MARKETSCOPE : “FED : we have a problem !”

May, 01 2023

When banks have a problem, we all have a problem. That was a central learning from the implosion of 2008, and last month’s sharp market reversals in the wake of the failures of several sizeable regional banks showed that it held good. Expectations for the Federal Reserve turned on a dime.

For a succession of weekends, survivors of 2008 suffered flashbacks as they awaited news of the latest institution in trouble, be it Silicon Valley Bank, Signature Bank or Credit Suisse Group AG.

This time regulators have taken possession of First Republic Bank resulting in the third failure of an American regional bank since the collapse of Silicon Valley Bank and Signature Bank in March. Is this the closing chapter of the banking turmoil that started in March, or just the next phase in the crisis?

Banks that never fail again, assisted by the State, supported at arm’s length by public money, systematically rewarded for their failure: this is what we now see at regular intervals.

Firs t Republic, the third bank to fail despite the hundreds of billions injected by the Fed to secure the entire banking system, still recovers all its deposits and all its assets, while the State organizes its takeover by JP Morgan.

t Republic, the third bank to fail despite the hundreds of billions injected by the Fed to secure the entire banking system, still recovers all its deposits and all its assets, while the State organizes its takeover by JP Morgan.

A market of subsidized mega-banks is thus created, which would never have deserved to exist in normal times, with public assistance and the permanent and free guarantee of the taxpayer. As a reward for their failure, these private actors are made bigger and riskier. The completed end of what was left of the credibility of liberalism.

Photo Source : Reuters

In FANGs We Trust

Major stock indexes posted solid gains Friday to end the week and the month on higher ground, in part as earnings reports from several big tech companies including Alphabet, Microsoft and Meta Platforms were received positively by investors.

A return to defense meant that Communication Services and Consumer Staples were the best-performing sectors for the month, both up 4%. Cyclical sectors generally performed poorly, however, as investors weighed several new signs of an economic slowdown. Momentum and Low Volatility led among factors, while High Beta was the laggard.

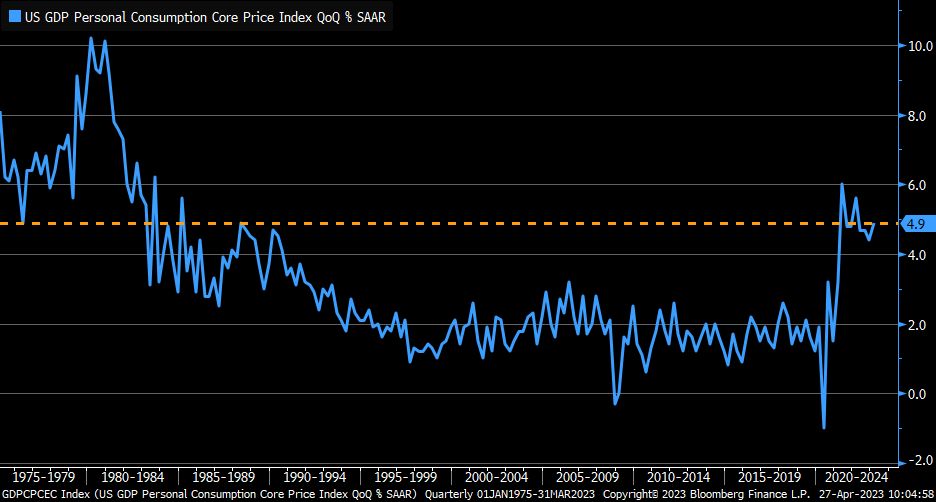

US statistics are still blowing hot and cold. April consumer confidence, Q1 GDP and March housing sales disappointed. In contrast, durable goods orders were much stronger than expected. At the end of the week, PCE inflation was more or less in line with expectations. Core PCE Index within 1Q23 GDP print reaccelerated to +4.9% (q q ann.) which, compared to pre-pandemic, is fastest since 1980s

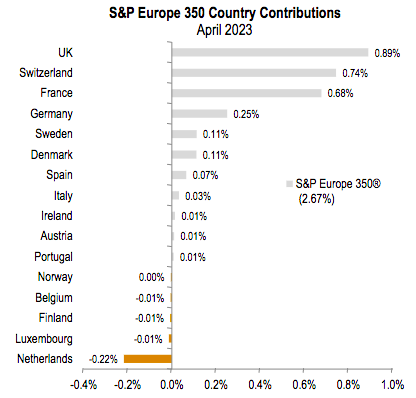

In Europe shares fell as fears that interest rate increases might tip the economy into recession intensified. The U.K. market contributed the most to the pan-European

benchmark’s return, followed by Switzerland and France.

