MARKETSCOPE : In the Doldrums

April, 24 2023The debate is heating up over the true state of the US economy.

Welcome to a non-binary world. In economics, more than anywhere else, nothing is totally black or totally white. Shades of grey come and go. Economic data, meanwhile, was downright depressing. It’s getting harder to find an economic indicator that’s saying the economy isn’t already in a recession right now let alone on the verge of one.

Thursday’s US economic data (housing sales and employment) were downgraded? But the activity indicators published on Friday (services and manufacturing PMI) largely exceeded expectations. Fed officials, though, sound out of touch, describing the economy and certain parts of it as ‘fine’, ‘resilient’, or even ‘unbelievably strong’. What are they looking at?

The current market positioning doesn’t tell us much, we just note that, on the institutional investor side (smart money), the bulls are gaining some ground against the bears last week. They are at 50.7%, their highest level since November 2021. On the other hand, among small investors (AAII American Association of Individual Investors), sentiment deteriorated significantly during the week of April 12, which is rather good news for the market.

In addition, JPMorgan notes that its latest client survey found that only 26% of clients plan to increase their equity exposure, a new record low. It also points out that 90% of respondents expect a recession in the U.S. by the first half of this year.

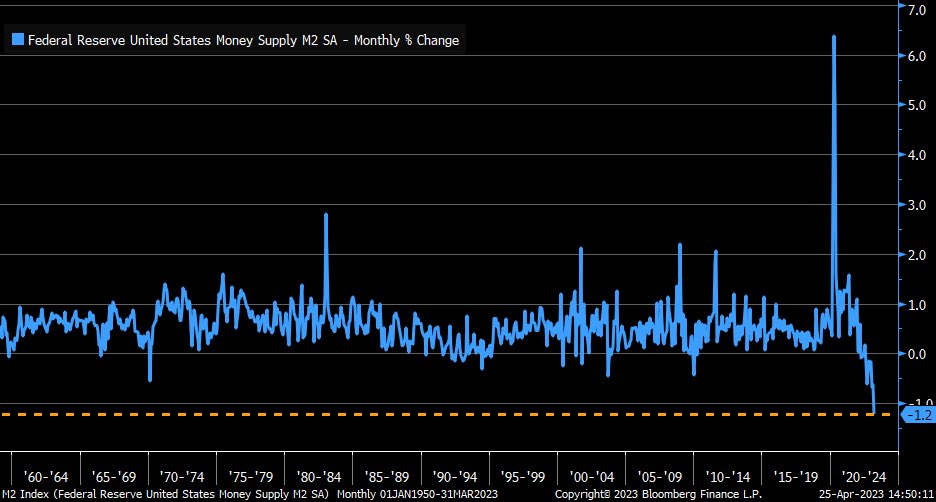

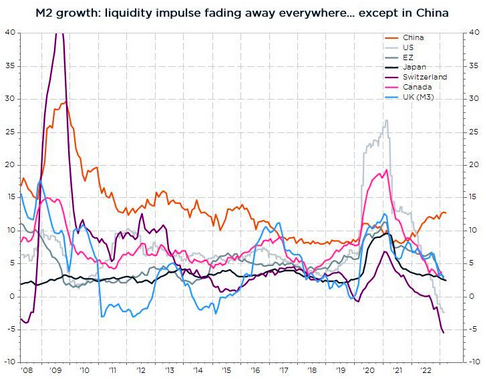

The market is torn, both sides have arguments and it is quite logical that the indices are in horizontal mode, waiting to see a winner emerge. The focus of the current thinking is also on liquidity, especially with the recent rejection of the idea of further expansion of the Fed’s balance sheet to help deal with the banking sector turmoil as quantitative easing. In March, M2 money supply contracted by -1.2% m/m, worst on record.

As a result, investors are still guessing: is it better to have a strong economy and high interest rates, or an economy under pressure and a more flexible monetary policy?

As a result, investors are still guessing: is it better to have a strong economy and high interest rates, or an economy under pressure and a more flexible monetary policy?

Pending central bank decisions in early May, financial markets ended the week in disarray, reacting to contrasting corporate results in the US, as well as Europe. Stocks finished little changed on the week, as investors weighed the start of quarterly earnings reports and conflicting economic data to assess whether an economic slowdown is coming. The Cboe Volatility Index (VIX), Wall Street’s so-called fear gauge, fell to its lowest level since late 2021.

The pan-European STOXX Europe 600 Index gained 0.45%, as optimism about the economic outlook outweighed concerns about interest rates staying higher for longer.

