performance; this is often evident in market cash flows mirroring what appears to be an emotional response—fear or greed—rather than a rational one. Investors also can be moved to act by fund advertisements that tout recent outperformance, as if the investor could somehow inherit those historical returns, despite disclaimers stating that past performance “is not a guarantee of future results.” Historical studies of mutual fund cash flows show that, after protracted periods of relative outperformance in one area of the market, sizable cash flows tend to follow.

Adding value through portfolio construction

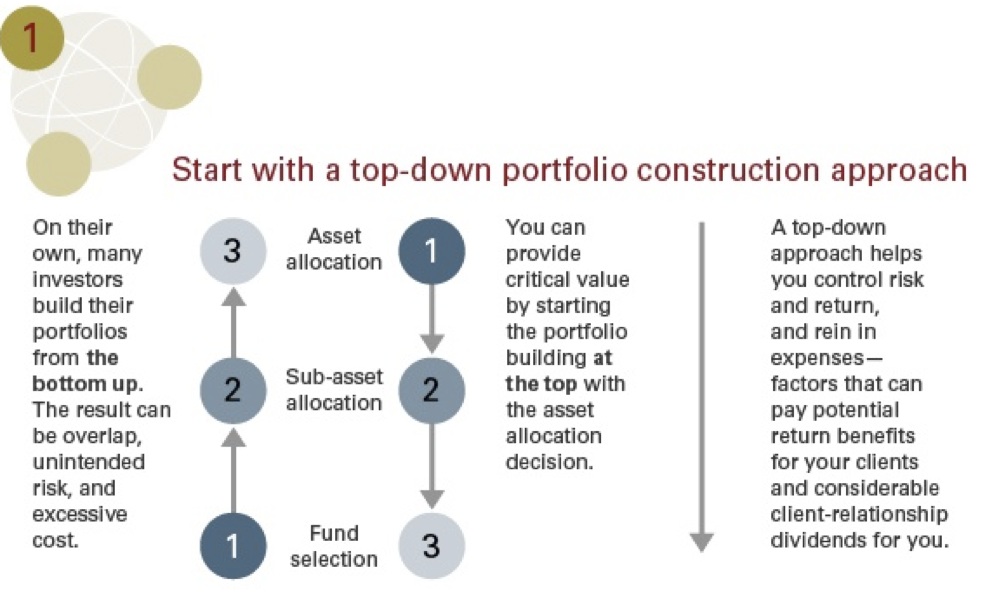

Many advisors use a “top-down” approach that starts with analyzing the client’s goals and constraints, then focuses on finding the most suitable asset allocation strategy. This process is extremely important, yet too many investors neglect it on their own, overlooking its contribution to their long-term investment success. As a result, providing a well-considered investment strategy and asset allocation is an important way in which advisors add value. And the knowledge that the asset allocation was arrived at after careful consideration, rather than as a happenstance of buying funds with attractive returns (the investment equivalent of butterfly collecting), can serve as an important emotional anchor during those all-too-frequent uprisings of panic or greed in the markets.

The asset allocation process may be separated into two parts: determination and implementation. Within the overall framework of each client’s goals and circumstances, the allocation is often determined based on the historical risk/reward relationships between asset classes. Although no forward-looking investment process is perfect, particularly one based on historical data, it is reasonable to think that some historical risk/reward relationships are likely to persist. Future investors are as likely to demand compensation for bearing risk as investors in the past, and as a result, it is logical to expect assets with more return uncertainty (such as stocks or high- yield bonds) to outperform lower-risk assets over the long run.

Once an asset allocation has been determined, advisors can help their clients understand the important considerations involved in implementing it. For example, the next question might be, “Do I want to use actively managed funds or index funds to implement this portion of the allocation?” To help clients evaluate the index side of the scale, an advisor can point out that—in addition to the higher expense ratios commonly charged for actively managed funds returns from active funds tend to be more volatile than those of the index benchmarks for their categories.5 The combination of higher expenses and higher volatility has often contributed to lower returns for actively managed funds than for their benchmarks, but with more risk—an unpalatable combination (Figure 6). It is not uncommon for an index fund to replicate the composition of its benchmark, as well as to provide returns and volatility that consistently approximate those of the benchmark over time.

Addition by subtraction: Emphasis on tax-efficient strategies

Taxes are another major consideration for many clients, and tax management is a further important way in which advisors can demonstrate the value they add. If future returns turn out to be more modest while taxes on those returns are higher than they have been, as some professionals are forecasting, then total costs (management fees, expense ratios, frictional costs, taxes, etc.) will erode an investor’s returns even further. And tax- conscious financial planning and tax-efficient portfolio construction will have proportionately larger benefits.

Actively managed equity strategies or funds tend to be tax-inefficient, potentially diminishing or erasing any gains from outperformance if they are held in taxable accounts. If an advisor has great faith in the active manager’s abilities, then techniques such as asset location—sheltering tax-inefficient funds in tax- advantaged accounts—may help preserve the expected rewards for bearing active-manager risk.

No matter how skilled the advisor, the path to better investment results may not lie with the ability to pick investments or strategies. Historically, active management has failed to deliver on its promise of outperformance over longer investment horizons.

Instead, advisors should consider a new value proposition based on alternative skills and expertise: They should act as wealth managers and behavioral coaches, providing discipline and experience to investors who need it. On their own, investors often lack both understanding and discipline, allowing themselves to be swayed by headlines and advertisements surrounding the “investment du jour”—and thus often achieving wealth destruction rather than creation. In the advisor’s alpha framework we’ve described, the advisor becomes an even more important factor in the client-advisor relationship, because the greatest obstacle to clients’ long-term investment success is likely themselves.