The shift in European rates and FX has also led to a significant rally for European stocks relative to their American counterparts.

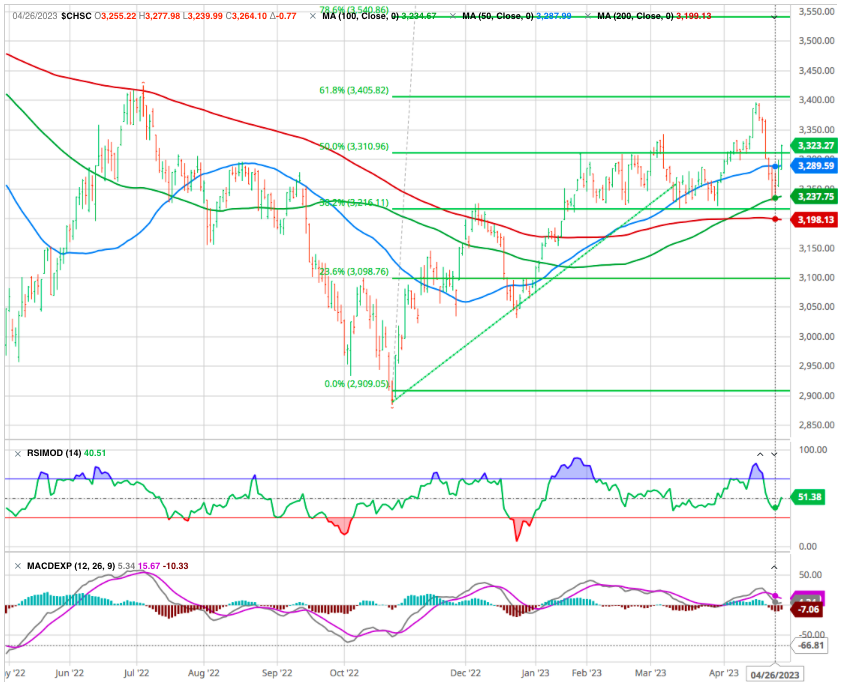

Chinese stocks corrected lately as Beijing reaffirmed its supportive policy stance. With respect to Chinese stocks two headlines caught our attention. According to the Wall Street Journal, China’s State-Owned Firms Are Suddenly Stars. Furthermore, Bloomberg noted that, “A robust earnings season should help Chinese stocks regain the momentum lost after the initial wave of optimism about the country’s reopening from Covid isolation, according to Goldman Sachs Group Inc.”

Shanghai Index

CHECK our Investment strategy and Asset allocation here

Caution should remain the order of the day in the sessions to come and volatility should persist, especially as the Federal Reserve will deliver its verdict on rates next Wednesday 3rd and the release of earnings reports will intensify.