The buildup to earnings season is always full of anticipation, but it usually starts off slowly as the pace of reports doesn’t usually really get going until the second full week of the reporting period. The release of earnings reports should intensify over the next few days and could allow a return of the volatility that had gradually disappeared with the buying craze, but we have to say that so far the results are pretty good overall, Bloomberg Intelligence says that more than three quarters of the numbers announced (20% of SPX companies) are better than expected.

While the earnings season is off to a relatively solid start, concerns over the impact of inflation, high interest rates, and a potential U.S. recession are still very much in the mix. All told, about 35% of the companies in the S&P 500 Index will spill numbers next week.

MARKETS : Windless Zone

While the market holds important support, more selling pressure appeared late in the week, even amid earnings season, where many companies were beating, albeit drastically lowered, estimates. On its face, that seems like a big “disconnect” between the economy and the stock market.

CHECK our Investment strategy and Asset allocation here

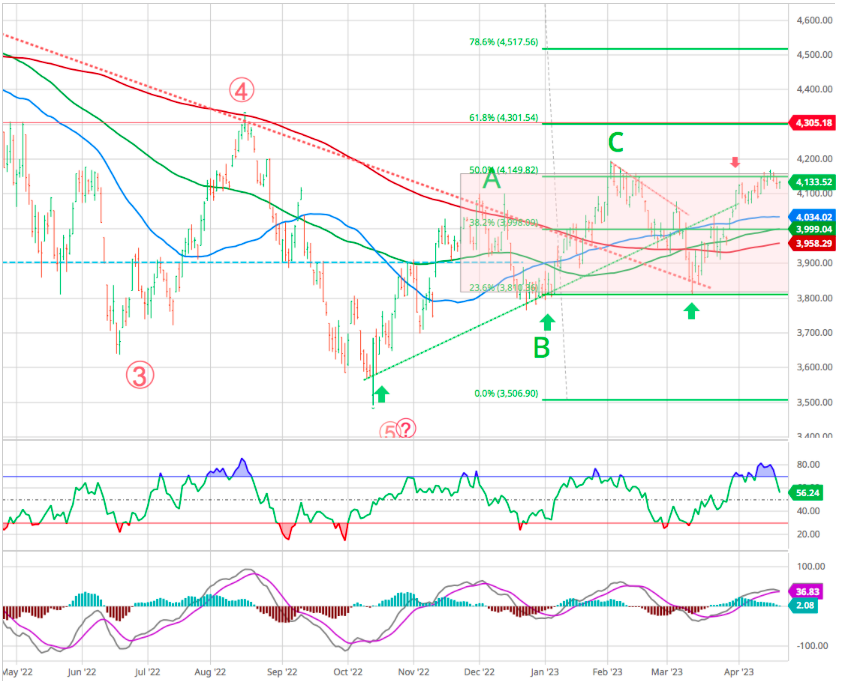

The index still miss to make a higher high and remains in its hesitant behavior as bulls and bears remain uncertain. Could be bull…could be bear…but until then likely range bound.

Our MACD signal is very close to triggering a sell signal which could occur this week. While the market could pull back some, there is no risk of a significant decline in the short term. With numerous levels of support directly beneath the market, with the 20-DMA providing immediate support, a correction will likely remain limited. More importantly, the rising bullish trend line from the lows suggests the maximum pullback will likely be 4000 on the index.

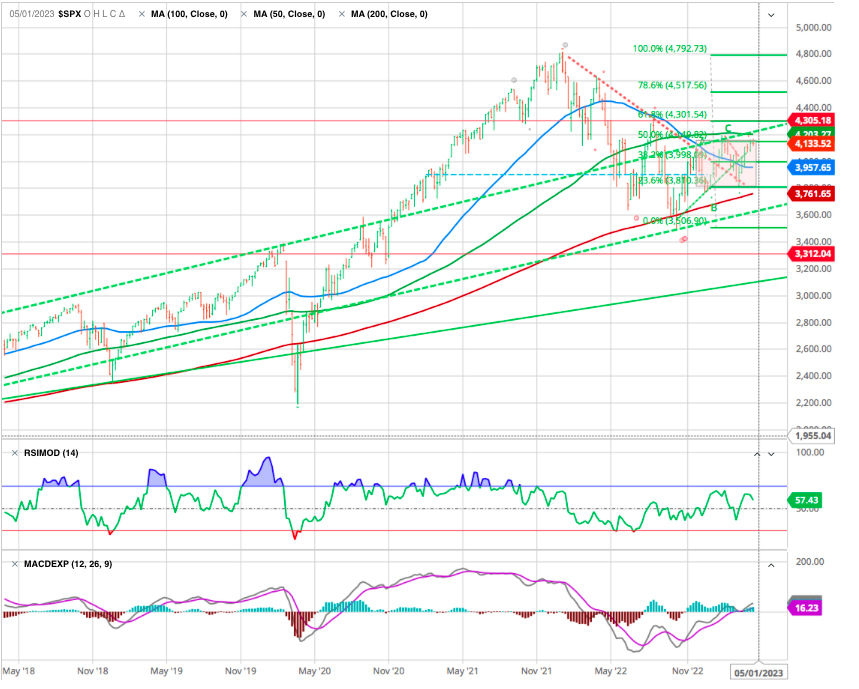

Nevertheless we can expect a correction. A 10% decline would lead to another retracement to the lows of the bullish trend channel, as shown below on the weekly chart -Green dotted line channel-. If that support holds, that would be a logical place to add exposure to risk assets from a purely technical perspective.

