Emerging Chronicles : The Final Tweet Of The Global Canary In The Coal Mine

September, 08 2013Bubble age

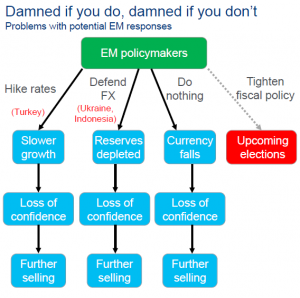

The biggest threat right now is that policy in emerging markets will overreact — that their central banks will raise interest rates sharply in an attempt to prop up their currencies, which isn’t what they or the rest of the world need right now. -see Krugman–

Continuing the litany of vindication, Edwards next observes that the “global economy and markets have been far, far more vulnerable to a resumption of the 2008 crisis than the happy-clappy consensus would have us believe. At the moment, investors think that problems are isolated to a few EM countries that have allowed their current account deficits to get out of hand. I see this as the beginning of a process where the most wobbly domino falls and topples the whole precarious, rotten, risk-loving edifice that our policymakers have built.”

The emerging markets ‘story’ has once again been exposed as a pyramid of piffle. The EM edifice has come crashing down as their underlying balance of payments weaknesses have been exposed first by the yen’s slide and then by the threat of Fed tightening. China has flip- flopped from berating Bernanke for too much QE in 2010 to warning about the negative impact of tapering on emerging markets! It is a mystery to me why anyone, apart from the activists that seem to inhabit western central banks, thinks QE could be the solution to the problems of the global economy. But in temporarily papering over the cracks, they have allowed those cracks to become immeasurably deep crevasses…

It is the “next shoe” that concern Edwards the most. Namely China.

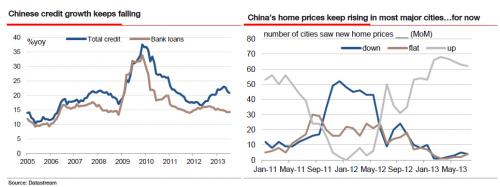

China has gone off the radar in the last month, as the data have firmed, but it is set to return centre stage. Our China economist Wei Yao, thinks “this sudden turn-around is similar to that during Q4 2012, when the multi-quarter deceleration trend reversed shortly after the policy stance shifted to “cautious” easing. But that growth pick-up did not last for more than one quarter.” A continued slowdown in credit growth will strangle the current buoyancy of house price inflation (see charts below), with property sales growth having already peaked. Wei expects the Chinese data to relapse in Q4.

He then links to recent observations by CLSA’s Russell Napier and ties it all together:

“Many people are writing about a Chinese credit crunch and banking crisis. I disagree. The authorities will have a choice as to whether to accept such a crunch or devalue and launch a new credit cycle to keep the balls in the air once again. Devaluation is the preferred option…..So the (recent) spike in SHIBOR was not a tremor indicating the earthquake of a banking crisis, but a tremor of a forthcoming RMB devaluation.” That will be the biggest domino of all to fall. And, as with the 1987 crash, markets will react to the fear of the devaluation and the deflation it will bring to the west, rather than the event itself. This is one domino it will pay not to be resting under as it comes crashing to the ground.