MARKETS : Climb a wall of worries

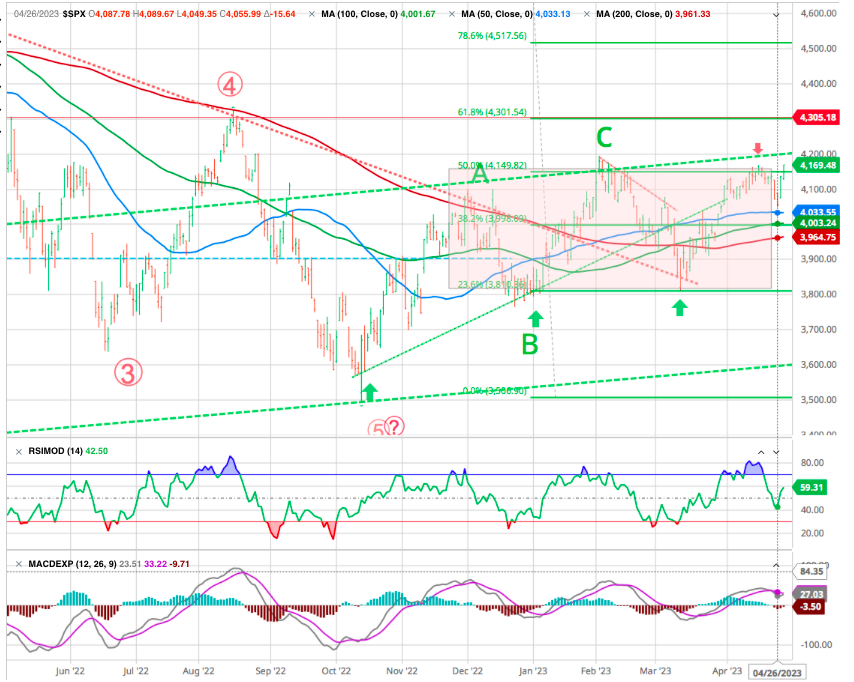

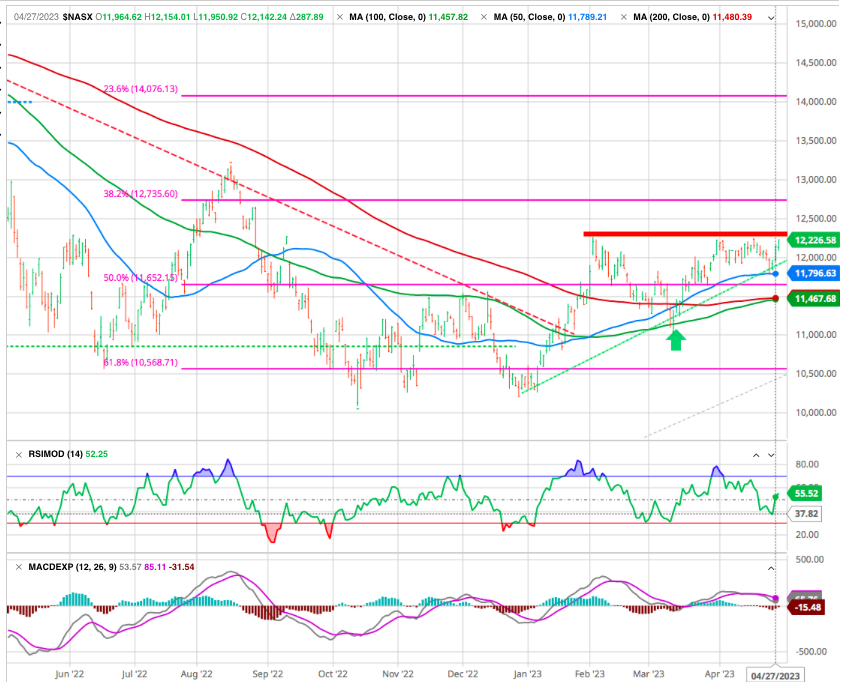

It may come as a surprise that the S&P 500 Index is up over the past year, and also more than 17% from the 2022 low. You wouldn’t know it from the lingering air of pessimism in the market fueled by mixed indicators and the constant stream of doom-and-gloom predictions of a massive crash lower at every turn.

For the time being, the indexes seem to hit a major resistance (4’187 for the SPX and 12250 for the Nasdaq) despite the bank failure, remain strong. Ahead of the upcoming Fed meeting, bulls and bears might prepare their ammunition.

We can sense that trapped bears are turning desperate as we’re eyeing a breakout above SPX $4200, which has major implications for the trading environment. The path for SPX to make a new 52-week high would add a new wave of momentum.

Don’t Fight the Trend

The great chartist Louise Yamada who said, “The longer the base the higher in space”. Her aphorism very conveniently concurs with today base case, which is that the next phase will be panic buying that will take us past 4200 and perhaps on to 4300. The rise can be so sharp that it will be unsustainable.