Let’s realize there is serious resistance overhead at 4,200. That is where we got stopped out in early February. But also above that many would consider the start of a new bull market (20% above the October lows of 3,491).

However, one positive news, as contrarian indicator, is the late Barron’s poll showing that investors remain bearish :

- only 36% of investors are bullish over the next 12 months,

- investors are much more bullish on bonds: 52% prefer bonds over stocks,

- most investors believe the FED is almost done hikin,

- BIG SHIFT: until recently the fear was that the FED was too slow to raise rates but NOW there is a fear that the FED may be too slow to react to inflation coming down,

- BIGGEST RISK: 25% call a U.S. recession the biggest risk,

- most money managers are not concerned about the health of the banking system.

CHINA

Money supply slowing down everywhere except in a “not-so small village of irreducible high rollers”. There is a tactical window of opportunity for Chinese equity thanks to a more resilient decorrelated macro backdrop of solid growth on the back of reopening, no inflation issue and easy monetary policy, while valuations remain cheap overall.

GOLD : Dollar related

According to the FelderReport the last time the deficit reversed from a narrowing trend and began a major widening trend, back in the early-2000’s, it coincided with a major top in the dollar index which evolved into a major bear market for the greenback (in the chart below) that lasted roughly a decade. This was one of the primary catalysts for a major bull market in the price of gold which rose from a low of $250 in 2001 to a high of nearly $2,000 a decade later.

CRYPTO

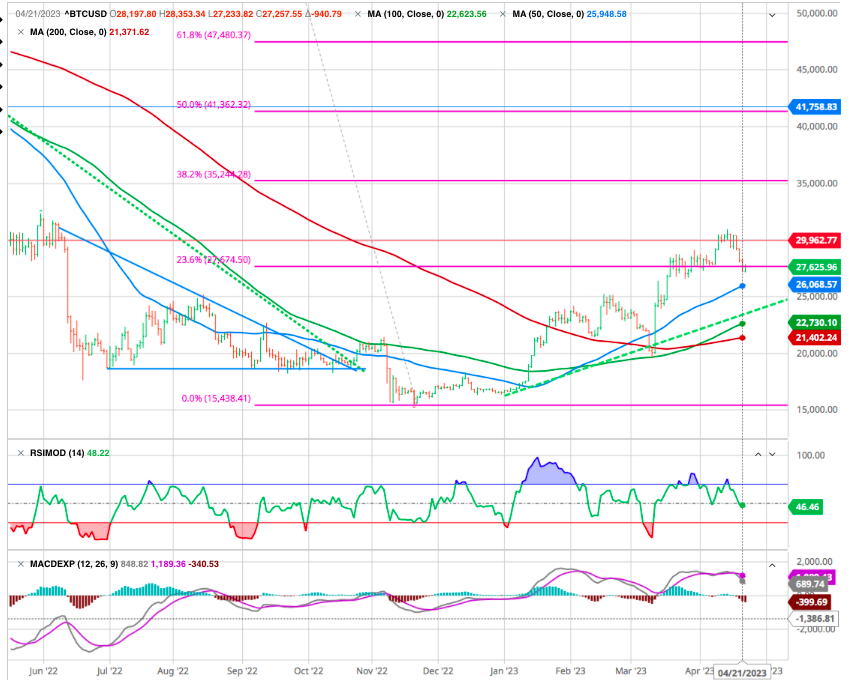

Bitcoin has lost everything it gained in the last week, falling -6.8% since Monday and hovering around $28,200 at the time of writing. Still not knowing in which direction to frame crypto-currencies, US regulators’ position is still unclear, which contributes to the lack of visibility for market players. Meanwhile, the European Parliament has passed the MiCA regulation, which provides more clarity and a much-needed framework for companies in the industry wanting to expand in Europe.

As long as the Fed remains hawkish it leaves the door open to a future recession. That is because keeping rates higher for longer is akin to stepping on the brakes of the economy.

Stocks will never race ahead into clear bull market until the Fed lets off those brakes and the fear of recession fades. This limits upside for now.