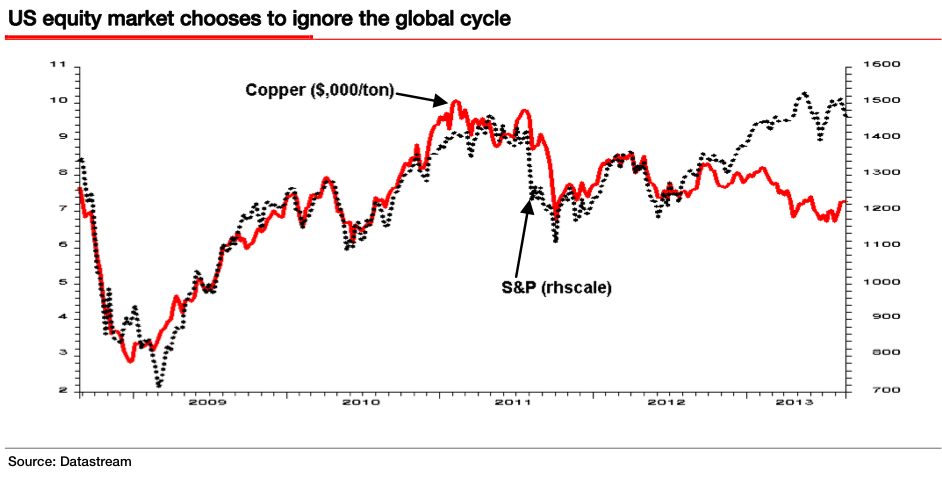

And to support his argument he mentioned the “Dr Copper” indicator : As to this year, ‘Dr Copper’ has been telling us for some time that all is not well with global growth, and long before the markets’ ears picked up the loud sucking sound of the air draining out of emerging markets. As you can see from the chart below, the S&P has decoupled from copper. Edwards obviously believes that will correct as stocks crash.

Federal Reserve sneeze is met with the flu in EM.

If there is anyone here who thinks that emerging markets are a great short-term buy, I’m listening … and hearing crickets.

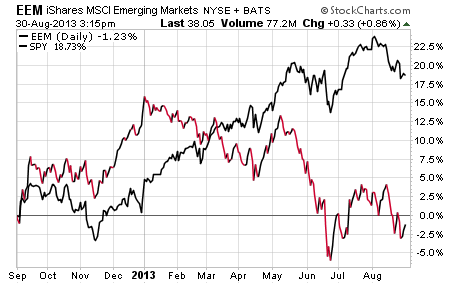

The bottom line? There’s definitely opportunity in the stocks of emerging markets or the BRIC countries. But you won’t capture that opportunity by treating those stocks as part of a monolithic sector. The halcyon years of emerging market stock and bond gains took a turn for the worse in May.

Such a swift and precipitous drop in both EM stocks and bonds has some suggesting that a reversion to the mean makes these tankers look ship shape. But, that argument assumes either worsening conditions in the established markets, in particular the U.S. — the core driver of EM markets’ past success — or a spectacular catch up to current U.S. market price levels. I am not forecasting either.

Instead, I think emerging market success relies on the U.S. growth story; if the U.S. recovery gains some scope and scale, manufacturing demands should rise globally, benefitting emerging market economies well enough to spark a rebound in emerging markets. In fact, the latest global manufacturing data suggest this is beginning to happen and not coincidently emerging markets have been staging something between a dead-cat bounce and a comeback. Perhaps more motivated by having been oversold on tapering fears here rather than on economic data there, but at least in part propelled by the view that slow growth here safeguards against no growth everywhere else, the floor may have been found — the question being how quickly one can winch themselves from the ravine back onto the road to sustained recovery.

We all know the long-term story of that road: emerging market economies are growing at faster rates than developed ones, their government debt-to-GDP ratios make Ben Bernanke look like the high priest of voodoo economics, and their growing consumer class (compared to the demographically aging one here, and the aged one in Japan) dictates demands and growth rates for everything from better infrastructure, agriculture and health care that we should envy.

But, such growth is and will be correlated, maybe inextricably linked, to established market consumption of emerging market goods. That’s why a Federal Reserve sneeze here is met with the flu there.

Companies across Asia are facing a debt-repayment crunch as plunging local currencies make it more costly to repay foreign loans, a situation that is exacerbating stresses on the region’s economies. Asian companies took out sizable foreign loans in recent years as the U.S. Federal Reserve kept interest rates low and printed money. For firms in nations like India and Indonesia, rates on U.S.-denominated debt were more attractive than local borrowing costs.

But the current exodus of capital from emerging markets, amid expectations the Fed will end its period of extraordinary monetary stimulus later this year, has changed that equation. Foreign funds are pulling out of Asian bonds and other assets amid expectations U.S. rates will rise further. That is pushing currencies in Asia sharply lower and raising the cost of repaying U.S.-denominated borrowings.