However this rally have to be called a “bear market rally”. We have a lot of ground to cover before we can call this a sustainable rally going forward. For one S&P 500, earnings have to be a lot higher to justify the index to reach the old highs, let alone make new ones. In fact, S&P 500 earnings have to be plenty high to justify 4300. We have learned the lesson that expanding P/E without higher profits or any profits is ultimately unsustainable.

Our destiny at some point (perhaps late May or June) we could have a very sharp retreat. In case of of break out we suggest using the rally to reduce risk, rebalance portfolios and raise cash levels moderately is still advisable.

The “R-Word”

Recession talk is all the rage, but the U.S. economy managed to eke out another gain in Q1, with GDP growth expanding by an annualized rate of 1.1%. That severely missed estimates of 2.0% growth and was slower than the 2.6% growth seen in Q4, but investors were excited nonetheless.

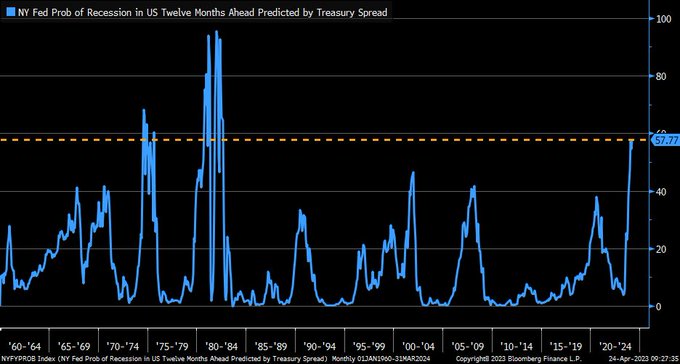

Recession probability model from NewYorkFed continues to move up and is now at highest since 1982.

Many analysts and economists had predicted that a recession would already come in Q1, and while the U.S. economy is clearly shifting into a lower gear.

The numbers also support the case for the Fed to begin pausing its aggressive rate hike cycle, while consumer demand is still holding strong despite lower private inventories and residential fixed investment. Robust job growth has additionally outpaced layoffs, with the unemployment rate still at multi-decade lows, suggesting that Americans might be well-positioned to deal with inflation and economic uncertainty.

So is the ‘R -Word’ that one should use when discussing the economy over the past two years should be resilient, not recession? The shocks of inflation and interest rate increases and a tightening in lending that are now affecting small and midsize businesses have yet to put a material dent in consumption.

As we mentioned last week, some contend that a rolling recession has been happening to different sectors of the economy, and could support a soft landing, while others are doubling down on a mild to moderate recession coming in the latter half of 2023. But the principal problem of inflation is the same as it has been since it was being dismissed as ‘transitory’ by Fed and Treasury officials: there is too much money in the economy.

The FED has no good option

The FED is struggling to cool inflation further without damaging the economy and on its May 2nd meeting the FED is widely expected to hike rates for the 10th consecutive time by 25bpt to 5-5.25% target range.

The challenge is that the economy is souring at the same time that progress on reigning in inflation is stalling out and in addition the financial sector is on increasingly unsteady footing sitting on unrealized losses on securities totalling more than $620BN.

The FED’s primary error in the past 2 years was misreading the economic situation and thus failing to act quickly enough to change course, a blunder that allowed inflation to spiral out of control.

However, the Fed has been clear that it does not expect to cut in 2023 and expects the Federal Funds rate to be at 4.3% in 2024 (much higher than the market currently expects) and at 3.1% in 2025, which is essentially what the market expects, but the market expects the Fed to get there in 2024.

The Fed will likely hike beyond the current expectations

Will the FED pivot quickly if and when the economy really slows down?

We think not. Actually, the Fed will have to hike beyond the current expectations. However, there is significant uncertainty as to whether Powell and his colleagues will indicate a pause after this. Now, while inflation continues to remain well above the target, markets price that the Fed may cut as early as June. The Fed has to continue hiking until:

1) unemployment rate increases;

2) the asset price bubbles deflate, which includes the real estate prices, and the stock prices.

Otherwise, inflation is not going down. The alternative is to just abandon the 2% inflation target, but that’s unlikely at this point. So, eventually, expect a deep selloff in the S&P 500, and the beginning of last leg of the bear market.

Happy trades