What will create renewed downside is that the fears of recession become reality. That mostly will be seen from a combination of negative GDP and job loss.

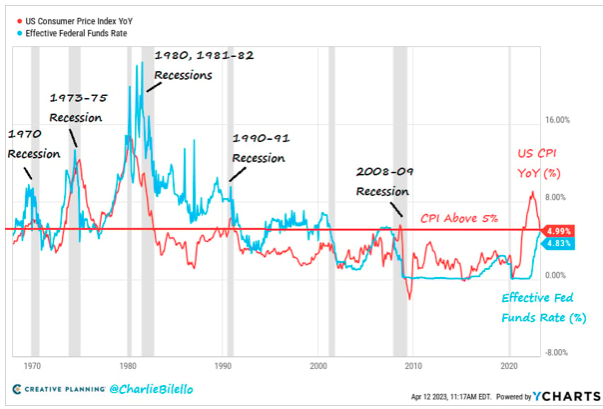

In the past 55 years, every time the Fed has fought high inflation (CPI >5%) with rate hikes, a recession soon followed. Will this time be different?

Moreover the New York Fed’s 12-Month Recession Probability Soars To Levels Unseen Since 1982. We note that at current levels, there has never been a false signal.

Here’s the bottom line: Past events never guarantee future results, but investors should mentally prepare themselves for a recession. A growing body of evidence suggests the economy is headed for a downturn, including recent commentary from the Federal Reserve, the inverted yield curve, and the shrinking M2 money supply.

A Rolling Recession

“The idea of a rolling recession in the economy over the past year, rather than a recession where the bottom falls out of everything at once.“ argued Liz Ann Sonders from Charles Schwab.

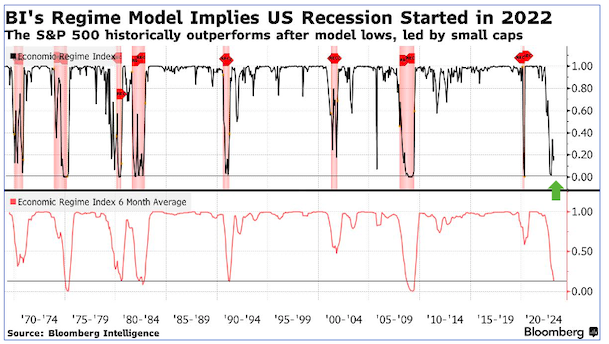

Actually, a little-known Bloomberg indicator called the Economic Regime Index may hold the answer. According to Bloomberg’s model, that U.S. recession may already have happened – in the middle of last year. And the painful sting of that recession appears to have come and gone – months ago.

(Bloomberg’s Economic Regime Index, shown above, takes key economic factors like jobless claims, manufacturing activity, and sentiment and crunches those numbers on a monthly basis.)

And it tells us that an economic slump started last June and likely ended in December. Kind of a “blink-and-you-missed-it recession.”

So, are we talking about the ghost of a recession past? Or the specter of a recession future?

Analysing the market sector rotation and looking at our last week ABS Matrix here we know that

- During a recession, defensive sectors including Consumer Staples, Health Care, and Utilities consistently outperform. Consumer Discretionary may also outperform to a lesser degree.

- In the early phase of a recovery, it’s the cyclical sectors – including Real Estate, Consumer Discretionary, and Industrials – that typically outperform to the greatest degree. Financials, Technology, and Materials also outperform to a lesser degree.

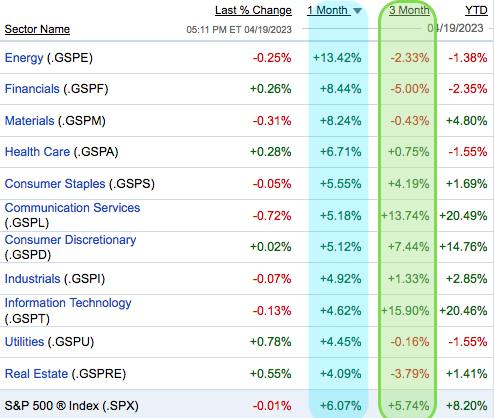

Now looking at the sector performances for the past months

Right now, you can see that Technology, Communication Services, and Consumer Discretionary are the Top Three sectors over three months (Green shadow area). Two of the three (Consumer Discretionary and Technology) typically do outperform in the early recovery phase.

Meanwhile, two of the worst-performing sectors over three months are Utilities and Health Care. But these two sectors typically outperform heading into recession.

Yeah – it’s a bit of a mixed picture. But it might confirm that the Bloomberg Economic Regime Index may be correct in telling us that the worst of any economic slump is behind us.

So stay tuned and listen to the possible early innings of a short term economic rebound.

Happy trades