Few observers expect a re-run of the 1997-98 Asian crisis, when companies and banks across the region folded as they were unable to repay foreign loans amid a currency crisis.

A higher portion of Asia’s corporate debt is in local currencies today than back then. HSBC estimates that Indonesia’s public and private external debt was 45% of gross domestic product in 2012, much lower than 90% before the Asian crisis. Asia’s central banks also have much larger stockpiles of foreign reserves, which they can use to defend currencies.

Still, there are worrying signs of stress. Many Asian countries are running current-account deficits, meaning they import more than they export….

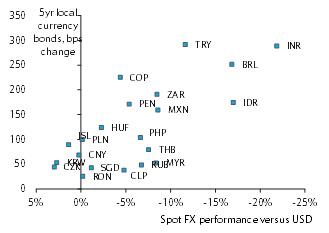

And another great chart : The X-axis is the change in the spot currencies against the dollar since late May. The Y-axis is the change in the local 5-year debt.

Emerging Market Stocks

Put it another way: like a carnival mirror, emerging markets reflect our own markets in an exaggerated manner. Even absent issues of domestic political, economic and class unrest, volatility permeates their markets. If the growth die is cast (alea iacta est) for the U.S. economy (which I believe it still is), I’d expect to see more than snake eyes in the emerging markets. But with the global markets swinging on a tapering hinge, I’d also expect to see emerging markets become more unhinged if the Fed decided (uncharacteristically) to shock the system with a sudden and sizable stimulus pullback … or perhaps just execute on what the markets expect rather than just jawbone about it.

Against that backdrop and foreground, I’d take a diversified approach to trading the emerging markets: one that capitalizes on a secular trend in the labor market shifting away from China and closer to our southern border; one that looks to capitalize on a beaten down trading partner whose recovery could lead rather than follow an emerging markets rebound; one that pairs the broad basket of emerging market stocks with our stolid greenback.

Two Ways to Play

Aggressive investors who are seeking purchases in beaten up sectors should consider emerging markets as a potential area of opportunity. If you have the stomach for the volatility and a long-term time horizon then you may be early to an area of the market that is offering better value than domestic stocks. However, there are still many headwinds that these countries face before they are able to return to their glory days of double-digit growth.

More conservative investors may want to consider waiting until we see some additional stability before repositioning their portfolio to take advantage of this sector. I would look for emerging market stocks to break out above their August highs and hold above the 50-day moving average before making an entry. In addition, it is always a prudent idea to implement stop losses to guard against downside risk and use the prior low as your exit point.

PREMIUM RECO : Picks for playing emerging market waters in September come with this caveat: Drinking such water can be hazardous to your wealth.

My preferred way to play the emerging market region is through the SPDR Emerging Market Small Cap ETF. This small-cap ETF has performed much better than its large-cap rivals over the last year and offers investors an avenue to tap into the local consumer in these regions.

My preferred way to play the emerging market region is through the SPDR Emerging Market Small Cap ETF. This small-cap ETF has performed much better than its large-cap rivals over the last year and offers investors an avenue to tap into the local consumer in these regions.

In Mexico, iShares MSCI Mexico Capped puts you where the jobs are heading not where they have been (China).

For Europe, I’m thinking a recovering Europe is not so much a precedent for emerging markets rebound, as it is an antidote for what has been ailing them. I like Vanguard FTSE Europe to net the upside of the coalmine for the EM canaries.

Always cognizant that I can be wrong in any short-term trade, I’m pairing a position that runs counter to my view with one that safeguards my being right. Buying the whole emerging markets basket (using either the iShares Emerging Markets or Vanguard FTS Emerging Markets) runs counter to my current views, but offsets the risk of me being wrong.

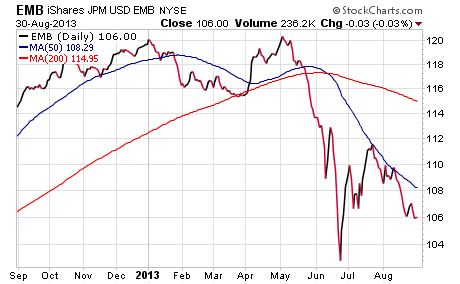

Emerging Market Bonds

Emerging market bonds have recently been taken to the woodshed over a trifecta of events that have caused investors to flee to the safety of cash in the month of August. These confluences include rising interest rates, currency volatility, and fears over what might be the next global crisis.

Emerging market bonds are unique because many issuers have lower overall indebtedness and stronger growth potential than domestic counterparts. However, many countries don’t have the legal system, or the long-term credibility to garner consistent investor interest. So as the global fixed-income landscape warns of trouble ahead, investments in these types of bonds are typically the very first to get thrown out of an investors’ portfolio.

The Emerging Markets Debt Evolution

The emerging markets (EM) bond space experienced significant changes in the last decade, surging in size, improving in quality, offering investors a composite asset class with higher liquidity, transparency and potential for diversification.

Have we seen constant demand in the emerging market bond space similar to the U.S. fixed income markets?

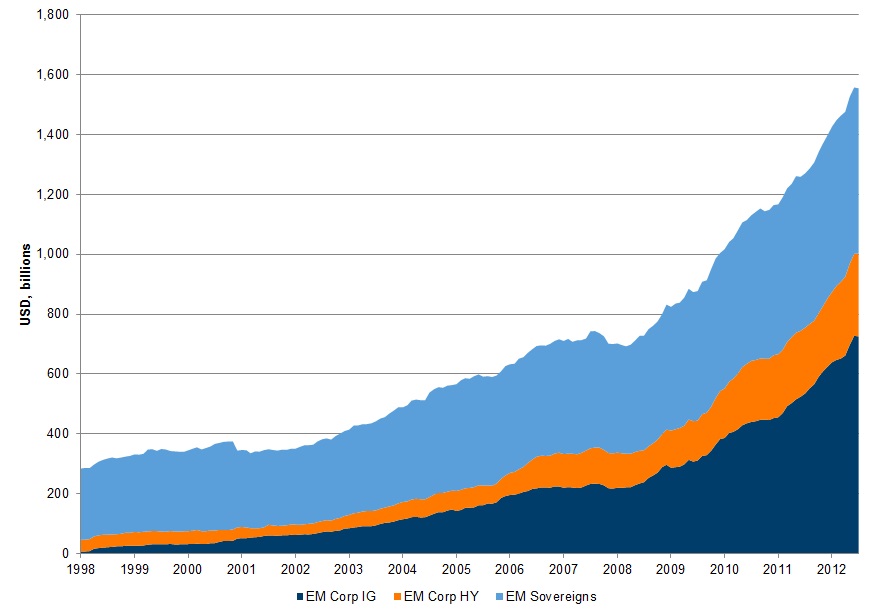

The EM bond universe has grown at an average annual rate of 12% in the last 15 years, passing from a niche market, valued at $285 billion at the end of 1998 to $1.555 billion as of June 2013¹. Its size (including corporate and sovereign) is now larger than the U.S. and Euro high yield space combined, making it an increasingly important segment for bond investors.

How has the emerging market bond space evolved over time?

The evolution of the market is not just a matter of size, but also a matter of composition. From being an asset class mainly limited to sovereign bonds, which accounted for more than 80% of the EM bond size in 1998, this industry has now become a more diversified space with corporate bonds accounting for over 50% of the EM bond market.

Another structural change has occurred in the EM corporate bond segment, which has moved from being a small universe of mainly high yield issuers based in Latin America in the late 90s, to a varied universe, which now includes issuers from all of the emerging areas (Asia, Europe, Middle East, Africa and Latin America). The majority of these bonds are investment grade. The growth of the EM investment grade corporate segment in recent years is impressive, with the size of the segment being almost 6 times that in 2005. Today, the EM corporate segment accounts already as much as the U.S. high yield market, and its size looks to continue to rise, as the market sets new records in EM corporate issuance.

Growth of Emerging Markets Bond Universe

Source: Bank of America Merrill Lynch, data as of June 30, 2013

What are some of the changes we’ve seen with the investment grade corporate issuers?

Another important development both in the sovereign and corporate spreads is the improvement in the quality of issuer. At the sovereign level, the debt to Gross Domestic Product (GDP) ratios generally improved and public finances have become stronger. This has allowed some emerging market countries to implement expansionary fiscal policies to contrast global contraction. Corporate fundamentals have also improved. Emerging market corporates are operating with more liquid balance sheets and lower financial leverage, which has resulted in higher credit ratings.

What other indications towards financial globalization have we seen in emerging markets?

While developed economies have been on the side of this last globalization phase, EM have been at the center, absorbing capital and also providing capital through foreign direct investments outflows, especially directed into other emerging economies.

Proceeding on the path of financial globalization requires that financial markets are able to handle and manage capital inflows. The expansion and evolution of the EM bond universe, as outlined, is moving in this direction. Improvements in liquidity, transparency, and the potential of diversification, which this composite asset class is experiencing, are important for answering the needs of global demand. Demand, that is expected to remain supported by low interest rates in advanced economies and the positive perspectives of emerging economies.

PREMIUM RECO

Ultimately this sector could be setting up a great buying opportunity, as consistent cash flow is still one thing investors need. With bond prices consistently falling and yields rising since late May, it appears there is no near-term bottom forming that would attract even short-term traders.

Ultimately this sector could be setting up a great buying opportunity, as consistent cash flow is still one thing investors need. With bond prices consistently falling and yields rising since late May, it appears there is no near-term bottom forming that would attract even short-term traders.

Investors would be wise to keep a close eye on a few of our favorite emerging market bond ETFs such as the iShares Emerging Market Bond ETF and the Wisdom Tree Emerging Market Corporate Fixed Income Fund. Look for a series of higher lows to form before establishing a position, that way the chances are higher that a strong base has been put in.

FRONTIER MARKETS

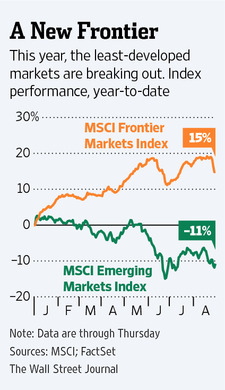

As money flows out of emerging markets on fears about an end to the US FED’s bond-buying program, frontier markets have enjoyed something of a renaissance – but there can be “huge problems” for intrepid investors.

The MSCI frontier markets 100 index – which consists of companies from across 25 frontier market including countries such as Jamaica, Tunisia and Vietnam – is up around 15 percent (in dollar terms) over the year to date, bucking the trend of emerging and developed markets which are in the midst of a sell-off.

Frontier markets had escaped this market flight because they were less exposed to global market factors. Frontier markets are very much focused on internal demand and they exhibit relatively low correlation to the more global markets… and that probably explains why we see a great performance year-to-date on the frontier markets.

A significant number of frontier markets are in the Middle East and four of the most heavily weighted countries in the index – Qatar, the United Arab Emirates (UAE) , Kuwait and Nigeria – belong to the wealthy Organization of the Petroleum Exporting Countries (OPEC). Earlier this year, MSCI upgraded Qatar and the UAE to emerging market status, which will be effective from May 2014.

Frontier markets aren’t correlated to the global market: Pro

Interestingly in these countries, the oil business… is widely guarded by the government and is not open to public investment so in the index you won’t find any petrol companies, rather, the index is skewed towards financials and telecoms.

Each frontier market had its own “peculiarities” and that the people investing in the markets were equally diverse. Many of the investors are local. They are very individual segregated markets which have their own investors base which isn’t one, over-lapping investor base that gets worried about tapering or sequestration. That’s why, if you look at the markets year-to-date, emerging markets have had a torrid time but frontier markets are up 10-20 percent.

Blackrock’s top frontier market picks are Saudi Arabia, Nigeria, Bangladesh and Kazakstan, which have above-average gross domestic product (GDP) growth and a collection of growing companies that are well run.

That doesn’t mean frontier markets don’t have risks – they definitely do have risks, they’re just not the same as the western or indeed, the emerging world.